Radhus in Oslo, capital of Norway. (Photo: Kim Kaminski/Alamy Stock photo)

Norway’s Economic Outlook in Seven Charts

June 12, 2019

Norway's economy has performed well over the past year, especially compared to its neighbors. It is enjoying low unemployment and a broadly neutral budget, while its economy continues to grow. Given its strong momentum, now would be the ideal time for the country to address long-term challenges, suggests the IMF in its latest assessment of the Norwegian economy. Here are seven charts that tell the story.

Related Links

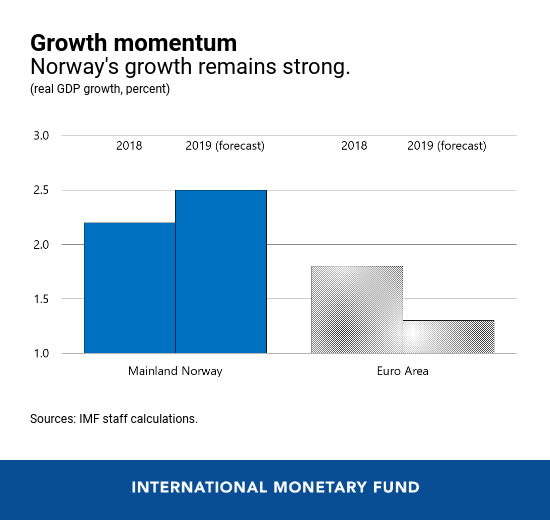

- Growth in many advanced economies has slowed, but Norway’s economy

continues to expand strongly. The weaker krone is helping exporters, low

unemployment is boosting incomes, and oil prices remain materially above

break even levels, supporting investment. Although global trade tensions and

uncertainty about European growth cloud the horizon, Norway’s outlook

remains positive.

-

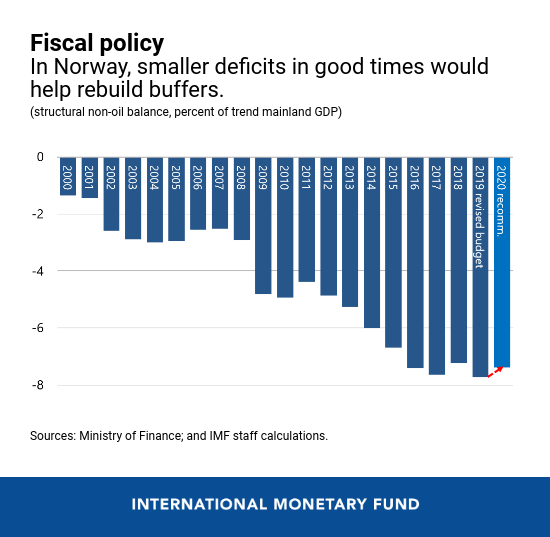

In good times, it is important to avoid complacency. On fiscal policy:

in recent years, the budget has been broadly neutral, neither adding nor

subtracting from economic growth. This marks an improvement from the past,

when the deficit kept rising even when growth was healthy. However, in the

current upturn there is a strong case for reducing the deficit. Smaller

deficits now would generate fiscal buffers to counteract the next slowdown.

-

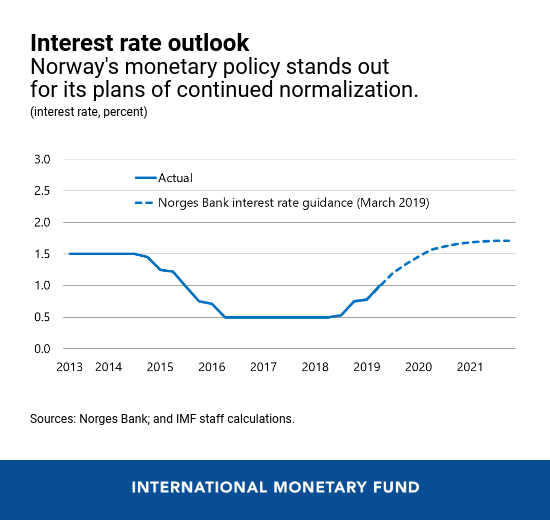

Low unemployment and rising wages are pushing inflation higher, leading

Norway’s central bank, Norges Bank, to hike interest rates twice in the

last nine months. How fast should the central bank lift rates going

forward? Raising rates too slowly could lead to high inflation, while

hiking too aggressively could expose households to sharp increases in

interest rates. In our view, the tightening projected by Norges Bank

strikes the right balance between these risks.

