Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Soft Landing Ahead for U.S. Economy

August 6, 2007

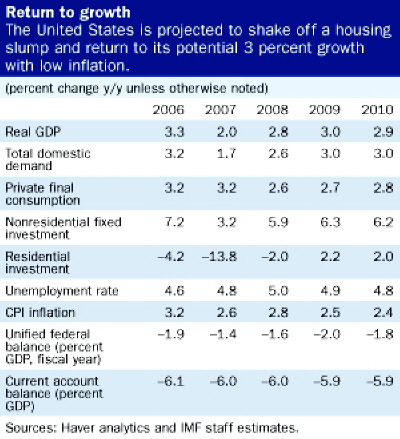

- United States should return to potential growth rate near 3 percent by mid-2008

- But housing market problems could still get worse

- Fall in budget deficit tops expectations; entitlement spending is fiscal challenge

The U.S. economy should shake off the effects of a steep housing market decline and return to potential growth of almost 3 percent by the middle of 2008 while core inflation would ease, the IMF says.

New car launch in Detroit, United States where, IMF annual assessment notes, private consumption remains strong (photo: Rashaun Rucker/MCT)

ANNUAL ECONOMIC HEALTH CHECK

The report, part of the IMF's annual "Article IV" consultation with the United States on the country's policies and prospects, cites a number of factors that should contribute to this so-called soft landing scenario.

• After exerting a substantial drag on overall growth in 2006 and 2007, housing investment should stabilize as its share in GDP is approaching historical norms.

• Despite the weaker housing market and high gasoline prices, private consumption has remained strong. Although it is expected to moderate a bit, strong employment, continued income growth and low inflation are likely to support solid consumer spending.

• Business fixed investment, which slowed late last year after three years of solid growth, should recover with strong corporate balance sheets and continued profit growth.

• Economic growth in the rest of the world should raise U.S. net exports.

Risks to soft landing

But the IMF warned that there are risks to the soft landing scenario. "Year-on-year growth is likely to remain for some time uncomfortably close to the 2 percent `stall speed' associated with past recessions," the report noted. Subprime mortgage difficulties could extend the housing downturn, which in turn could weaken consumption.

Financial conditions could tighten if lax underwriting standards uncovered in the subprime mortgage market prove more widespread and systemic. At the same time, with output still close to potential, unemployment low, commodity prices elevated, and productivity growth falling, cost pressures could boost inflation.

In its appraisal of U.S. economic policies, the IMF said that current monetary policy "is consistent with a soft landing," and that the Federal Reserve's policymaking Open Market Committee "has rightly emphasized maintaining well-anchored inflation expectations. However, while the favorable recent fiscal performance and the adoption of a medium-term fiscal target are commendable, further political effort is needed to sustain deficit reduction," the IMF said.

Entitlement programs

The key fiscal challenge, the IMF noted, is "unsustainable entitlement programs" driven by rising health costs and aging. Any reform of entitlement spending should be accompanied by tax reform as well. Revenue increases may well be needed in addition to spending restraint and "an overhaul of the complex tax system is in any case overdue."

While the large U.S. current account deficit with the rest of the world has been financed easily and the probability of a disruptive flight from U.S. dollar assets remains low, a reduction in the current account deficit is needed and policies supporting U.S. savings, including further fiscal deficit reduction, would help that adjustment. Staff analysis suggests that further dollar depreciation is required over time to rebalance demand and asset portfolios.

Are credit problems spreading?

At the time the report was completed in July, the IMF noted that problems seemed mostly confined to the subprime mortgage market—made of the least credit-worthy home loan customers. But while staff saw little contagion in other mortgage market segments, it warned of similar developments in a few non-mortgage sectors such as leveraged buyouts. "A turn in the credit cycle, especially if volatility and risk aversion rise, could expose financial vulnerabilities and unanticipated risk concentrations, with adverse effects on activity," the report said.

Events in recent days have underscored some of those findings. Markets have become more volatile, and many investors appear to have fled riskier assets to invest in safer securities, including U.S. Treasury obligations.

U.S. growth prospects obviously have important implications for the rest of the world, but new staff analysis finds that the degree of spillover hinges on conditions in U.S. financial markets. To the extent that financial market distress—the sort associated with recessions—is avoided, the impact on the rest of the world is much smaller. Indeed, this explains the limited global impact of the U.S. slowdown so far.

Focus on financial system

A particular focus of this year's Article IV consultation with the United States was the health of the U.S. financial system, which accounts for about half of the world's private bond market and dominates the issuance of securitized assets. "The income of institutions at the core of the financial system, the commercial and investment banks, increasingly derives from bundling and servicing securitized assets for investors—asset-backed securities and collateralized debt/loan obligations (CDOs/CLOs)—rather than from holding loans."

This innovative originate-to-distribute model has protected these core institutions from credit risk, created peripheral institutions that contribute to market liquidity, and spread risk through the asset-based securities. It has kept U.S. financial markets pre-eminent in the world and made the current account deficit easier to finance.

"Many investors have grown complacent about credit quality and increased the share of higher-yielding, oftentimes more complex higher-risk securities in their portfolios."

But these innovations are a double-edged sword. Because the originators of the loans do not hold them for their own portfolios—most of their remuneration is fee based—there is less incentive to maintain loan quality. And because financial conditions have been so benign for so long, many investors have grown complacent about credit quality and increased the share of higher-yielding, oftentimes more complex higher-risk securities in their portfolios.

These developments have "created new regulatory challenges," IMF First Deputy Managing Director John Lipksy said at a press conference in June. He said the Fund agrees with the approach of U.S. authorities of focusing "prudential oversight on core institutions while relying on market discipline to limit risks in general." But risk-taking and new instruments "have made it more difficult to assess vulnerabilities as we have seen, of course, in the subprime market. This will put a particular premium on supervisory systems geared to careful risk management."

The U.S. authorities broadly agreed with the basic assessment in the review, which is part of the IMF's mandate, under Article IV of its Articles of Agreement, to monitor global economic stability. Typically, the Fund holds annual consultations with each of its 185 member countries.