Auto factory in Baden-Wurttemberg, Germany; the weakness in trade and manufacturing is slowing economic activity in many European countries (photo: Caro / Kaiser/Newscom)

Europe: Facing Spillovers From Trade and Manufacturing

November 6, 2019

As in the rest of the world, European trade and manufacturing have weakened. There are some signs that this slowdown is spreading into the rest of the economy. While services and consumption have remained relatively resilient in line with strong labor markets, investment is starting to lose steam.

Related Links

These developments have slowed economic activity in the region, especially in advanced Europe, according to the IMF’s latest health check of Europe’s economy.

The report predicts growth will moderate from 2.3 percent in 2018 to 1.4 percent in 2019, its lowest rate since 2013. In 2020, growth is projected to recover modestly to 1.8 percent as international trade is expected to rebound. But several risks to the outlook remain.

Here are six charts that tell the story of Europe’s economic health and its prospects.

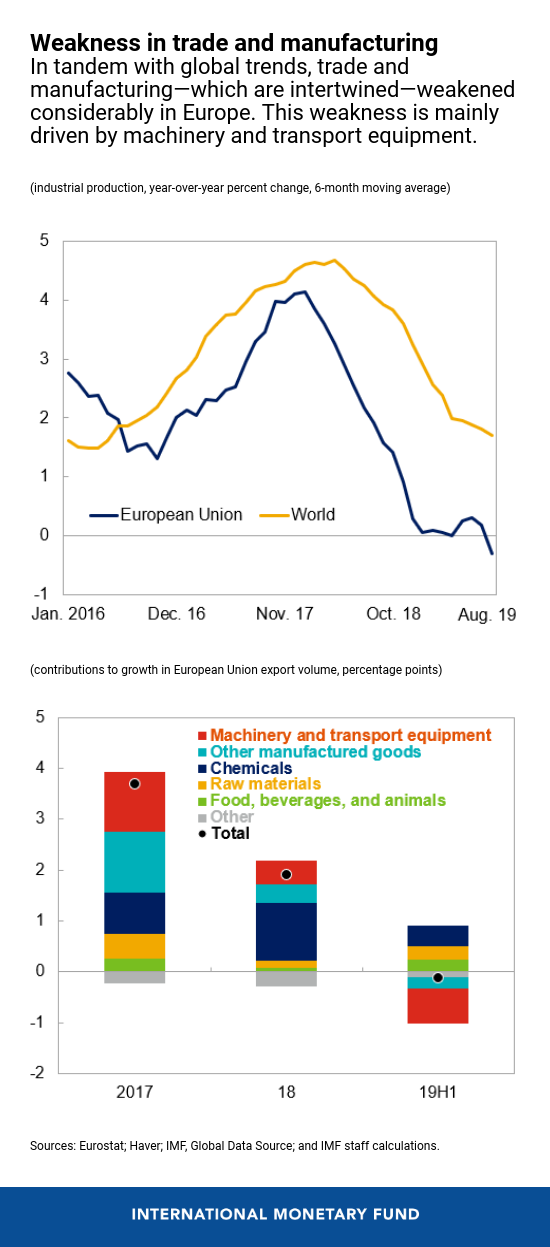

European trade and industry have weakened, slowing growth. Following global trends, trade and manufacturing in Europe have weakened considerably. This weakness is primarily driven by machinery and transport equipment—sectors that are particularly relevant for Europe. As a result, economic activity in Europe has slowed, especially in advanced economies. Emerging European economies outside of Russia and Turkey were a bright spot, with growth remaining strong.

