Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : More Efficient Public Investment a Mideast, Central Asia Priority

November 17, 2014

- Infrastructure essential for growth but impact depends on efficiency of public investment

- Oil exporters in Mideast, Caucasus, Central Asia lag in efficiency relative to advanced countries

- Strong institutions, better management of projects are crucial

Improving the efficiency of public infrastructure investment across many oil exporters in the Middle East and North Africa and the Caucasus and Central Asia is now more important than ever. Developing strong institutions to manage public investment in these countries is crucial to foster economic growth, a new IMF study says.

Monorail in Dubai, United Arab Emirates. Better public infrastructure investment by many Mideast, Central Asia oil exporters is crucial (photo: Ingram Publishing/ Newscom)

Public Investment Efficiency

The study explores three alternative measures of public investment efficiency in oil and gas exporting countries in the Middle East and North Africa (MENA)—Algeria, Bahrain, Iran, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, United Arab Emirates, and Yemen—and the Caucasus and Central Asia (CCA)—Azerbaijan, Kazakhstan, Uzbekistan, and Turkmenistan. The analysis uses a global sample and other oil exporters as benchmarks when making cross-country comparisons.

Improving public investment efficiency in these countries is a priority, partly because they continue to have substantial infrastructure needs despite high levels of investment spending over the past decade amid high oil prices. For example, “the stock of paved roads in this group of countries is considerably smaller than in advanced economies,” says the study.

This is the case even for countries of the Gulf Cooperation Council (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates)—the best performers within the group. However, the gap vis-à-vis advanced economies is less pronounced in some other areas such as electricity generation capacity, where the Gulf Cooperation Council countries are already on par with advanced countries, the IMF report added.

Room for improving efficiency

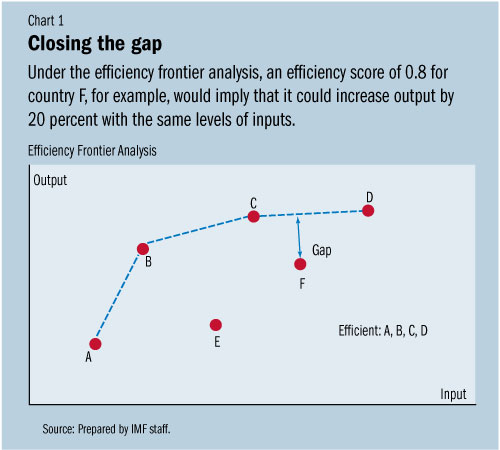

The first approach used in the study measures public investment efficiency or inefficiency relative to the best-performing countries. In doing so, it uses “efficiency frontier analysis” as a way to measure the relationship between public capital stock (which is the cumulative value of past investment, taking into account depreciation) and infrastructure. The latter is measured by the overall quality of infrastructure component from the Global Competitiveness Index, which is closely correlated with physical measures of infrastructure such as paved roads per capita.

The room to improve efficiency is determined relative to the best-performing countries in the global sample (A, B, C, D) located on the efficiency frontier. The efficiency scores for MENA and CCA oil exporters suggest that these countries could improve the quality of their infrastructure by up to one-fifth with the same amount of public capital stock (see Chart 1).

The second approach, which is based on project-level analysis, focuses on estimates of unit investment costs in large projects (such as metros and roads) across different country groups. The study finds that the average metro unit cost (expressed in dollars) is broadly similar to that in the United States, despite the fact that MENA and CCA countries pay much lower wages.

The final approach, which looks at the quality of the public investment management system over the investment project cycle, also points to weak performance in MENA and CCA oil exporters. The analysis of median scores suggests that these countries lag behind Central and Eastern Europe and Latin America and Caribbean regions in the appraisal and selection stages of the investment project cycle.

The study notes that public investment efficiency varies within the focus countries in the study, with the GCC countries generally ranking higher than other MENA and CCA oil exporters.

Roadmap for improvement

The study makes a series of recommendations for MENA and CCA oil exporters to enhance efficiency of public investment.

Exercising greater scrutiny of public investment projects to help increase the efficiency: this will entail more transparency of investment projects in the context of the budget process and over the project cycle (for example appraisal information, competitive procurement process, and bidding statistics).

Modifying, subsequently, the framework for managing public investment to help improve its productivity: analysis suggests that stronger medium-term budget frameworks—more thorough appraisal and selection of investment projects and systematic ex post assessments—could help strengthen the productivity of public investment.

The role of sound institutions plays out in a selected review of public investment management systems of countries with similar challenges in managing public investment amid abundant commodity-related revenues.

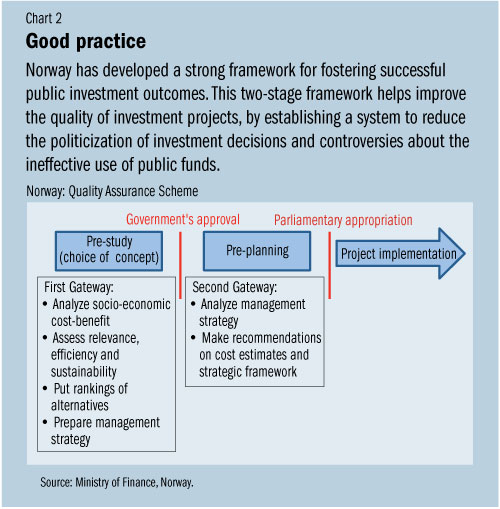

The study uses Norway—a resource-rich country that has achieved relative success in the outcomes of infrastructure programs—as an example of how quality of institutions plays a strong role in fostering efficient public investment. In particular, technical management of projects along with independent reviews of projects’ costing can help reduce the politicization of investment decisions and controversies about the ineffective use of public funds (see Chart 2).

A forthcoming IMF Policy paper “Making Public Investment More Efficient,” will look into reform strategies in these and other economies.