United Kingdom: Staff Concluding Statement of the 2020 Article IV Mission

October 29, 2020

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Washington, DC: The pandemic has taken a significant human toll in the UK. It hit an economy already facing strains from Brexit and longer-term challenges (e.g. low productivity growth), but which had rebuilt fiscal and private sector buffers post 2008. The authorities’ aggressive policy response—one of the best examples of coordinated action globally—has helped mitigate the damage, holding down unemployment and insolvencies. Still, GDP has dropped dramatically, and private and public debt levels are set to rise significantly. A sharp initial economic rebound now faces headwinds from a second Covid-19 wave, Brexit-related uncertainty, rising unemployment, and stress on corporate balance sheets.

- Continued policy support is essential to see the economy through the pandemic and the transition to the post-Brexit trade regime. Fiscal policy should continue to accommodate the costs of programs now in place to protect workers and firms directly affected by the pandemic. There is room to loosen monetary policy in the near-term.

- Invigorating growth as the pandemic subsides will require an additional fiscal policy push, and this should take advantage of opportunities to “build forward better”. Current plans would lift public investment to address productivity, climate goals, and regional inequality. There is a case to spend more, if project effectiveness can be preserved at higher scale.

- Fiscal consolidation, to stabilize and reverse the rise in public debt ratios, should start once the private sector begins to durably lead the recovery. It should be gradual, while preserving investment and a strong social safety net. Planning can start now to guide expectations. As inflation will likely stay subdued, monetary policy should remain accommodative.

- Policies should remain anchored within robust frameworks. The crisis points to issues in setting new fiscal rules, more constrained monetary policy space, and gaps in non-bank financial regulation (also at the international level). The UK’s frameworks have an enviable track record and should be adapted where needed to continue to deliver their objectives.

- We encourage the UK and EU authorities to make every effort to reach a post-Brexit trade agreement and finalize preparations for its implementation.

The global pandemic has taken a deep toll on the UK population, adding to pre-existing economic challenges . Despite containment measures and sharply higher health spending, infection and mortality rates have been relatively high. The pandemic arrived as the UK was preparing to transition to a post-Brexit trade regime, still under negotiation with the EU. The country also faced longer-term challenges, including raising productivity growth, addressing regional inequality, dealing with population aging, and meeting net zero climate targets by 2050. At the same time, the UK had built up buffers and policy space since the 2008 crisis, with public and private balance sheets both significantly improved.

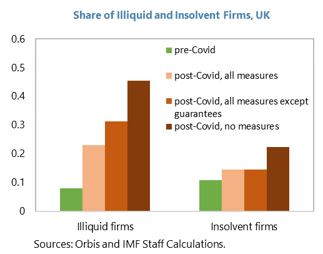

The authorities’ aggressive economic policy response has extended safety nets, limiting the potential long-term damage to productive capacity . The unprecedented and coordinated package of fiscal, monetary, and financial sector measures has supported incomes, kept unemployment down (preserving worker-firm matches) and curbed bankruptcies (preserving firm-specific capital)(chart). Still, GDP dropped precipitously, reflecting lockdowns and social distancing, and remains some 10 percent below pre-crisis levels. The cost of this response has been a sharp deterioration of the public sector’s balance sheet, although borrowing costs have fallen and there remains fiscal space. Private debt levels are also rising sharply, but the banking system remains well-capitalized and liquid, reflecting reforms post-2008 and measures taken since March to preserve financial stability.

The outlook is for a muted recovery with risks weighted to the downside . The sharp summer rebound in activity faces strong headwinds from a second wave of Covid-19 infections, Brexit-related uncertainty, rising unemployment, and stress on corporate balance sheets. We project the economy to contract by 10.4 percent in 2020 and to recover partially in 2021, with growth at 5.7 percent, in both cases downwardly revised from our latest WEO forecast. Reduced capital accumulation, persistent unemployment (as job losses in low skill sectors create skills mismatches), and lower productivity growth will hold GDP 3-6 percent below its pre-pandemic trend through the medium-term. Inflation is expected to climb to the 2 percent target only gradually, as compressed demand and rising unemployment muffle production cost increases. Projections are, however, subject to unusually high uncertainty, and downside risks related to a prolonged Covid-19 impact and a no-deal Brexit could bring more persistent unemployment and corporate balance sheet stress.

Continued commitment to monetary and fiscal policy support remains essential. This boosts expectations and confidence and helps the economy work through the effects of the pandemic. The skewed distribution of risk argues for an aggressive approach, to rule out a sharper and more extended period of deleveraging.

· Monetary policy should be loosened to guard against the considerable risk that projected inflation remains below target. A commitment to further government bond purchases over the next 12 months would be effective to this end. Other tools like negative policy rates could be brought in incrementally when needed, and it will be important to complete an assessment about how the net impact of such an approach could be maximized.

· Fiscal policy should continue to accommodate the ongoing costs of pandemic health, job, and small business support schemes. These have proven to be an essential temporary extension of the safety net. Recent adjustments to extend job schemes and more tightly link them to the degree of pandemic impact are an important enhancement. We welcome further reviews to ensure their continued effectiveness in limiting scarring. There is a case to extend guaranteed lending along similar lines, with availability and the burden borne by firms and banks linked to pandemic impact. The various schemes should be allowed to naturally sunset as the direct impact of the pandemic on the economy subsides.

