Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : IMF Staff Paper: Linkages Between Labor Market Institutions and Inequality

July 17, 2015

- Declines in union density and minimum wages linked to higher inequality

- But unions, if nonrepresentative, can also increase unemployment and inequality

- Labor market policies should be assessed on a country-by-country basis, considering other policy objectives

In a continuation of their ongoing work on inequality, IMF economists have found a decline in unionization—that is, the reduction in the proportion of workers who are union members—and the erosion of minimum wages to be associated with rising inequality in advanced economies. However, these findings do not necessarily constitute a blanket recommendation for higher unionization and minimum wages.

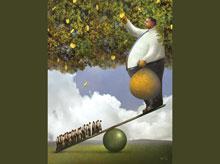

Lower union density is associated with increased income shares at the top (illustration: Michael Gibbs)

Inequality and Labor

In an interview with IMF Survey, Florence Jaumotte and Carolina Osorio Buitron, economists in the IMF’s Research Department and authors of a recently published IMF Staff Discussion Note, Inequality and Labor Market Institutions, explain how their findings shed new light on the sources behind the rise in inequality within advanced economies.

IMF Survey: The rise in inequality and, in particular, the growing concentration of incomes at the top of the distribution, are growing concerns for policymakers in advanced economies. You focus on the role played by labor market institutions. Why?

Osorio Buitron: As part of the IMF’s continuing work on inequality, we wanted to look at inequality from another angle. Traditional explanations for the rise in inequality have been technological progress and globalization. But there is little policymakers can do to reverse these trends, which benefit growth. Labor market institutions are of particular interest because they are more amenable to policy action. Moreover, while high-income countries have been similarly affected by technological change and globalization, inequality in these economies has risen at different speeds. This has led economists to underscore the role of other factors, such as country-specific institutional changes. And there have been significant changes in labor market institutions over the past 30 years—in particular, a strong decline in unionization and, in some countries, an erosion of minimum wages relative to median wages—which stood out as strong candidates to explain the rise in inequality.

IMF Survey: Do your findings imply that all countries should strive for higher unionization and higher minimum wages in order to reduce inequality?

Jaumotte: No, our findings don’t constitute a blanket recommendation for more unionization or higher minimum wages. Other dimensions are relevant, and higher unionization and minimum wages have their limitations. For instance, unions, if they primarily represent the interests of only some workers, can lead to high structural unemployment for some groups, such as the young. Moreover, if minimum wages are too high, they may increase unemployment among unskilled workers and undermine competitiveness.

Assessment of whether reforms to labor market institutions are appropriate needs to be done on a country-by-country basis, taking into account possible trade-offs with other macroeconomic priorities.

IMF Survey: What did you discover about the relationship between labor market institutions and inequality?

Jaumotte: We find that the decline in unionization is strongly associated with the rise of the income share of the top 10 percent of earners (to the detriment of middle- and low-income workers) in advanced economies. This holds even after controlling for other established determinants of inequality, such as technological progress, globalization, political and social factors, financial deregulation, and declining top marginal tax rates.

Moreover, the weakening of unions appears to be associated with less income redistribution, likely through a reduced influence of unions on public policy. Although causality is always difficult to establish, the decline in unionization appears to explain about half of the observed increase in top income shares and in the Gini of net income (a summary statistic that gauges the average difference in income between any two individuals from the income distribution).

In some countries, the erosion of minimum wages (relative to median wages) is also correlated with considerable increases in overall inequality. In contrast, we find some evidence that a lack of representativeness of unions—when unionization is low but the negotiated collective agreements apply to a large fraction of the nonunionized workforce—could lead to higher inequality, likely through higher unemployment.

It is also worth noting that, beyond union density and minimum wages, we do not find robust evidence that changes in other labor market policies are associated with higher inequality.

IMF Survey: Is IMF policy advice consistent with these findings?

Osorio Buitron: As mentioned earlier, the appropriate labor market reforms should be decided on a country-by-country basis, while taking into account other policy objectives. For example, the IMF’s advice on Sweden has recognized that the country’s collective bargaining institutions have, on average, delivered wage growth in line with productivity, while stressing that social partners also have an important role to play for exploring ways to increase wage flexibility at the firm level. Regarding minimum wages, the IMF’s advice is dependent on individual country circumstances—recently, the IMF supported raising the minimum wage in the United States; however, in Portugal the IMF recommended a freeze of the minimum wage after rapid increases during 2007–10 as a way to limit the rise of unemployment. In the case of China, recent IMF research points out that, depending on the circumstances, minimum wages can either help the cause of equity by ensuring that workers, particularly low-wage workers, have enough to live on or end up excluding low-wage workers from employment prospects, which may have adverse effects on both welfare and efficiency.

IMF Survey: Your finding that lower unionization correlates with higher top earners’ income shares appears a bit surprising at first. How do you explain it?

Jaumotte: Naturally, top income shares are mechanically influenced by what happens in the lower part of the income distribution. If de-unionization weakens earnings for middle- and low-income workers, this necessarily increases the income share of corporate managers and shareholders. Intuitively, the weakening of unions reduces the bargaining power of workers relative to capital owners, increasing the share of capital income—which is more concentrated at the top than wages and salaries. Moreover, weaker unions can reduce workers’ influence on corporate decisions that benefit top earners, such as the size and structure of top executive compensation.

IMF Survey: Are there other policies that can be useful to address inequality?

Osorio Buitron: Recent research has underscored the role played by reductions in top marginal personal income tax rates and financial deregulation in the rise of inequality, especially at the top of the income distribution. We do control for these factors in our analysis, and find supportive evidence that they also contribute to the increase in inequality in advanced economies. Hence, addressing inequality requires a multipronged approach across policy areas.