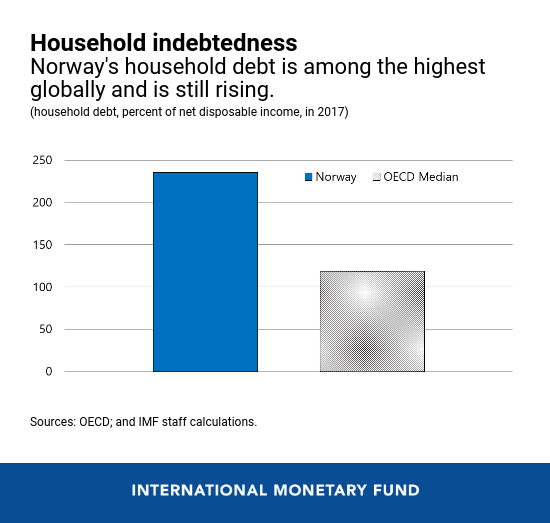

- House prices had been growing too fast until last year, raising concerns

about disruptive price falls. Since then, house price gains slowed, and

valuations now appear less stretched. But Norwegian households still have

one of the highest debt levels globally, and indebtedness keeps rising. For

these reasons, mortgage regulations should not be relaxed. Developments in

commercial real estate should also be monitored, as valuations appear

stretched, notably in Oslo’s prime segment.

-

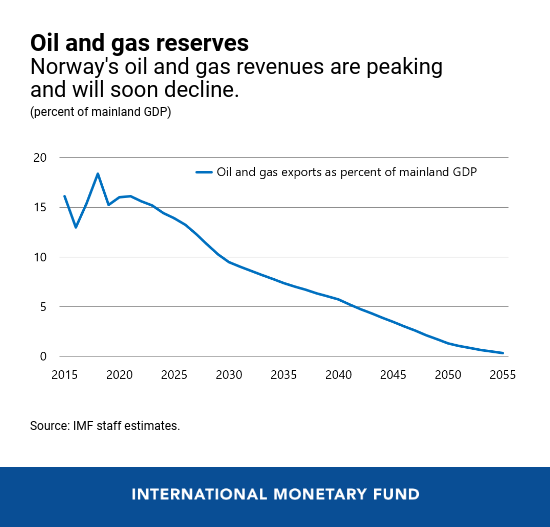

Good times provide the ideal opportunity to address longer-term

challenges. In the future, oil and gas revenues are expected to drop, as

reserves are progressively depleted. Simultaneously, pensions and

health-related costs will continue to climb because of aging. These two

forces imply that over time Norway’s budget will face increasingly hard

choices, which will require finding new sources of revenue or savings to

accommodate new spending.

-

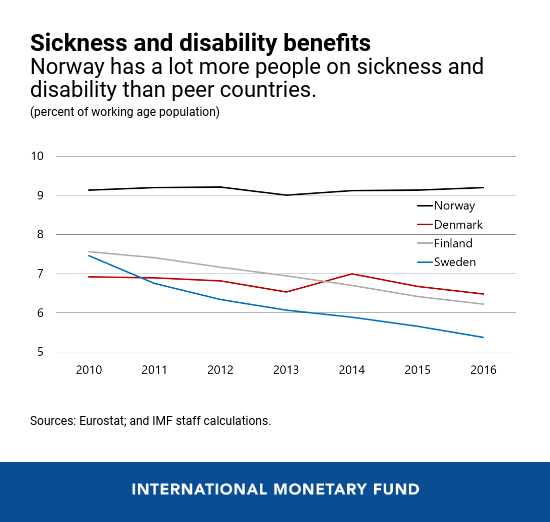

Sustaining high living standards as the population ages will require

expanding the labor force as much as possible. Reforming sickness and

disability benefits is a priority. Compared to other Nordic countries, a

significantly higher share of Norwegians is on these programs and not

working. Social partners will soon convene to discuss the reform proposals

of an expert commission. In the IMF's view, these recommendations are a good

starting point for a reform.

-

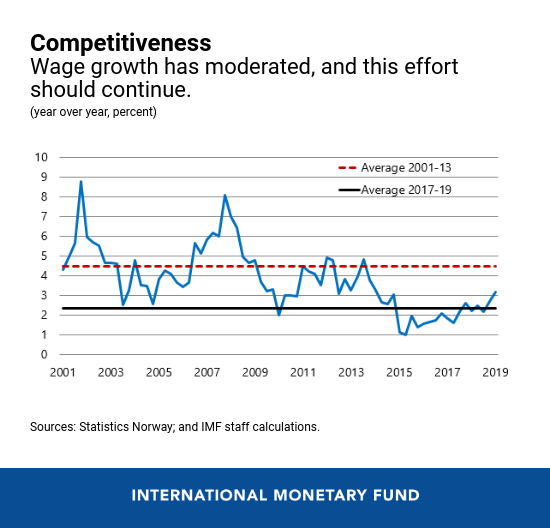

As the economy continues to transition away from oil and gas, other

sectors will have to become more competitive. The weak kroner has helped,

but this won’t be enough on its own. Continued wage moderation, underpinned

by a sense of shared trust and responsibility, will also be needed.