An oil tanker sails in the waters of Indian ocean (iStock/Charalambos Andronos)

The Economic Outlook of the Middle East, North Africa, Afghanistan, and Pakistan in Five Charts

April 29, 2019

In the best of times, countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region would face a formidable task of creating jobs for the millions of young people entering the workforce. Now, they must tackle this challenge amid a slowing global economy, volatile oil prices, and uncertainty around trade tensions.

A steadfast commitment to reforms that build resilience and help secure higher and more inclusive private-sector-led growth is more urgent than ever.

Below are five charts that help illustrate key findings from the IMF’s Regional Economic Outlook Update:

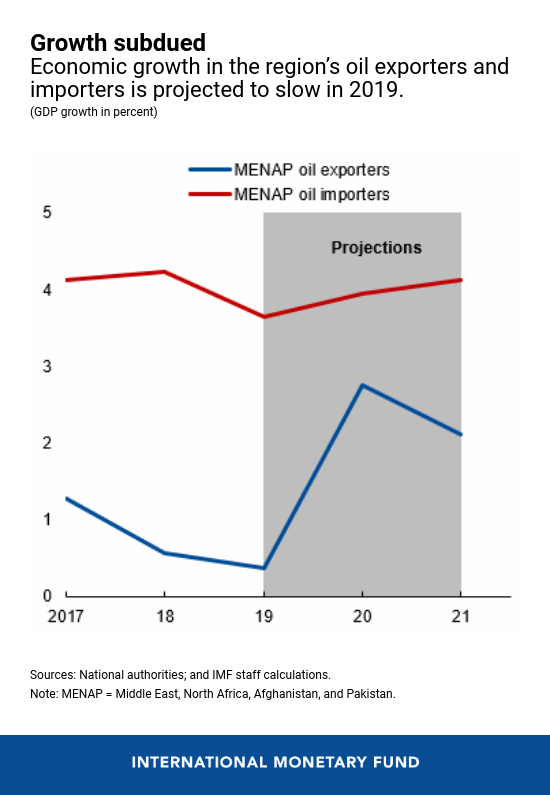

- Growth in oil exporters is projected to remain subdued relative to 2018. Although growth in the Gulf Cooperation Council (GCC) is projected to improve slightly to 2.1 percent in 2019 from 2 percent in 2018, a sharp decline in Iran’s economic activity (of 6 percent) amid sanctions results in a mere 0.4 percent rate of growth for 2019 for the region’s oil-exporting countries.

Meanwhile, growth for oil importers is projected to slow from 4.2 percent in 2018 to 3.6 percent this year, reflecting the slowing global economy and domestic factors. However, this aggregate projection does not reflect the wide variation among oil-importing countries. Egypt, for instance, continues to perform strongly, while weak growth in Pakistan weighs on the region’s aggregate growth rate.

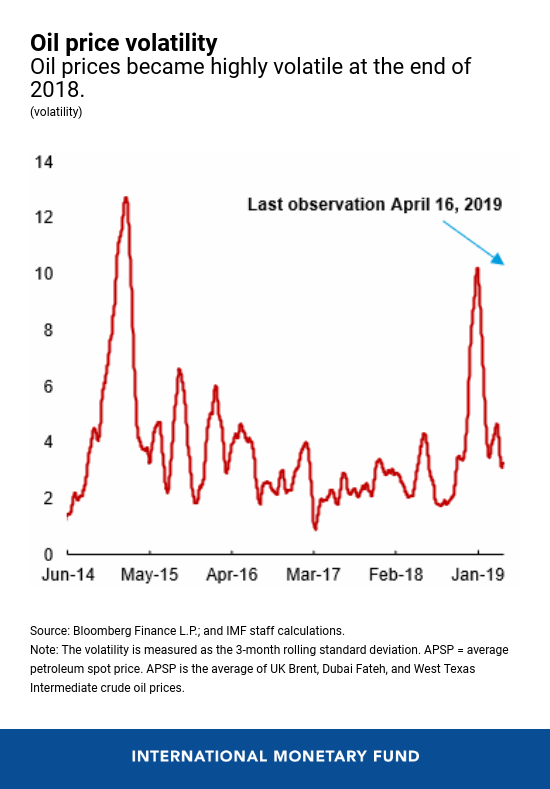

- One key development that will shape the region’s economic outlook is oil price volatility, which recently reached levels not seen since the shocks of 2014-15. This trend may continue amid uncertainties around global trade tensions, Iran sanctions, and the OPEC+ production strategy. Other risks to the region include geopolitical risks, security concerns, and uncertainty surrounding global financial conditions.

