Residential properties line the Sydney suburb of Birchgrove in Australia, where household debt remains high (photo: Reuters/Steven Saphore/Newscom)

Australia's Economic Outlook in Six Charts

February 21, 2019

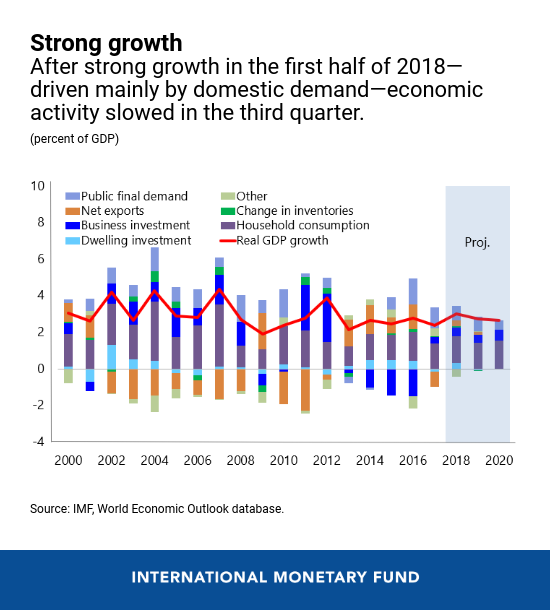

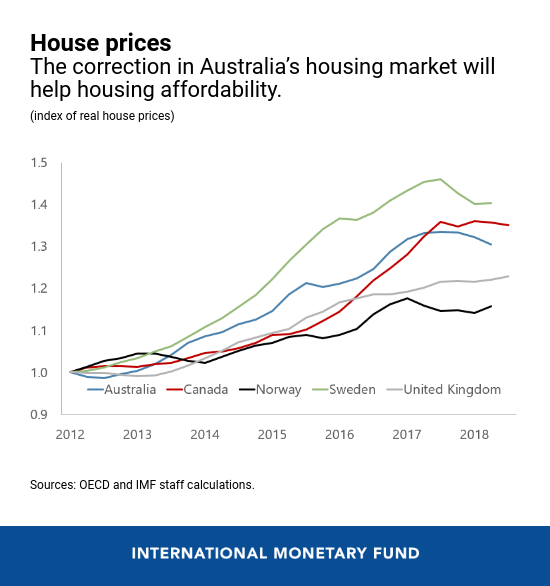

Economic growth in Australia picked up strongly in the first half of 2018, and the economy made further strides in its adjustment and rebalancing after the end of the mining investment and commodity price boom. Despite strong employment growth and declining unemployment rates, wage growth was low and underemployment still above its longer-term average. In the absence of wage or other cost pressure, inflation remained below the central bank’s 2 to 3 percent target range. After a recent housing boom, a housing market correction is now underway.

An important economic policy priority in Australia is to maintain supportive macroeconomic policies and secure stronger demand momentum. Other priorities include holding the course on macroprudential policies to reduce macro-financial risks, and complementing the current infrastructure boost with broad tax reform, sustained promotion of innovation and competition, and energy policy reform. Australia’s continued commitment to openness and trade will also support longer-term growth.

Related Links

Below are six charts that encapsulate Australia’s economic profile and policy priorities:

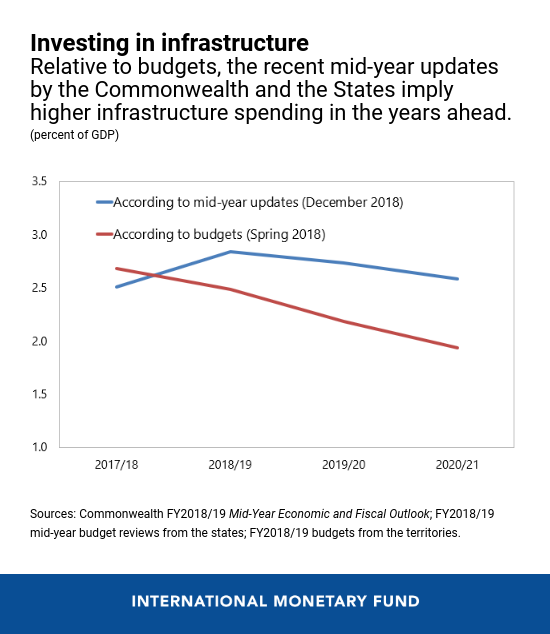

- Economic growth in Australia is expected to moderate in the near term but remain close to trend. A rebound in non-mining business investment and public infrastructure spending are projected to offset the expected contraction in dwelling investment.