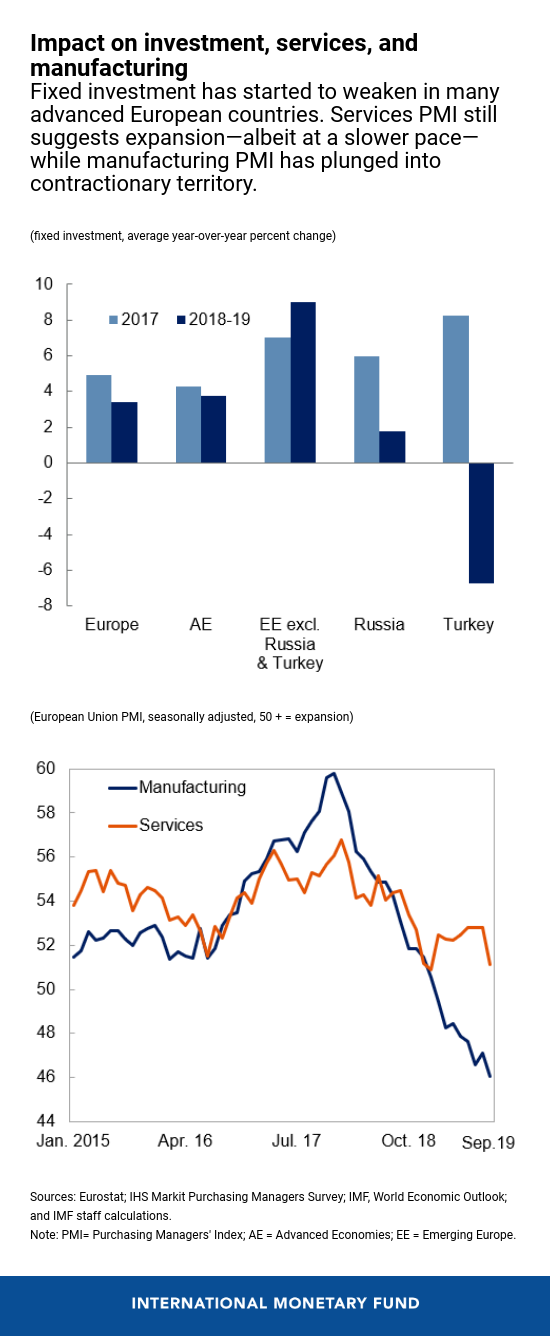

Some signs of spillovers, but still relatively limited. The weakening trade and manufacturing—along with subdued business confidence and elevated trade uncertainty—have started to spill over into investment, especially in many advanced European countries. While the services sector has been relatively buoyant, it too has started to soften. Private consumption, however, has stayed relatively robust.

Labor markets hold the key to the resilience of services and consumption. As long as employment and wage growth remain robust, consumption spending and hence the demand for services will remain buoyant. Labor markets in Europe are still strong—unemployment rates are at or below precrisis levels and wage growth has generally held up. However, signs of a slowdown are also emerging in labor markets. For example, job openings—a measure of labor demand—are not only falling in the manufacturing sector, but vacancy growth for the overall economy has also slowed since the beginning of the year.

Europe’s economic outlook. On balance, Europe’s growth is projected to decline from 2.3 percent in 2018 to 1.4 percent in 2019. A modest and precarious recovery is forecast for 2020 due to an expected rebound in external demand that would limit emerging spillovers into investment and services. This projection, broadly unchanged from the April 2019 World Economic Outlook, masks significant differences between advanced and emerging Europe.

Growth in advanced Europe has been revised down by 0.1 percentage point to 1.3 percent in 2019, while growth in emerging Europe has been revised up by 0.5 percentage point to 1.8 percent. Amid high uncertainty, there are several risks to the outlook, including Brexit-related disruptions, intensifications of protectionism and related uncertainty, abrupt declines in risk appetite, and rising geopolitical tensions.

Policies. Monetary policy in many European countries should remain accommodative given subdued inflationary pressures and slowing economic activity. At the same time, keeping interest rates low for long can create financial sector vulnerabilities, which need to be carefully monitored.

With low levels of unemployment in most countries, fiscal policy should be anchored by medium-term objectives, while allowing automatic stabilizers (that is, spending and revenue that adjust to the ups and downs of the economy) to work fully. Given elevated risks, countries should have contingency plans ready to be implemented in case of a severe downturn.

Structural reforms—such as policies to improve competitiveness and increase labor force participation—remain vital to boost productivity and incomes.