Opening Remarks and Presentation: IMF Press Briefing on Economic Outlook for Asia Pacific and Korea

May 4, 2023

As prepared for delivery

Good morning. Thank you very much for joining our presentation that will cover our latest report, the Regional Economic Outlook for Asia and the Pacific, as well as provide you with a brief update on the economic outlook for Korea.

Global growth is expected to decelerate and bottom out in 2023, as rising interest rates and Russia’s war in Ukraine weigh on activity. Global inflation is easing but remains stubbornly high, and banking strains in the US and Europe have injected greater uncertainty into an already complex economic landscape.

Despite the somber backdrop of a challenging year for the world economy, Asia and the Pacific remains a dynamic region.

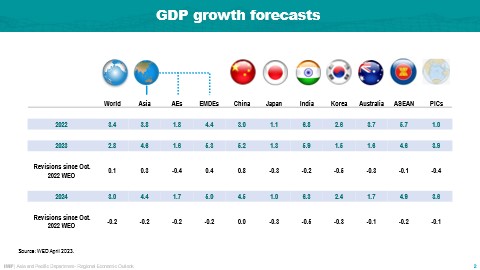

These are our latest growth forecasts, which were released during our Spring Meetings.

Domestic demand in Asia has, so far, remained strong despite monetary tightening, even as external demand for technology products and other exports from Asia is weakening. Growth in Asia and the Pacific is projected to increase this year to 4.6 percent, up from 3.8 percent in 2022. This reflects an increase of 0.3 percentage points compared with projections we had made in the October WEO.

The biggest driver of Asia’s upward growth revision this year is China, while other emerging economies in the region are on track to enjoy solid growth, though in some cases at slightly lower rates than seen last year.

In Asia’s advanced economies, growth will slow this year to 1.6 percent. This is about 0.4 percentage points lower than we projected in October.

Our forecast revisions imply that the economies of Asia and the Pacific are expected to contribute about 70 percent of global growth in 2023, which is a significantly larger share than we have seen during the past few years.

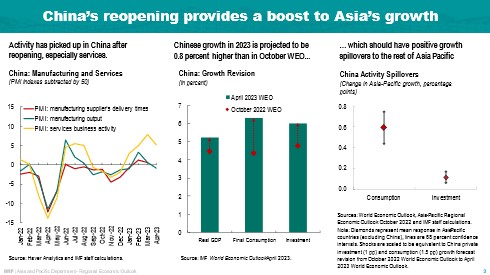

Let me start by discussing China, where the reopening of the economy will provide fresh momentum for the region’s growth. The Chinese economy is expected to expand by 5.2 percent this year. Data from the first quarter, which includes a very sharp rebound in exports, have confirmed our forecast of a dynamic start to 2023, and PMI surveys show that the recovery will continue to be led by services.

The upward revision to Chinese growth by 0.8 percent in 2023 is our largest in this edition of the WEO.

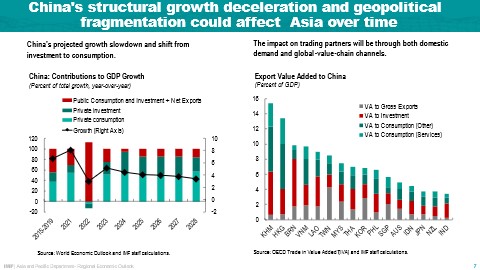

We see this boosting growth in the rest of Asia as well—typically, a one percentage point increase in Chinese growth leads to an increase, on average, of about 0.3 percentage points in the rest of Asia. Normally the strongest spillover from China would be from its demand for investment goods, but this time the biggest effect is from demand for consumption. We estimate that this will generate stronger spillovers to the region than we’ve seen in the past.

For sure, these spillovers from China will have heterogeneous effects to trade partners across the region. The boost will vary according to their exposure to Chinese demand for consumption and investment. For example, countries that export final consumption goods to China or those that depend on tourists from China will stand to benefit a lot, while those economies that mainly export raw commodities to China are unlikely to receive a strong boost from China’s recovery this time around.

One factor that is weighing on the short-term outlook for the region is the weakening of external demand, with the US and Europe expected to have very weak import growth in 2023 and 2024. In recent data, this is putting pressure on Asia’s exports of manufactured goods.

The slowdown is already manifesting in a moderation of demand for technology exports from Asia to the US, with orders for semiconductors having slowed substantially.

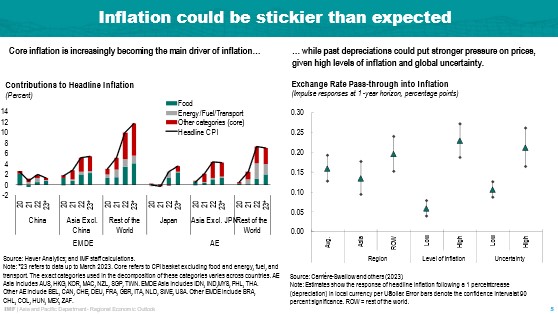

Headline inflation has been easing but remains above central bank targets in most economies. As commodity prices recede, core inflation is becoming a more important driver of headline inflation and is proving stickier.

