Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : ‘Microdata’ Give Boost to Economic Decisionmakers

December 23, 2015

- Microdata allow users to analyze policy impact

- Trustworthy, informative, and accessible data fundamental to good policy decisions

- Legal frameworks necessary to balance confidentiality and access to microdata

The revolution in data collection, dissemination, and analysis has yielded more granular data, or “microdata,” that provide number-crunchers a degree of certainty not seen in traditional aggregate data analysis, the audience at a recent forum co-sponsored by the IMF was told.

The Forum empowered a global dialogue among key statistics stakeholders. (photo: Frank Rumpenhorst/Bundesbank)

IMF Statistical Forum

Private corporations are also mining extensive datasets from social media, credit card transactions or cellphones to reveal patterns, trends, and associations of individuals, groups, and businesses.

The Third IMF Statistical Forum—co-hosted by Deutsche Bundesbank in Frankfurt am Main, Germany in November 19 and 20—gathered statisticians, central bankers, policymakers, and university professors to discuss a range of topics–from big data and microdata hubs to measuring material conditions of households. Microdata became the focal point of the forum.

What are microdata?

Microdata are unit-level data obtained from sample surveys, censuses, and administrative systems. They provide information about characteristics of individual people or entities such as households, business enterprises, facilities, farms or even geographical areas like villages or towns. An example would be the wages of individuals in a given company for a set period. They allow in-depth understanding of socio-economic issues by studying relationships and interactions among phenomena. Microdata are therefore key to designing projects and formulating policies, targeting interventions and monitoring and measuring the impact and results of projects, interventions and policies.

Leverage the data

Intelligence and judgment remain key ingredients to make microdata truly useful for policy purposes, indicated Professor Shirakawa, former governor of the Bank of Japan. During the 2011 earthquake crisis in Japan, for instance, policymakers consulted with local businesses to determine appropriate policy decisions.

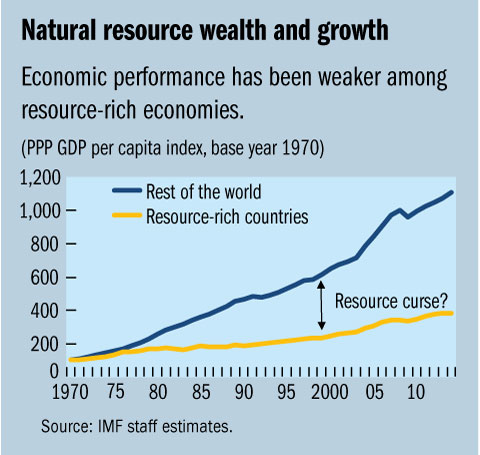

Vitor Gaspar, Director of the IMF's Fiscal Affairs Department, noted that we are in the midst of one of the largest booms and busts faced by resource-rich countries in the last 100 years. Data show the weaker performance of resource-rich economies over the long run with very few exceptions (see Chart). Even the oft-cited success story of Norway in managing oil revenue has challenges. Therefore, use of reliable data on natural resources and microdata on households’ and firms’ decisions can help address some difficult questions: How to design countercyclical policies when it is unclear if the current low oil price is cyclical or part of a permanent trend? How can a country know if it saves enough for future generations?

With the use of a financial accounting approach, aggregated household micro data can open the blackbox of consumption provided by the national accounts and shed further light on the material conditions of households. Professor Samphantharak, University of California, San Diego and Professor Manski, Northwestern University discussed factors such as the heterogeneity of households with respect to age, education, gender and the role of household expectations which impact household income and wealth.

Balance on confidentiality and access

Private entities are now in a position to measure or track economic phenomena using data generated exclusively through private sources. Google, for example, has introduced a series of tools–for example, “trends” and “correlate”–to allow users to analyze Google’s vast cache of microdata to determine the frequency of search terms used and organize them by countries, regions, cities and languages.

The availability of detailed data brings concerns about the privacy of individuals and confidentiality of data, because official statistics are compiled using microdata from administrative or other sources. Some compilers are reticent to allow users direct access to data which could identify entities or individuals. New practices and legislation are therefore being developed to appropriately balance confidentiality and access to microdata.

Data compatibility and comparability

Central to all discussions during the Forum was the understanding of the need to promote compatibility and comparability between the official statistics that are compiled using internationally agreed statistical standards and the data produced by private entities.

For example, the Billion Prices Project (run by MIT) uses web-scraped data to produce an alternative indicator of the consumer price index (CPI) for many countries. When comparing data from the Billion Prices Project with CPI data from official statistics, the high frequency and lower costs of producing these data are advantageous. However, their coverage can be limited and the extent to which they properly track CPI inflation is yet to be established.

The forum concluded with a roundtable discussion chaired by IMF Deputy Managing Director Min Zhu who challenged the participants to explain how “the New Age of data” will change policy making. Claudia Buch, deputy governor of the Bundesbank suggested to include evaluation clauses when new policies are adopted. Others noted that basic principles of statistics still hold: trustworthy, informative, and accessible data are fundamental to good policy decisions. The statistics community must work together to build the legal and technical frameworks to incorporate them.