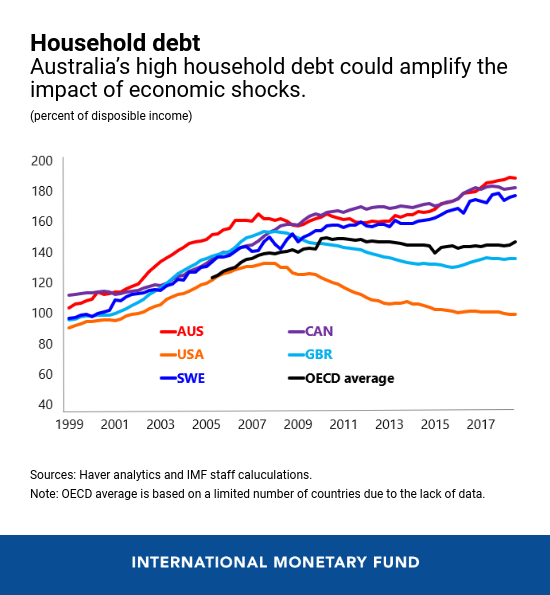

- Economic and financial vulnerabilities relating to high household debt and low housing affordability have become major concerns after Australia’s recent housing boom. The forecasts incorporate a soft landing in the housing market, but a stronger market correction remains a risk. Under an orderly correction, house price overvaluation and average household debt both decline over time. Even so, at 165 percent of disposable income or higher, household debt is expected to remain elevated in international comparison over the next few years, as will related vulnerabilities.

- Housing supply reforms will remain critical to restoring housing affordability. While the housing market correction will help, it is unlikely to be sufficient for inclusive, broad-based affordability and growth. Demand for housing is expected to remain strong, given a robust outlook for economic growth and high population growth in urban areas. As planning, zoning, and other reforms affect supply and prices with long lags, housing supply reforms should, therefore, not be delayed because of the housing market correction.

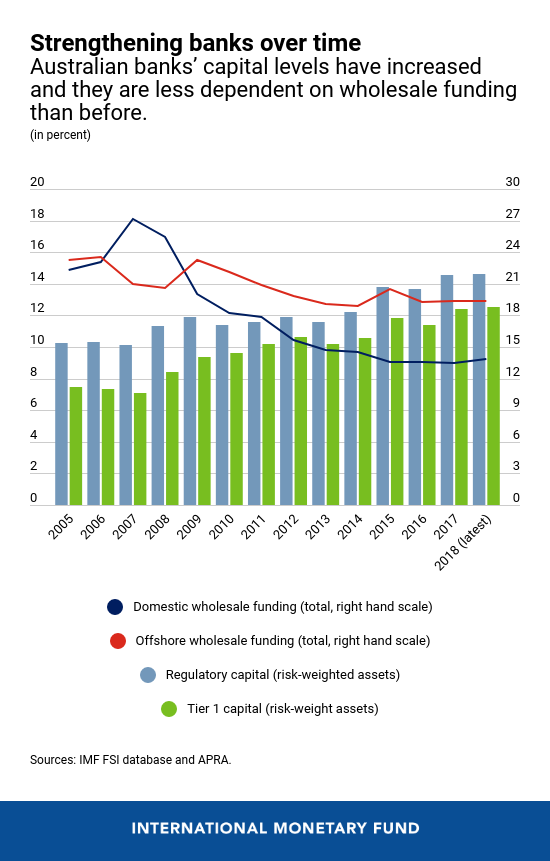

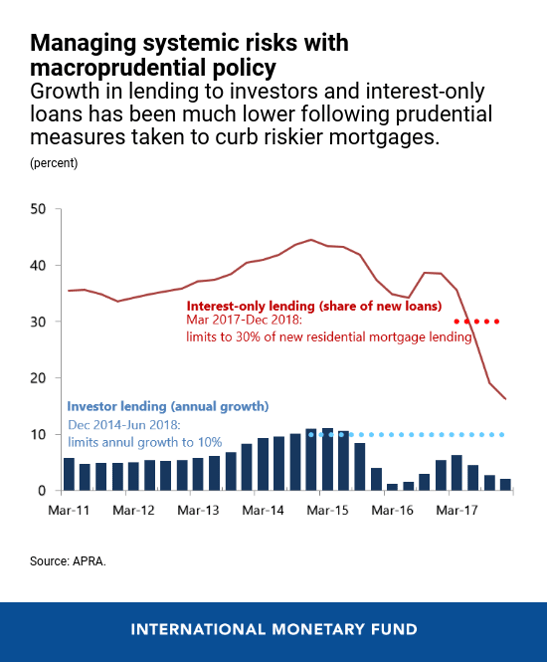

- Financial system resilience strengthened since the IMF’s 2012 assessment of Australia’s financial sector with the introduction of a number of measures including raising capital requirements of banks, taking steps to reduce their reliance on less stable sources of funding from global markets, introducing macroprudential measures to calm rapid growth in the riskier segments of the mortgage market, and enhancing the quality and effectiveness of financial supervision and systemic risk oversight. Tests conducted by the IMF’s 2018 financial sector assessment suggest that banks remain relatively resilient under conditions of economic and financial stress.

- Nevertheless, the assessment also found that the financial sector faces continued vulnerabilities from high household debt, still-stretched real estate valuations, and banks’ ongoing dependence on funding from global markets. It recommended further steps to bolster financial supervision as well as to reinforce financial crisis management arrangements.

- Policy reforms will help in raising the longer-term growth potential. Australia’s current boost in infrastructure investment supports domestic demand growth, while also helping to meet the needs of a growing population and laying the foundation for higher future productivity growth. Scope exists to further expand infrastructure spending to stimulate productivity, given Australia’s notable infrastructure gap compared to other advanced economies. Raising future productivity growth cannot rely on infrastructure alone. The national energy policy should reduce policy uncertainty and catalyze investment. Broader tax reform would be beneficial, if it focused on using more efficient taxes with stable bases, such as the GST and land taxes, while reducing overly generous tax concessions.