As output gaps are closing or have already closed across the region, and exchange rate depreciations are still passing through to domestic prices, the battle to contain inflation remains. Our analysis finds that exchange rate pass-through is stronger when inflation is already high, as it is today in many Asian economies.

And yet, monetary tightening has slowed down or paused in most countries. Given the still substantial inflation risk, we are of the view that monetary policy in Asia will need to remain tight until inflation falls durably back to target. The exceptions are China and Japan, where output is below potential and inflation expectations have stayed muted.

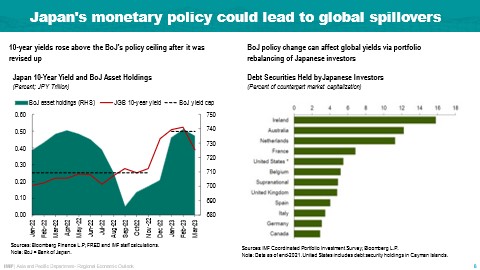

There is uncertainty around the direction of monetary policy in Japan, amid a rise in inflation. Japanese government bond yields have increased notably since October.

Changes in Japan’s monetary policy that lead to further increases in government bond yields could have global spillovers through Japanese investors, who have large investment positions in debt instruments abroad.

Portfolio rebalancing of these investors could trigger a rise in global yields, causing portfolio outflows for some countries.

It is important to consider how shifts in the global economic landscape could affect Asia over time.

Over the medium term, we expect the Chinese economy to experience a slowdown in productivity and investment, which will lower growth below 4 percent by 2028. This may have profound adverse implications for the rest of the region, given their strong trade linkages with China.

In addition, we see a risk that the global economy fragments into trading blocs. If this happens, the larger exposures will be to Asian economies that currently export significantly to the US and Europe, and those that are currently part of global value chains that see them export intermediate goods to China for use in Chinese exports.

These challenges call for the implementation of structural reforms to boost long-term growth. The region should prioritize reforms that boost innovation and digitalization, while accelerating the green energy transition.

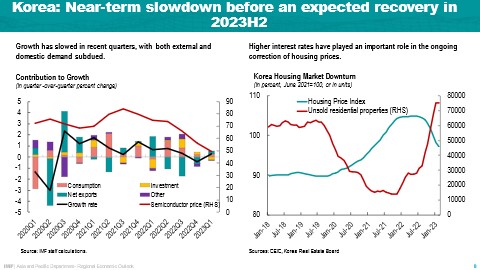

In Korea, growth has slowed in recent quarters, as subdued growth of trading partners and the global semiconductor downcycle have been impacting exports. At the same time, the effects of past monetary policy tightening and of the normalization of fiscal policy following significant stimulus last year are affecting domestic demand. Higher interest rates have played an important role in the ongoing correction of housing prices as well, which is also a factor holding back domestic demand.

But there is also a silver lining. The contribution to growth from net exports turned positive again in 2023Q1 driven by automobile shipments. China’s rapid recovery, following its reopening from Covid-related restrictions, and a broadening from the initial expansion centered on domestic services should also increasingly bear positively on Korea’s exports. The global economy, more broadly, is also slated to improve over the course of the year. And industry experts expect an improvement in the semiconductor cycle later in the year, which will have clear benefits for Korea’s exports.

All in all, we expect growth of 1.5 percent this year, with strengthening momentum in H2 carrying into 2024, where we expect growth of 2.4 percent.

The housing market downturn is also linked to potential financial sector vulnerabilities. There are still risks associated with real estate project financing. While overall liquidity conditions have improved significantly, credit risk remains elevated for some small and medium-sized developers and construction firms. Pockets of vulnerability may also exist in some non-bank financial institutions that are heavily exposed to project financing, though we do not see this at any scale that would be systemic.

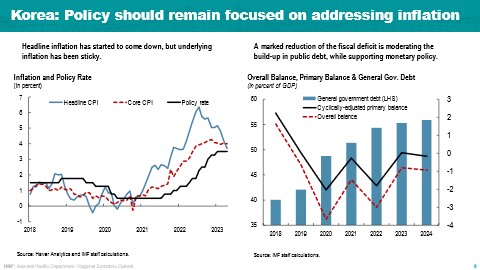

Despite the growth slowdown, inflation has remained significantly above the BoK’s 2 percent target. While headline inflation has come down jointly with lower international energy prices, core inflation (that is, inflation excluding food and energy prices) has not yet come down decisively. While we expect further reductions in inflation in the coming months, in the near term, monetary policy clearly needs to remain focused on the inflation challenge, and a premature easing should be avoided.

At the same time, policy tradeoffs are shifting, with the growth momentum slowing and tightness in the labor market expected to ease. So risks of policy overtightening also need to be minimized. Taking these considerations together, the BoK has appropriately paused rate hikes in the February and April meetings, while keeping options open for further hikes depending on incoming data.

Following significant fiscal support measures in early 2022, normalization of fiscal policy started in the second half of 2022 and is continuing in 2023 with a marked reduction of the central government fiscal deficit to below 1 percent of GDP in 2023 and 2024. This is helpful in supporting monetary policy to address inflation. It also helps improve public debt dynamics, with the pace of the build-up in public debt moderating after substantial increases during the pandemic.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Ting Yan

Phone: +1 202 623-7100Email: MEDIA@IMF.org