Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Emerging Europe Moves Ahead but Slower

May 6, 2016

- Robust recovery in most of the region, except in Russia and other CIS economies

- Growth still lower than before crisis, catch-up with advanced Europe to take longer

- Countries need to address structural bottlenecks

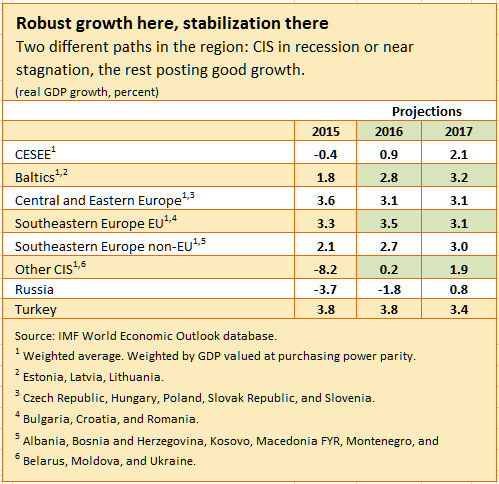

Most of the Central, Eastern, and Southeastern European economies (CESEE) continue to record robust growth, while Russia and other countries in the Commonwealth of Independent States (CIS) remain in recession, says the IMF in its latest Regional Economic Issues report for the region.

Tram in Prague, the Czech Republic. While most of the regional economies have grown, catching up with advanced Europe will take longer (photo: Pacific Press/Sipa USA/Newscom)

Regional Economic Outlook

Yet, average growth rates across the region are well below the levels before the crisis, thus it could take longer to catch up with advanced Europe. With the global economy facing mediocre growth prospects over the medium term, structural reforms offer the best hope for CESEE to lift growth and speed up convergence.

Central and Eastern European (CEE), Southeastern European (SEE) and Turkish economies have continued to expand at around 3-4 percent in 2015 (see table). In much of the region, growth has been driven by domestic consumption, which, in turn, is due to supportive macroeconomic policies and rising real wages. European Union (EU) member countries also benefited from a boost to investment due to increased utilization of EU funds before their expiration in 2015.

CIS countries remain in recession. The Russian economy contracted sharply last year as a result of plunging oil prices and Western sanctions, and will likely return to growth next year. Other CIS countries suffered from domestic political and financial woes and weaker external demand. IMF forecasts CIS contraction in 2016 to moderate to 1.5 percent, from 4.25 percent in 2015.

Heading for choppy waters

Although there is a strong cyclical rebound in CESEE countries, risks have increased. The strongest break on CESEE growth would be a stagnation in the euro zone, the largest trading partner for many CESEE countries. Also, prospects for CESEE countries would be dampened by lower-than-expected growth in the United States and China, and tighter financial conditions around the world. In addition, political instability and the rise of populist parties aggravate uncertainty throughout the region. With these higher risks, supportive monetary policy combined with medium-term fiscal consolidation remains valid policy advice for many economies in the region.

Catching up with advanced Europe requires extra effort

With the global economy less supportive in the medium term, lower growth can turn out to be the new normal in the region. This means that the pace of convergence to the living standards of advanced Europe may fall short of earlier aspirations.

To close the gap with advanced Europe faster, CESEE countries thus need stronger policies to improve labor supply, boost investment, and increase efficiency.

Improving the workforce

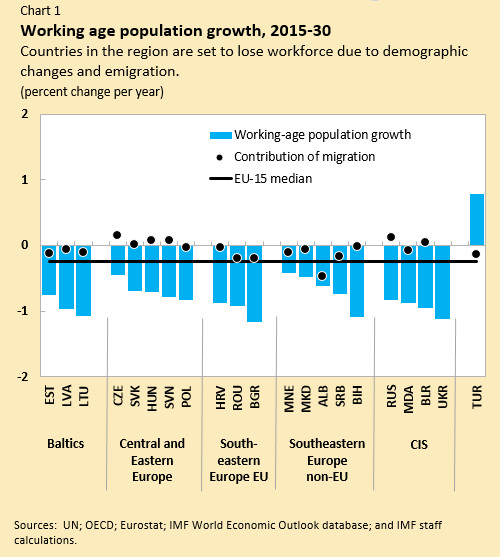

Most CESEE countries are facing severe declines in the working-age population. The trend is expected to continue or worsen in some cases (see Chart 1), exacerbated by emigration, which is estimated to have removed 20 million people (or 6.25 percent of the working-age population) from the workforce in the past 25 years. CESEE countries therefore should pursue policies to reduce structural unemployment and skill mismatches, extend work opportunities to underemployed groups like women and seniors, as well as improve health care in order to raise life expectancy. Better institutions would also help CESEE countries to retain and attract skilled workers.

Boosting investment

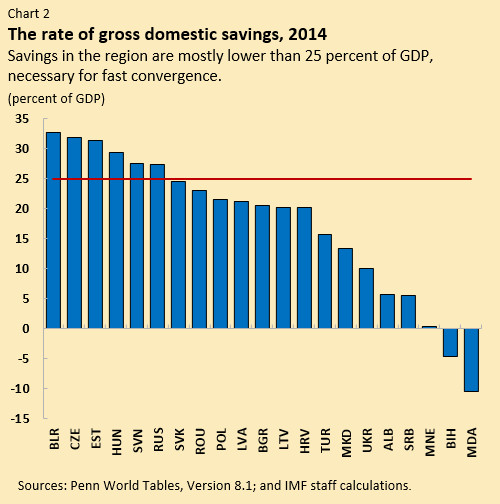

Capital stock per capita in a typical CESEE economy is still about one-third of that in advanced Europe. Investment gaps are particularly wide in infrastructure, where public investment could help, but on its own would not be enough. While in some cases investment is held back by lingering issues from the crisis—high debt burdens and nonperforming loans—most CESEE countries need to cure deeper structural issues in order to lift private investment. The countries should focus on institutional reforms that reduce inefficiencies and increase returns on private investment and savings. In most of the region, domestic savings are lower than what is needed to sustain investment rates high enough to close the income gaps with advanced Europe within a generation or so (see Chart 2).

Raising productivity

Structural reforms are of paramount importance to raise productivity that, in turn, could result in faster convergence with advanced Europe. CESEE countries should upgrade their legal systems, improve health care, and ensure a supportive environment for high productivity sectors and firms. To achieve this, governments should increase their efficiency, reduce the regulatory burden on businesses and improve affordability of financial services, in particular for small but productive firms. Certain countries in the region require deeper reforms to re-orient the economy toward more private-sector-led growth (Belarus), reinforce the independence of the judiciary system (Moldova), and to fight corruption and reform tax administration (Ukraine).