Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Sub-Saharan Africa Builds Momentum in Multi-speed World

May 10, 2013

- Continued robust growth in sub-Saharan Africa conditional on policy choices

- Region’s economic performance still subject to downside risks

- Rebuilding policy buffers while meeting developmental needs is priority

With a gradually improving outlook for the global economy, growth in sub-Saharan Africa is set to strengthen, according to the IMF’s latest forecast for the region.

Carpentry shop in Monrovia, Liberia. Strong activity in Africa’s low-income countries offsets slowdown in middle-income countries (IMF photo)

REGIONAL ECONOMIC OUTLOOK

The near-term outlook for the region is broadly positive because most factors lending support to economic activity in the last few years remain in place—namely strong investment, favorable commodity prices, and generally prudent macroeconomic management.

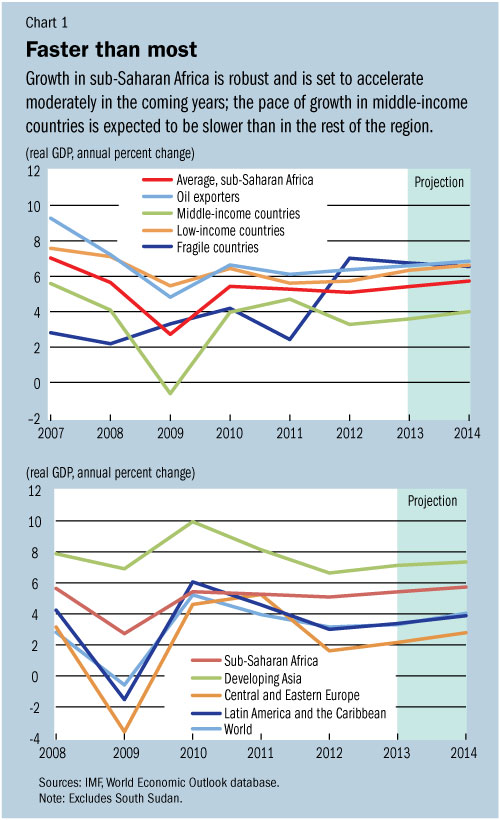

The IMF’s Regional Economic Outlook for sub-Saharan Africa projects regional economic growth of 5 ½ percent in 2013–2014, compared with 5 percent in 2012. Investment is expected to remain a key driver of growth, while measured activity in 2013 will also be boosted by one-off factors in some countries, including rebound effects from floods in Nigeria and recovery of agriculture in regions previously affected by drought.

Upper middle–income countries are expected to continue grappling with sluggish growth, while activity should gradually normalize in some fragile economies that were negatively affected by political instability.

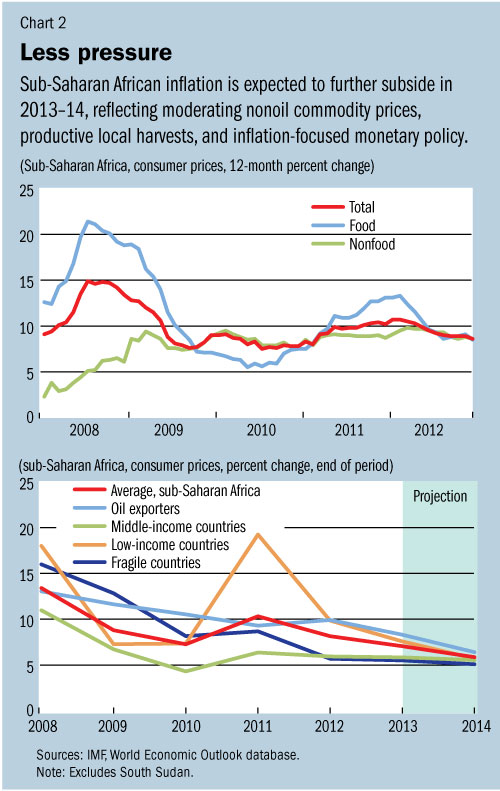

The region’s downtrend in inflation is set to extend into 2013–14. This forecast is premised on moderating nonoil commodity prices, productive local crops, and inflation-focused monetary policy. Gains made in combating inflation in eastern Africa are expected to be consolidated, while the pace of price rises is projected to slow in countries that experienced inflation flare-ups.