· Fiscal policy will also need to provide a meaningful additional push to invigorate the recovery as the pandemic starts to subside, and the opportunity should be taken to “build forward better”. The planned expansion of the public investment program could help raise productivity (e.g. by supporting digitalization), address regional inequalities, and reduce carbon emissions. There is a case to go even further than planned, provided projects can be well targeted and managed. In this context, recent measures to enhance project selection and ensure compliance with spending processes are welcome. An externally validated assessment of the full oversight framework, using the IMF’s public investment management assessment methodology, could help identify remaining gaps.

Financial sector policies should continue to buttress the system’s ability to fund the recovery. The strong position of the banking system suggests that releasing regulatory buffers was appropriate, and banks can put these buffers to use to provide funding for the recovery. In view of macroeconomic risks, close supervision of banks should continue and, in line with Fund advice in other jurisdictions, dividend payment restrictions should be extended to ensure that capital remains ample after losses start to materialize. Pandemic business loan support schemes have been useful to sustain lending. It will be important to better define the trigger points and procedures for the activation of government guarantees to avoid tying up bank resources. Small and medium size enterprises will also need better access to long-term debt and equity finance. Opening up avenues for support from institutional investors and investment funds could help to this end.

Policy rotation toward adjustment will be essential to reverse the rise in public debt ratios and allow fiscal buffers to be rebuilt, but rotation should only come when the private sector begins to durably lead the recovery. Fiscal consolidation should be gradual when this stage arrives. But there are advantages in beginning to consider the difficult choices soon, including to cement expectations that public investment will be protected, thereby enhancing its impact now. Re-launching a full spending review in 2021 would help identify space in the budget. And there are equity reasons to re-examine the expensive pension triple lock. However, with limits to expenditure compression given reductions already made over the past decade, some adjustment of both tax bases and major rates appears inevitable. Monetary policy should remain accommodative as rotation occurs—to counter fiscal headwinds that would otherwise depress inflation—and a continued commitment to appropriate forward guidance will be a critical component of this.

To support macroeconomic adjustment, impediments to structural changes in the economy will need to be tackled. The pandemic and Brexit, in their specific ways, will likely cause some industries to shrink and others to expand. During this transition, unemployment might rise persistently, especially among the low skilled, and corporate financial distress will likely increase. The UK economy is relatively flexible by international standards but some adjustments to policies could prove helpful.

· Measures to strengthen the social safety net and invest in human capital are key. Changes introduced since March, which temporarily raised universal credit and other benefits and expanded active labor market policies (ALMPs) are welcome. Given the risk of persistently higher unemployment, and low ALMP spending relative to other OECD countries, enhancements to the safety net and even-higher funding for ALMPs should be considered, subject to preserving appropriate incentives for labor force re-entry. This could be funded within the additional fiscal push recommended above.

· On the corporate side, the insolvency framework has recently been modified to provide more flexible restructurings, although it still requires significant court involvement. Additional efforts should be considered to allow for a more streamlined and standardized out-of-court approach and ensure a constructive role for the government as a creditor in restructurings.

Policies should remain anchored by strong institutional frameworks, which may necessitate some adaptations in light of the current crisis. The authorities’ forceful response to the pandemic has been possible thanks to the robust and credible policy frameworks and the strong institutions that support them. Potential adaptations should be considered to ensure that frameworks continue to function effectively:

- Fiscal framework . Over more than 20 years, fiscal rules have generally steered policies in the right direction, albeit with more frequent revisions to targets of late. Rules are under review, and a new medium-term anchor and annual targets are needed to support fiscal sustainability. A good medium-term anchor should focus on an indicator of debt pressure (e.g. net debt, as at present, but perhaps informed by gross financing needs or debt service to revenues), while a good year-to-year target should be tightly controllable and capable of delivering the medium-term anchor (e.g. a rule for public expenditure). The impact of asset sales and contingent liabilities also need to be taken into account (e.g. via an indicative benchmark on public (financial) net worth). Year-to-year targets should enter into force only when the recovery from the pandemic is firmly in place and fiscal consolidation begins.

- Monetary framework . The inflation targeting regime has provided stability and kept inflation close to target and expectations well anchored. Going forward, low-for-longer interest rates could constrain monetary space. Whether the current framework may need adjustment to address this merits consideration. Introducing a calendar-based schedule of framework reviews, in line with the practice in some peers, might be helpful in this regard, while avoiding sending unwanted signals about intentions.

- Financial . The UK bank regulatory framework was strengthened substantially after 2008, but as in other jurisdictions pandemic-related financial stresses brought to the fore weaknesses in the non-bank financial system. The initial pandemic stages and ongoing response will also offer insights into the effectiveness of bank buffers and the degree to which they will continue to prove usable (i.e. to allow banks to provide credit for the recovery). It will be important for the authorities to use the ongoing Financial Stability Board review of non-banks and IMF financial sector surveillance in 2021 (under the FSAP program), to consider these and other issues in more depth.

Finally, we encourage the UK and EU authorities to make every effort to reach a post-Brexit trade agreement and finalize preparations for implementation . Progress on a range of issues has been made over the past year and there is room for a compromise beneficial to both sides. A solution would remove important downside risks to the outlook. In the absence of an agreement, a stronger policy response would be needed to address a deteriorated outlook. Regardless of the outcome, it will be important to prepare. The government will need to deliver on its plans for investment in border infrastructure, staff, and technology, as well as on the customs intermediary sector. Whereas financial firms have broadly prepared for systemic transition issues, non-financial corporations appear to be lagging. Stronger communications and direct assistance for SMEs would help expedite progress.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Meera Louis

Phone: +1 202 623-7100Email: MEDIA@IMF.org