Commuters going in and out of the Consolacao subway station in downtown São Paulo, Brazil, where growth is projected at 1.4 percent in 2018 (photo: Alfribeiro/iStock)

Recovery in Latin America and the Caribbean Has Lost Momentum

October 17, 2018

Economic recovery in Latin America and the Caribbean has stalled, amid escalating trade tensions, tighter financial conditions, and volatile commodity markets, according to the IMF’s latest regional update.

Related Links

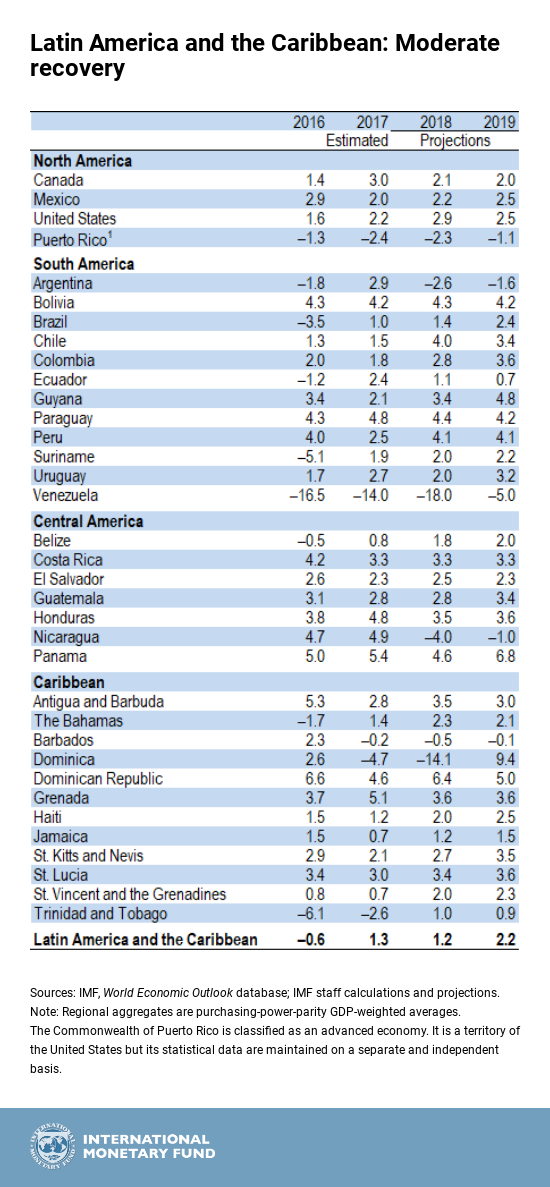

The Regional Economic Outlook for the Western Hemisphere marked down its growth forecasts for Latin America and the Caribbean to 1.2 percent in 2018 and 2.2 percent in 2019, from the May 2018 forecasts of 2.0 percent and 2.8 percent, respectively.

The moderating recovery is underpinned by divergent growth outcomes across the region. In some of the region’s largest economies, the recovery has slowed sharply, as country-specific characteristics amplify the impact of growing trade tensions and tightening monetary conditions.

Moreover, higher global oil prices coupled with increased political uncertainty have dampened the near-term outlook in several economies in Central America.

There are bright spots to the outlook, however. Better terms-of-trade over the past year and improvements in consumer and business confidence have boosted the growth prospects in some Andean economies (such as Colombia, Chile, and Peru) and activity is recovering in the Caribbean, reflecting the uptick in tourism owing to robust U.S. growth.

Investment pickup

“Despite the slowdown in regional economic activity, private investment is showing signs of life,” Alejandro Werner, Director of the IMF’s Western Hemisphere Department, told a press conference in Bali, Indonesia.

Having contracted for three years in a row, private investment in Latin America and the Caribbean is estimated to have stopped being a major drag to growth in 2017 and is gaining further strength.

In the last quarter of 2017 and the first quarter of 2018, the contribution of investment to growth in the region turned positive and is projected to continue supporting the recovery this year and next.

Nevertheless, investment levels are expected to remain below the levels observed in other regions, which would be explained in part by low saving rates. In this regard, prospects for long-term growth in the region remain modest, at 2.8 percent.

Regional mix

In Argentina, the economy is expected to contract this year and next. But, the authorities’ new push for stabilization should improve macroeconomic prospects in the medium run.

In Brazil, short-term growth prospects are weighed down by the effects of the truckers’ strike in May, the recent tightening of financial conditions, and the uncertainty surrounding the October elections.

Growth prospects in Chile have been upgraded due to the ongoing strong rebound of business and consumer confidence.

In Colombia, the economic recovery continues to be driven by higher oil prices.

Robust external demand for both traditional and nontraditional exports have provided a fillip to growth prospects in Peru.

There is still no end in sight to the economic and humanitarian crisis in Venezuela.

In Mexico, despite a preliminary trade deal with the United States and Canada, lingering uncertainty on the final agreement and tight financial conditions suggest the economy will recover gradually.

Growth in Central America has shown signs of deceleration since the beginning of 2018, driven by worsening terms of trade and subdued domestic demand.

Economic prospects for the Caribbean are improving. Growth in the region is expected to firm up this year and next, supported by robust U.S. and global growth. Reconstruction from the devastating hurricanes of 2017 in some tourism-dependent countries has been largely delayed so far but is expected to pick up in 2019. Rising commodity prices and production are projected to lead to stronger growth for commodity exporters.

Risks to the outlook

A slowdown in global trade, owing to a range of factors—including rising protectionism, an escalation of ongoing trade disputes, fluctuations in energy prices, and an abrupt tightening of global financial conditions―could undermine the nascent recovery and further reduce long-term growth prospects in Latin America and the Caribbean.

Regional and domestic risks have also intensified since the spring, and include political risks, regional spillovers, and the recurrence of extreme weather events, such as hurricanes in the Caribbean.

Policy priorities

Limited room in the budget. Latin America and the Caribbean countries continue to carry primary deficits that exceed debt-stabilizing levels, limiting the scope for government support. Higher energy prices and continued depreciation limit the room to maneuver interest rate policy. Credible policy frameworks should guide policies and expectations over time, to protect the recovery from a less benign external environment.

Exchange rate flexibility remains critical. With external dollar financing needs being relatively high in some countries and capital flows ebbing, policymakers in the region should be prepared for further capital outflow pressures. In this regard, exchange rate flexibility (where applicable) will remain key. Foreign exchange intervention should be limited to containing excess volatility in the event of disorderly market conditions.

Implementing key reforms can build growth with widespread benefits. Despite the increased downside risks, many countries in the region should continue to focus on much-needed structural reforms that would boost productive capacity and help build strong, durable, and inclusive growth over the medium term.

Reforms should focus on increasing saving and investment rates, reducing misallocation of resources, making labor markets more flexible, liberalizing trade, reducing informal labor markets, and improving the business climate.