London commuters on the way to work. Despite a moderation in economic growth, UK employment is at historic highs (photo: Gustavo Valiente/i-Images / Polaris/Newscom)

UK's Economic Outlook in Six Charts

November 14, 2018

Growth in the United Kingdom has moderated since the 2016 Brexit referendum. An exit from the European Union without an agreement is the most significant risk to the outlook, the IMF said in its latest annual assessment of the economy.

Related Links

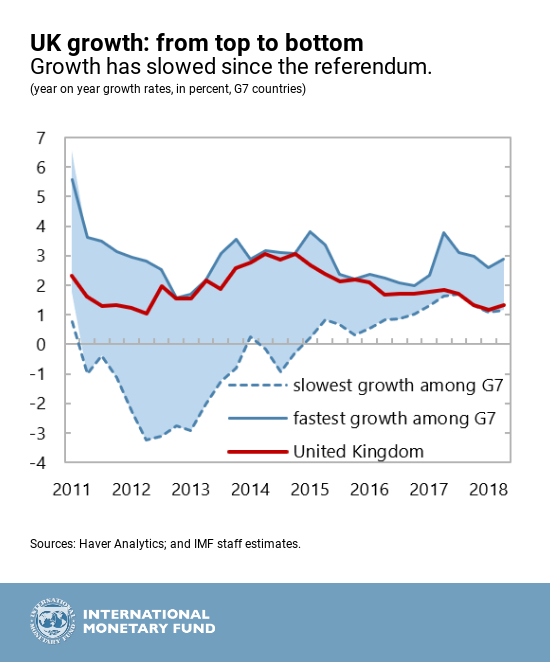

- The UK is set to exit the EU in March 2019. It is now in the process of negotiating its future relationship with the EU. Growth has moderated since the 2016 referendum, moving the UK from the top to near the bottom of the Group of Seven growth tables.

Private consumption has been constrained by slow growth in real incomes. Business investment—which was affected by expectations of higher trade costs and uncertainty over the terms of the withdrawal from the EU—has been lower than expected given robust global growth and favorable financing conditions.

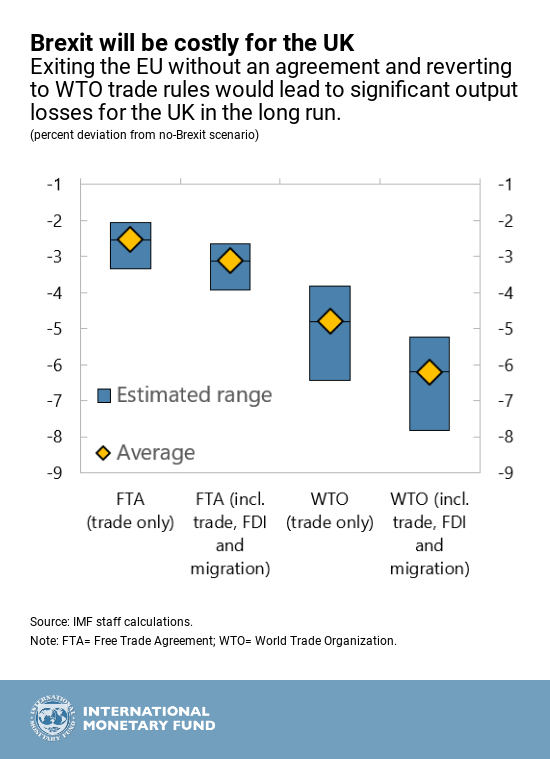

- An exit from the EU without an agreement is the most significant risk to the outlook. Moderate growth of just above 1½ percent is projected for the coming years, conditional on reaching a broad free trade agreement (FTA) with the EU and a smooth Brexit process. There are risks on both sides.

On the upside, an agreement with fewer impediments to trade could boost confidence and lead to higher growth.

On the downside, reverting to WTO trade rules, even in an orderly manner, would lead to long-run output losses for the UK of around 5 to 8 percent of GDP compared to a no-Brexit scenario. This is because of higher tariff and non-tariff trade barriers, lower migration, and reduced foreign direct investment.

A worst-case scenario would be a disorderly exit without a transition period. Such an outcome would lead to a sharp fall in confidence and reversal of capital flows, which would affect asset prices and the value of sterling. Careful preparation and close cooperation between the EU and UK authorities would help mitigate risks to financial stability associated with a potential disorderly Brexit.

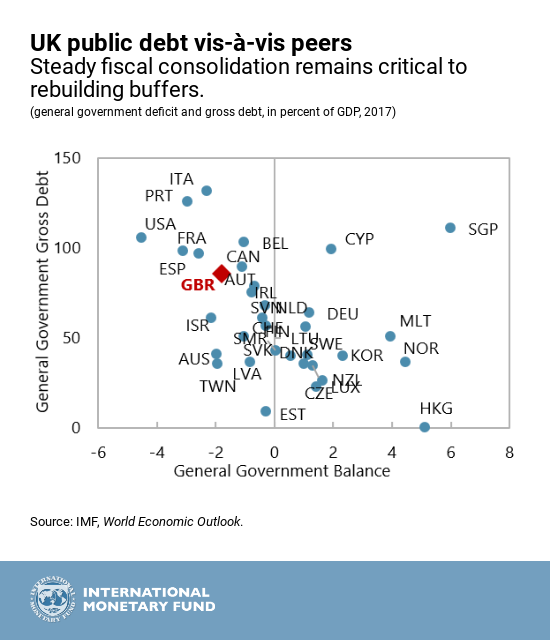

- Steady fiscal consolidation remains critical to rebuilding buffers and keeping debt on a downward path. Public debt is high, and the fiscal position is sensitive to negative shocks to growth. Population aging will create significant spending pressures over the longer term, presenting the public with difficult choices: either taxes and fees will have to increase, or the level or quality of health services and pensions will be affected.

A no-deal Brexit would require greater austerity in the long run through its negative effects on growth: a permanent decline in the level of output relative to the baseline scenario would reduce tax revenues and require further adjustment to maintain fiscal sustainability.

- Despite the moderation in growth, the employment rate has reached historic heights. The capacity of the economy to continue to grow without generating inflation is diminishing as firms invest less, the number of EU migrants coming to the UK for work declines, and the growth of output per worker remains low.

As spare capacity declines, domestic wages and other business costs are likely to increase. Thus, some further tightening of monetary policy over the next two years would likely be needed to ensure that inflation converges sustainably to the government’s 2 percent target.

Continued focus on strong prudential supervision would help ensure financial stability in the context of relatively easy financial conditions and Brexit-related risks.

- Sustained efforts are needed to support growth and reduce inequality over the long term.The future living standards of UK residents would depend on increasing productivity, the amount each worker produces per hour worked. A key priority in this context is strengthening human capital: UK students rank low on tests of basic numeracy and literacy despite relatively high average education spending.

The government’s efforts to invest in infrastructure, boost housing supply, and increase female labor force participation will also help support a more sustainable and inclusive growth.

- Brexit is likely to reshape the UK economy and policies could play a role in facilitating the transition. Different economic sectors will be affected differently by Brexit, depending on the new barriers they face. Greater use of active labor market policies could help the adjustment for both low-skilled and highly-specialized workers. It is important to develop policies that support workers and not particular jobs or sectors.