Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Belgium: Time to Shift to Higher Gear

May 28, 2007

- Strong economic policies result in robust expansion

- Reforms needed to cope with costs of aging population

- Globalization provides clear growth opportunities

Belgium's economy is enjoying a robust expansion.

Glassmakers at work near Liege, Belgium: country's high labor costs have discouraged labor supply (photo: Francois Lenoir/Reuters)

National Economy

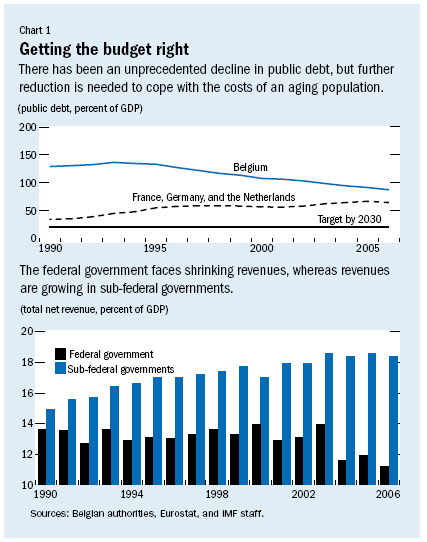

Output growth has outpaced the euro area average since 2002 and reached 3 percent in 2006, its fastest pace since the start of the decade and well above its long-term trend. Sound economic policies have underpinned growth. Public finances have been in balance since the beginning of the decade, bringing about an unprecedented decline in the public debt burden (see Chart 1, top panel).

Labor market reforms have helped more people find jobs. Nonetheless, the aging of the population and globalization make it increasingly evident that policies need to be strengthened further. With a new government taking office later this year, and a favorable macroeconomic environment, this is a good time to shift the pace of reforms into a higher gear.

Belgium's population is projected to age quickly, with significant repercussions for public finances. By 2050, one out of four citizens will be older than 65, compared with one in six today. As a result, the total age-related annual public bill will increase by almost 6 percentage points of GDP. At the same time, demographic change will contribute to a gradual drop in employment (only temporarily offset by a rise in female participation), depressing output growth over the long run.

By mid-century, every worker would have to contribute 8,100 euros (in today's euros) more annually to fund pensions and health care. For a small, open economy such as Belgium's, globalization provides clear growth opportunities. Larger export markets and cheaper inputs could boost workforce productivity—already among the highest in the world—with hourly labor productivity surpassing that of the United States by about 10 percent.

This strong performance reflects the efficiency of the manufacturing sectors and the specialization in capital-intensive industries, such as chemicals, pharmaceuticals, and oil refining. But Belgium's competitiveness has eroded and productivity growth has slowed, bringing up the challenge of maintaining its high living standards.It is equally important to ensure that globalization benefits are widely enjoyed.

Unsettling picture

Here, the picture is somewhat unsettling. Employment in Belgium is among the lowest in the industrial world (see Chart 2). This reflects a combination of structural problems. Labor costs, the highest among Organization for Economic Cooperation and Development (OECD) countries, have priced low-skilled workers out of jobs and encouraged capital- rather than labor-intensive production. Only about 40 percent of low-skilled workers are employed, and their unemployment rates are among the highest in the European Union.

Similarly, high labor costs and taxes have discouraged labor supply: a Belgian worker puts in half a day less a week than a peer in another OECD economy. Out-of-work benefits are generous and give little incentive to participate in the labor market. Activation measures, such as enforcement of job search requirements, have been spotty, and labor shortages in some regions and sectors underscore fundamental skill mismatches and limited labor mobility.

Current strategy could use a hand

To deal with the rising costs of aging, the government is pursuing a multipronged strategy of building up fiscal surpluses and implementing growth- and productivity-enhancing reforms. So far, the government's economic policies have met with success, and the principles of the strategy remain valid, but full implementation cannot be delayed further and policies need to be strengthened:

• Fiscal consolidation. Achieving fiscal balance for seven years running has established credibility, but interest savings associated with the declining public debt burden have been spent and used for tax reductions. Recognizing that this is no longer an option, the government now aims to build surpluses gradually to 1½ percent of GDP by 2013. As significant as this prefunding may be, it will fail to fully achieve the objectives of intergenerational equity; increases in social security contributions would be required later on. A somewhat more ambitious objective and, more important, a meaningful medium-term plan to reduce expenditures will be essential.

• Higher employment rates. Natural increases in female labor force participation and the impact of recent reforms will raise employment rates, though not enough to ensure an employment rate high enough to be consistent with the fiscal strategy. That means additional reforms of labor market institutions remain crucial, in particular in the context of mounting competitive pressures.

• Increased productivity growth. Further removing obstacles to competition in the services sector, including retail and financial services, would allow the economy to reap the benefits of new technologies and accelerate productivity growth.

• Further entitlement reform. Small but fair changes to pension requirements would help ensure against cost overruns and enhance the credibility and sustainability of the system; these should include fully phasing out early retirement, establishing complete actuarial fairness of the pension system, and tying contribution periods to life expectancy. In addition, achieving fiscal sustainability will require addressing emerging fiscal imbalances across levels of government (see Chart 1, bottom panel).

With population aging, it is increasingly evident that those imbalances between spending pressures and revenue growth across levels of government will widen. The federal entities face escalating aging-related spending but a decline in their relative share of revenues, mainly because of a policy of cutting social security contributions.

In contrast, the sub-federal governments are experiencing an increase in revenues as a result of prior decentralization agreements, with no pressing incentive to save. A revision of fiscal federalism arrangements should start now because it will take time for its effects to accrue. Its objective should be a more balanced sharing of the fiscal burden from population aging across levels of government while securing accountability and stronger coordination among government entities of both budgetary and other economic policies.

Labor markets: key and Achilles' heel

Labor market reforms of the recently enacted Generation Pact represent a breakthrough in awareness of the need to improve incentives to work and to make work pay, but they will not significantly lift employment rates above demographic trends. As a result, a balanced package of labor market and fiscal reforms (mindful of the implications for public finances) is essential to boost both labor demand and supply.

The tax wedge on labor should be further reduced and the generosity of out-of-work benefits reviewed. Eligibility for unemployment benefits will have to be tightened, its duration limited, and efforts to improve training and education enhanced. Finally, to raise their effectiveness, active labor market policies, such as job search assistance, training, and monitoring, will need to be streamlined, systematically evaluated, and coordinated across regions.

Rethinking wage-bargaining system

More wage flexibility would be a boon in the context of global competitive pressures. Although the central wage-bargaining framework has allowed for wage moderation, it has not favored wage differentiation across sectors, enterprises, and regions and has focused more on job preservation than on job creation. Broadening the use of practices in wage agreements to better reflect regional, sectoral, and firm-specific conditions would be helpful.

But a fundamental rethinking of the wage-bargaining system seems worthwhile.In the end, the trade-off is between endless wage moderation—sometimes bought with taxpayers' money—to keep waning industries alive and dynamic entry into new sectors with more promising overall wage prospects.

Belgium's capacity to maintain relatively high standards of living will also depend on its ability to promote its human capital and the development and adoption of new technologies. On-the-job and lifelong training keeps the labor force competitive, and raising the quality and efficiency of education should nurture a high-skilled labor force, key to continuing to attract foreign investment. In the same vein, ongoing initiatives with respect to research and development deserve to be pursued enthusiastically.