Strong growth, slowing inflation

Sub-Saharan Africa is now the second fastest–growing region in the world, trailing only emerging Asia (see Chart 1). However, growth patterns vary within the region. Strong economic activity in oil-exporting and low-income countries more than compensates for a significant slowdown in middle-income countries—largely reflecting problems in the euro area, but also local factors in a number of cases—and adverse effects from civil unrest in some fragile states.

After reaching more than 10 percent in 2011, consumer price inflation in sub-Saharan Africa dropped to 7.9 percent at the end of 2012 (see Chart 2). The reduction in inflation, which was particularly marked in eastern Africa, generally reflected good local harvests, well focused monetary policies and, in some cases, the appreciation of local currencies. That said, there were some exceptions to the downward trend in inflation in the region—most notably Malawi, which suffered pass-through effects from currency depreciation.

Downside risks

Growth prospects for the region are subject to downside risks, reflecting both external and domestic factors. On the external front, although near-term risks for the global outlook have diminished, sizable medium-term risks remain, including the possibility of prolonged near-stagnation in the euro area and a sharp drop in investment in major emerging market economies.

The Regional Economic Outlook indicates that should these risks materialize, they could temporarily affect sub-Saharan Africa’s growth but not derail it. That said, some countries with limited policy buffers or a high exposure to the shock—possibly reflecting a narrow export base—would likely experience more severe effects.

Domestic risks include adverse climate developments and internal conflict. These events, though potentially severe in their impact domestically and perhaps on close neighbors, usually do not have significant effects on the region as a whole.

Policy options

The region’s positive outlook is conditional on the implementation of sound macroeconomic policies, although there is no one-size-fits-all approach.

• With the risk of a significant global slowdown still present, rebuilding buffers to handle adverse external shocks is essential in many fast-growing economies—while preserving key capital and social spending.

• Large fiscal deficits in some countries point to the need for fiscal adjustment; but the pace of adjustment should take into consideration the state of the economy.

• Continued tightness in monetary policy is warranted in countries with high inflation; in other countries, there could be space for some cautious easing of the policy stance.

• Surging current account deficits in some low-income and fragile countries, although largely financed by export-oriented foreign direct investment, require careful monitoring.

Background studies

The Regional Economic Outlook also contains three background studies. The first analyzes the financial positions and ability to finance higher deficits of governments in the region, using a variety of approaches. The study concludes that although most countries in sub-Saharan Africa are not constrained from borrowing by high debt levels, many could find it difficult to raise sufficient financing for larger deficits in the event of a downturn.

The second study takes a look at the recent international sovereign bonds issued by sub-Saharan African countries, which have taken advantage of easy global financial conditions and good economic prospects for the region.

The possibility of issuing sovereign bonds enriches the menu of financing options available to some countries in the region; but making the most of this opportunity requires careful planning and execution, and proper consideration of the government’s overall fiscal and debt management strategies. Countries should maintain prudent fiscal policies, compare different financing tools, and follow best practices to ensure the most favorable financing conditions.

Energy subsidies

The third background study takes a look at energy subsidy reform. Many countries in sub-Saharan Africa maintain schemes that, directly or indirectly, subsidize the consumption of energy, particularly fuels. But energy subsidies tend to be costly, crowding out spending on much-needed social and infrastructure projects. Also, although subsidies may in some cases benefit the poor, most accrue to the more affluent segments of the population, making them an ineffective instrument of social protection.

The study documents some cases of successful energy subsidy reform in the region, and distills some lessons of broader applicability. These include the need for careful preparation and sequencing; the key role of strong institutions to support the reform process; and the importance of deploying well targeted social safety nets to offset the impact of the reform on the poor.