Political Consensus at the Heart of Portuguese Recovery

May 2019

When Portugal adopted the euro in 1999, the move was welcomed as the further consolidation of a young democracy. As well as more closely integrating the country into the rest of the European Union, an added benefit was the opportunity to borrow at record-low interest rates.

Less welcome was the uncontrolled spending that resulted. Public and private indebtedness surged without necessary structural reforms. The rise in debt proved unsustainable, and by 2011, Portugal tipped into a full-blown economic crisis.

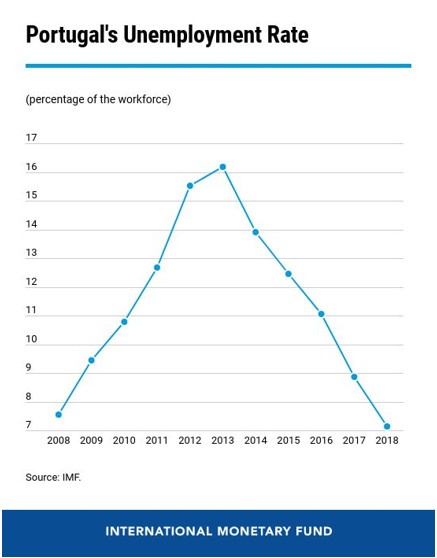

The overall fiscal deficit in 2010 ballooned to about 11 percent of GDP; at its worst, unemployment climbed to 16 percent in 2013, and yields on Portuguese sovereign bonds moved into double-digit territory. In spring 2011, Portugal reached out to the IMF and the European Union.

The program

The agreement between Portugal and its international partners extended financial assistance worth €78 billion ($116 billion; £70 billion)—of which one-third was committed by the IMF. The deal was described by the country’s then caretaker prime minister as “a good agreement that defends Portugal.”

In return, the country committed to progressively cutting its deficit, facilitating bank capitalizations, and implementing structural reforms. In particular, the government agreed to lower the public sector wage bill and reduce the most generous state pensions. Other measures included the privatization of stakes in national energy companies and the sale of the national airline.

The 2011–14 program prioritized social cohesion to build support for the measures: unions, business groups, the opposition party in Parliament, and social partners were consulted. The need for the measures was explained, and consensus was built. As a result of this consensus, program implementation continued without interruption, even after a change of government

The outcome

Portugal’s revitalized risk profile in international markets reflects the profound transformation of the country’s economy: from a fiscal deficit of about 11 percent of GDP, the government is targeting a small deficit this year, and the primary surplus is expected to hit its highest level since 1992. Whereas yields on Portugal’s bonds were once in double-digit territory, the yield on a 10-year bond is currently about 1.1 percent—reflecting in large part the responsible fiscal policies of the past several years.

The improved business environment—which included labor reforms—facilitated a recovery that boasts a boom in tourism and exports. Joblessness stands below 7 percent—its lowest level since 2004. Portugal now has a solid base to build on, which it can use to continue strengthening its potential and reversing the excesses of the past.