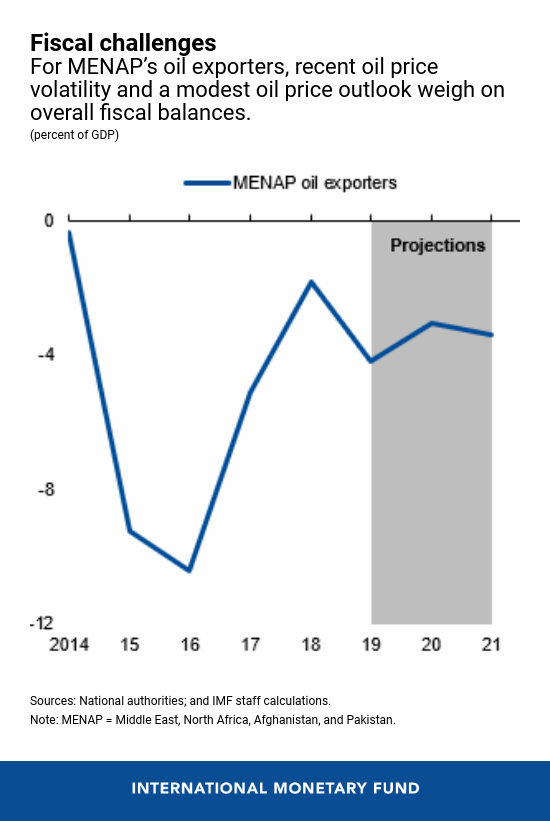

- Lower oil prices with bouts of volatility and a slower pace of fiscal consolidation will weigh on fiscal balances in oil-exporting countries. At the same time, there are indications that government spending may no longer be able to boost growth as it could when oil prices and investment were high, and the external environment was strong. This combination underscores the need to resume fiscal consolidation while sustaining growth. Anchoring fiscal policy, including government spending, in a medium-term framework would help insulate economies from rapid and pronounced oil price swings and gradually rebuild fiscal space.

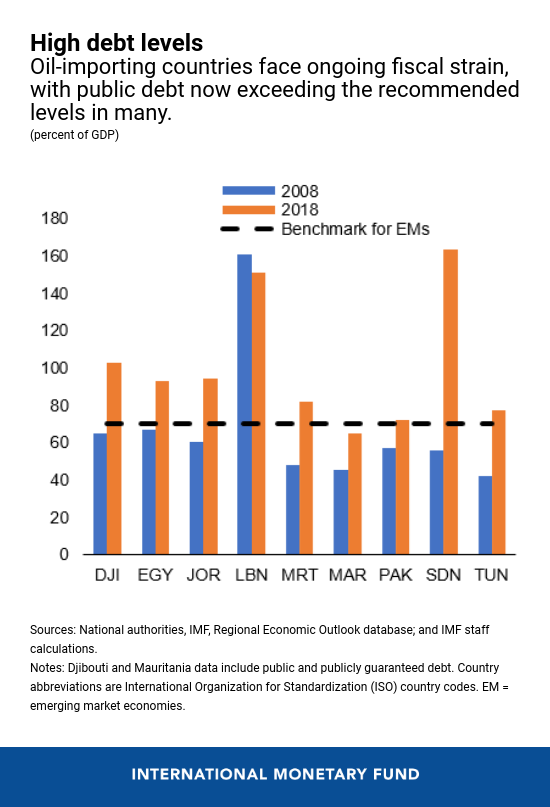

- Public debt ratios have continued to rise in several oil-importing countries in recent years despite fiscal consolidation efforts. In fact, debt ratios have increased by 20 percent of GDP on average since 2008, with two-thirds of countries carrying public debt of at least 70 percent of GDP, a level associated with a higher risk of debt distress. And as the chart below shows, the debt levels for some countries, such as Egypt, Jordan and Lebanon, exceed 80 percent of GDP, limiting the fiscal space needed for critical social and infrastructure spending, and leaving economies vulnerable to less favorable financial conditions. This underscores the need for continued growth-friendly fiscal consolidation to rebuild buffers and strengthen resilience.

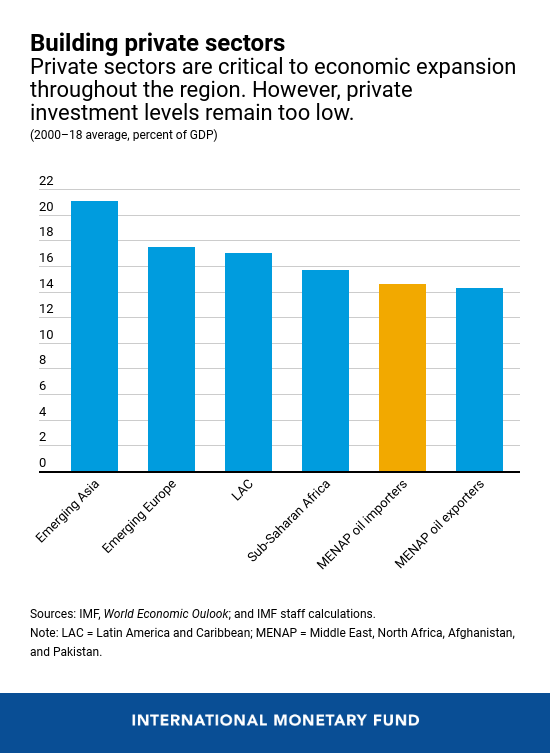

- Given considerable policy constraints, especially for fiscal policies, there is more urgency for countries to pursue reforms that leads to private-sector-led growth that benefits all. This means fostering an inclusive growth environment that can attract investment—an area where both oil exporters and importers have long trailed their peers, as seen in the chart below—create jobs, and drive innovation.

Key priorities include boosting the quality of education, reforming labor markets, addressing key infrastructure gaps, and improving the business environment, including by reducing corruption and shoring up legal systems.

Increasing access to financing for small and medium-size enterprises, which has long been low in the region relative to others, would help boost job creation and diversify economies.