Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Asian Growth Easing, But Will Remain Strong

April 11, 2008

- Growth forecast to ease in 2008 as Asia unlikely to delink from global slowdown

- Risks remain on the downside owing to financial market uncertainties

- Many countries have "policy space" to combat any serious decline in growth

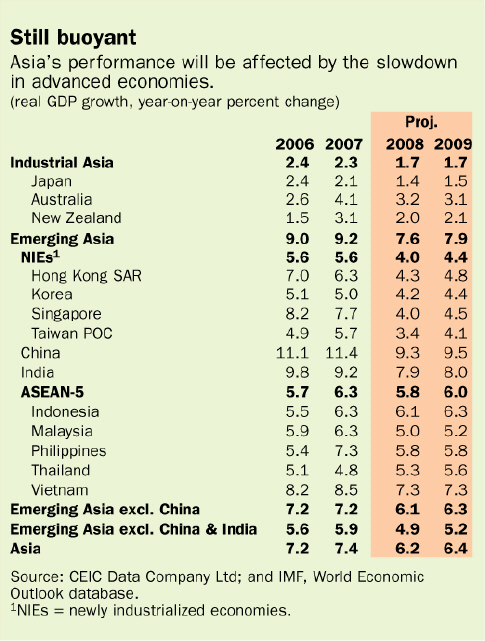

Growth in Asia is forecast to decline by 1¼ percentage points to 6.2 percent in 2008 due to the slowdown in advanced economies, but will remain buoyant—led by continued strong performances by China and India, according to the April Regional Economic Outlook for Asia and Pacific.

Open-air market in Vietnam, where inflation, as in several Asian countries, is on the rise.(photo: Newscom)

Regional economic outlook

"We see 2008 as a challenging year for Asia," said David Burton, Director of the IMF's Asia and Pacific Department. "Economic growth has held up well so far, but the region will not escape unscathed from the slowdown under way in the United States and, to a lesser extent, Europe.

"Already, exports to the United States and the European Union, and electronics exports in general, have begun to slow. Retail sales volume growth has declined in many countries, while industrial production and consumer confidence are easing in parts of the region," he told an April 11 press conference.

Inflationary pressures rising

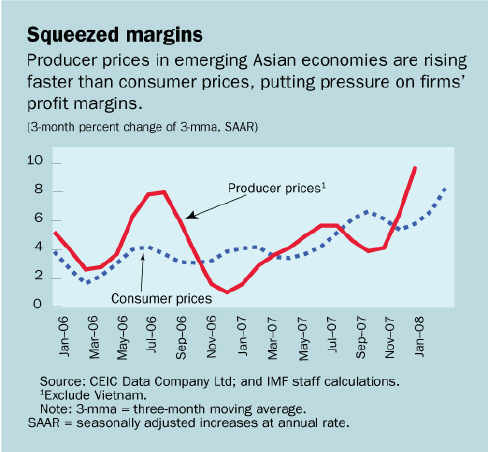

But inflationary pressures are now strong or rising across most of Asia. While the initial rise in headline inflation reflected supply-related food price shocks and higher global commodity prices, price increases are now starting to become more broad based.

"Moreover, the still-unfolding global financial crisis adds a dimension of uncertainty to the picture, and the balance of risks remains on the downside. Policymakers will need to remain vigilant and utilize their scope for action as conditions warrant," Burton said.

Asian financial markets have not been immune to the global turbulence. Equities are sharply lower than at the beginning of the turmoil, although price-earnings ratios remain elevated, and spreads have risen substantially. Risk aversion remains high, and fund managers in the region have reportedly shifted allocations toward safer investments. However, Asian markets have functioned well overall and there are few signs of a credit squeeze.

Rising inflation around the region constrains the extent to which macroeconomic policies, especially monetary policy, can be eased in the baseline scenario. However, in the event of a sharper slowdown in activity than currently envisaged, inflation pressures should abate, providing more room for a counter-cyclical response in many economies. In this connection, many countries in the region have strengthened their public finances during the recent upturn, which provides scope to use fiscal policy to counter any sizeable downturn.

Key regional trends

The report identified the following key trends in the region:

Asian growth. Emerging Asia is forecast to slow from 9.2 percent in 2007 to 7.6 percent this year, before picking up modestly in 2009. Growth in China is projected to decline by about 2 percentage points this year, to 9.3 percent, mainly owing to slowing exports. And India's economy should cool as well, as lower investment brings overall growth to just below 8 percent. Economies with large trade and financial exposure to the United States and Europe—for example, Singapore and Hong Kong SAR—will also see significant declines. In industrial Asia, growth is forecast to decline by ½ percentage point to 1.7 percent in 2008, with growth in Japan falling from 2.1 percent to 1.4 percent over the same period.

Trade. Asia's trade performance remains positive, despite lackluster electronics exports. Part of the explanation is strong growth of exports to "nontraditional" markets in Latin America, eastern Europe and Russia, and the Middle East. Import growth has picked up in recent months, even when excluding oil, suggesting some strength in domestic demand, the report said.

Inflation. Inflation pressures are rising across most of Asia. Headline inflation momentum has increased noticeably in India and the Southeast Asian countries of Indonesia, Malaysia, the Philippines, Thailand, and Vietnam in recent months and has picked up anew in China, after having leveled off in late 2007. Core inflation has also risen, as food and commodity price rises have begun to generate some second-round effects. Moreover, producer price inflation is now running above headline inflation across much of the region, pointing to the potential for margin squeezes and further price pressures ahead.

Exchange rates. Exchange rate trends have become less uniform across Asia. While the region's currencies as a whole have appreciated marginally in nominal effective exchange rate (NEER) terms since the previous forecast in October 2007, much of this is being driven by the sharp appreciation of the Japanese yen as carry trades are being unwound. Emerging Asian currencies as a group have weakened somewhat, led by the newly industrialized economies (NIEs) and India. Notably, the Chinese renminbi, while appreciating further against the U.S. dollar, has appreciated only modestly in NEER terms.

Delinking unlikely. Despite buoyant domestic demand so far, growth in Asia is unlikely to delink from economies outside the region, according to analysis cited in the report. In particular, there is evidence that spillovers from the United States, in particular to China, have risen in recent years, and that financial contagion and global confidence effects (certainly in play at the moment) could raise significantly the size of such spillovers.

Comments on this article should be sent to imfsurvey@imf.org