Colombian men transporting sacks of coffee. Lower levels of human capital and productivity are holding back Latin America’s growth. (photo: andresr/iStock by Getty Images)

Lack of Human Capital is Holding Back Latin America’s Growth

August 13, 2020

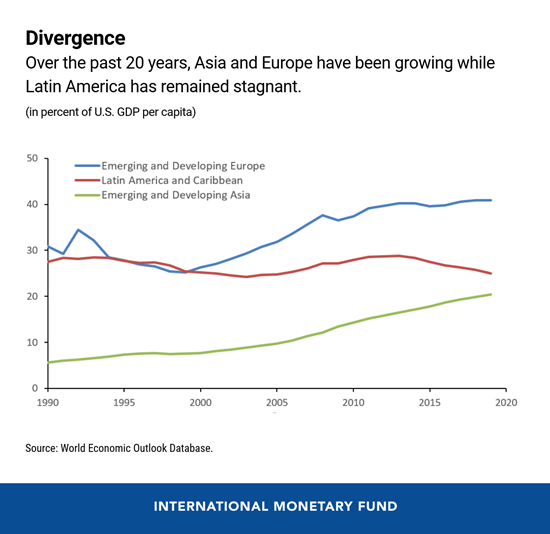

In 1990, Latin America’s average GDP per capita was a little over a quarter of the United States’ income level, while emerging and developing Asian countries’ GDP per capita was only 5 percent. In 2019, Asian countries had grown fourfold, but Latin America was still at the same level.

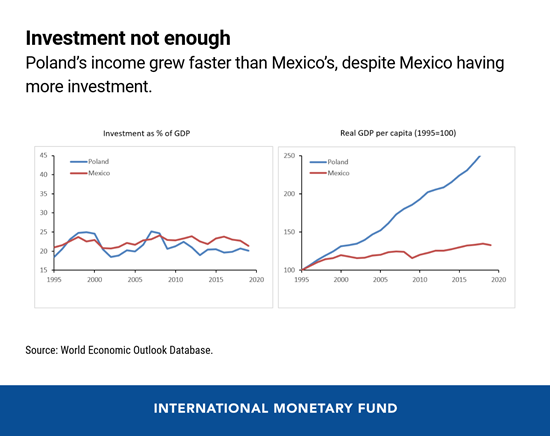

What explains this weak relative income growth? Since Asia has twice the investment level of Latin America, it is tempting to blame low growth on low investment. But Central, Eastern, and Southeastern Europe casts doubt on this narrative, having achieved faster growth than Latin America with lower investment than Asia.

Related Links

In a new working paper, we compare the experiences of these three regions (before COVID-19) and conclude that Latin America is poorer because of lower levels of human capital and productivity, not investment.

Temporary boost

Take Mexico and Poland. In the last 25 years, Mexico has had more investment (as a percent of GDP), but its growth per capita has been much slower. What explains that?

Investment does raise income. A higher so-called capital stock per worker increases GDP per capita. But only up to a certain point, after which the return on investment starts to decrease. A pizza deliverer with a motorcycle will do more deliveries than one who has to walk. But giving the same deliverer two motorcycles, or a more expensive one, will not do much to increase his output.

Productivity growth, human capital, and institutions

In the long run, it is not more input (labor and capital) that generates growth, but productivity (how much more output can be produced with the same input) in the same amount of time.

Productivity growth depends only partially on technological progress. In Charles Dickens’ time, letters were written with goose-feather quills. A century ago, with typewriters. Today, with computers. No wonder current office workers are much more productive! But it also depends on human capital. The same computer will make a college graduate much more productive than someone who has only finished elementary school.

We studied the different components of GDP growth for Poland and Mexico since 1995 and the picture is very clear: the combination of human capital and productivity is a major contributor for the European country, while often a negative factor for the North American one.

Strong governance and good business climate matter for productivity growth. In countries where property rights are not secure and governance is poor, firms will remain small and productivity low. In well-run countries, successful firms can become large and more efficient.

Cross-country differences in income levels

Our paper shows that countries with higher human capital and better governance and business climate tend to be richer than those with low scores on these variables. High human capital alone is not sufficient: our analysis shows that countries become rich only when governance also improves.

Not surprisingly, Mexico has worse readings in both areas than Poland. In general, Latin America scores poorly on both dimensions, compared to advanced countries or emerging Europe, which helps explain why it is relatively poorer. Of course, there are exceptions: Chile’s governance ranks well against some advanced economies and is better than most of emerging Asia.

Our paper argues that countries won’t grow faster and close the income gap with richer parts of the world without improving human capital, governance, and business environment.

Eastern Europe’s success factor

In 1989, on the eve of the fall of the Berlin wall, countries behind the Iron Curtain were much poorer than Western Europe. Now, some of them have income levels similar to Spain and Italy.

They converged rapidly because their human capital was already similar to Western Europe’s, while income was much lower in the early 1990s. Strengthening of institutions helped the process, and here the European Union (EU) played an important role. The prospect of EU membership led to more reforms and higher growth. Countries that joined, or worked toward that objective, saw significant improvements.

Why has Latin America not converged?

Latin America fell behind in the convergence process mostly for two reasons. First, it did not have that same combination of high human capital and low income of former communist countries. In fact, in the mid-1990s, GDP per capita was somewhat above what could be expected for the level of human capital. Second, the strong institutional improvement seen in Europe also didn’t happen in Latin America. Governance indicators actually deteriorated in many countries.

The same factors that hold back growth also make investment less attractive. Our conclusion is that low investment in Latin America is not the cause, but the result of low growth. Governments solely focused on boosting investment might want to look at the problem from a different perspective.