People walking in downtown streets, Lagos, Nigeria. The country needs to mobilize resources to invest in people. (iStock/peeterv)

Nigeria: Mobilizing Resources to Invest in People

April 3, 2019

Spending on health and education in Nigeria is among the lowest in the world. To fund these crucial sectors, Nigeria will have to maximize the amount of revenue it raises.

Diversifying the government’s revenue base, increasing non-oil revenues,

and securing oil revenues, will all be critical, says the IMF in its latest

economic health check of sub-Saharan Africa’s most populous economy.

“Identifying two or three big-ticket items could lift revenue sustainably and in a timely manner—other reforms could follow,” said Amine Mati, IMF mission chief and senior resident representative in Nigeria.

Challenges of a global dimension

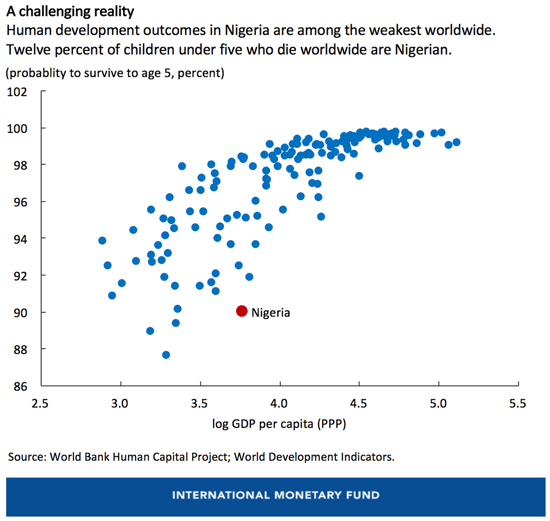

According to the report, public services and infrastructure in Nigeria are under considerable strain. Globally, Nigeria ranks first in the number of children out of school. Infant mortality is also high: 12 percent of all children who die under the age of five are Nigerian.

At 1.7 percent and 0.6 percent of GDP, levels of spending on education and health are among the lowest in the world, and insufficient to address growing challenges. To meet these large spending needs, greater resource mobilization is critical. With rapid population growth that could make Nigeria the third most populous country in the world by 2050, these issues will intensify if left unaddressed.

Limited breathing space

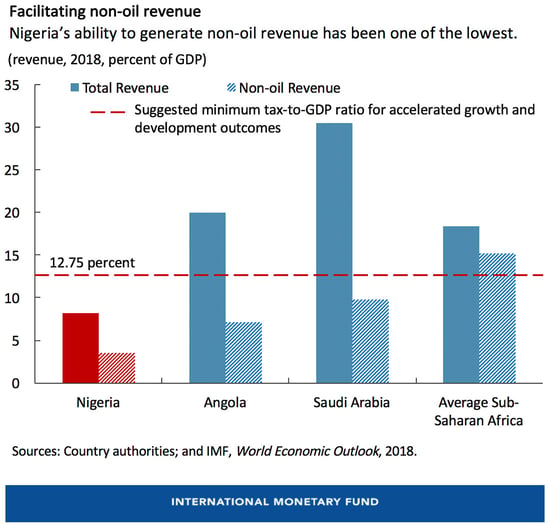

The revenue base is simply too low to address the current challenges, says the IMF. At 3-4 percent of GDP, Nigeria’s non-oil revenue mobilization has been one of the lowest worldwide, reflecting weaknesses in revenue administration systems and systemic noncompliance.

For corporate income tax, less than 6 percent of registered taxpayers are active. Estimates on payment compliance in the case of value added tax (VAT) vary between 15 and 40 percent, and Nigeria raises less than 1 percent of GDP in VAT revenue, compared to almost 4 percent of GDP in the countries of the Economic Community of West African States (ECOWAS). Tax exemptions and incentives are narrowing the base.

International evidence shows that a minimum tax-to-GDP ratio of 12.75 percent is associated with a significant acceleration in growth and development of state capacity. It would allow increased expenditure for economic development and reduce budget exposure to oil revenue volatility.

Accelerated and forceful reforms needed to make a visible dent

The government is recognizing these challenges. It has taken welcome steps to increase tax audits, use e-filing, self-assessments, conduct data matching exercises to close collection loopholes, strengthen tax enforcement, and combat corruption in tax offices, and increased excises on alcohol and tobacco. It also launched the Strategic Revenue Growth Initiative that calls for the appointment of a high-powered steering committee to guide reforms and monitor progress on several welcome proposals.

A more comprehensive tax reform could help increase the tax-to-GDP ratio by about 8 percentage points. These could be generated through tax policy and revenue administration measures that could yield an additional 3½ percent of GDP from VAT reforms, 1½ percent of GDP from excises, 2 percent of GDP from the rationalization of tax expenditures, more than 1 percent of GDP from efficiency gains and stronger internally-generated revenue collection, and through taxation of property at the state level.

Such a reform program would broaden the base of income and consumption taxes, improve data collection and monitoring, improve tax compliance and create incentives for sub-national tiers of the government to raise their own revenues.

Moving forward

"VAT reform would benefit both the federal and subnational budgets," said

Amine Mati, IMF mission chief and senior resident representative in

Nigeria. "It would include tax credits for intermediary inputs used for the

final products and capital expenditures, an annual turnover threshold for

VAT registration to exclude small and micro businesses, and improved

monitoring and control," he added.

The report suggests there should be a single and higher rate for VAT of

between 10-15 percent. Exemptions should be limited, well-targeted and

follow equity considerations. The report underlines that vulnerable

populations must be shielded from any negative impact of the reform,

including through targeted social transfers.

Short-term tax and customs administration measures are essential, suggest IMF economists. They should include strengthening taxpayer register and improving filing and payment compliance and initiating large scale data analysis and cross matching. Improving filing and payment compliance, for example, through document simplification and penalties for non-compliance, and putting in place appropriate management controls in customs are other key measures.

Oil revenues that make up a substantial share of government revenues also need to be secured. This includes ensuring that the ongoing work on new petroleum legislation brings an appropriate government take, while not discouraging foreign investment. It is also important that any sales of oil assets should be preceded by changes in legislation (Petroleum Profit Tax Act) to ensure revenues of the new operator are not exempted and find their way into public finances.

The report acknowledges that raising revenues in a short time by a significant amount is ambitious, but the authors believe the proposal is feasible, as shown by international experience. Facing this challenge will help Nigeria make the necessary investment into priority areas—crucial to boost living standards for its young and rapidly growing population.