Already before the pandemic, many store or restaurant workers living in a major city in Europe had to spend more than half of their household’s income on rent. During the pandemic, many of them have seen their incomes fall, pushing up their share of income going to rent. Since low-income and young renters tend to work more frequently in contact-intensive sectors or hold insecure jobs, government policies are needed to make sure that these households do not get left behind as economies recover from the COVID-19 crisis.

During the past decade, rental housing has become less affordable across many European economies.

Worrying trends

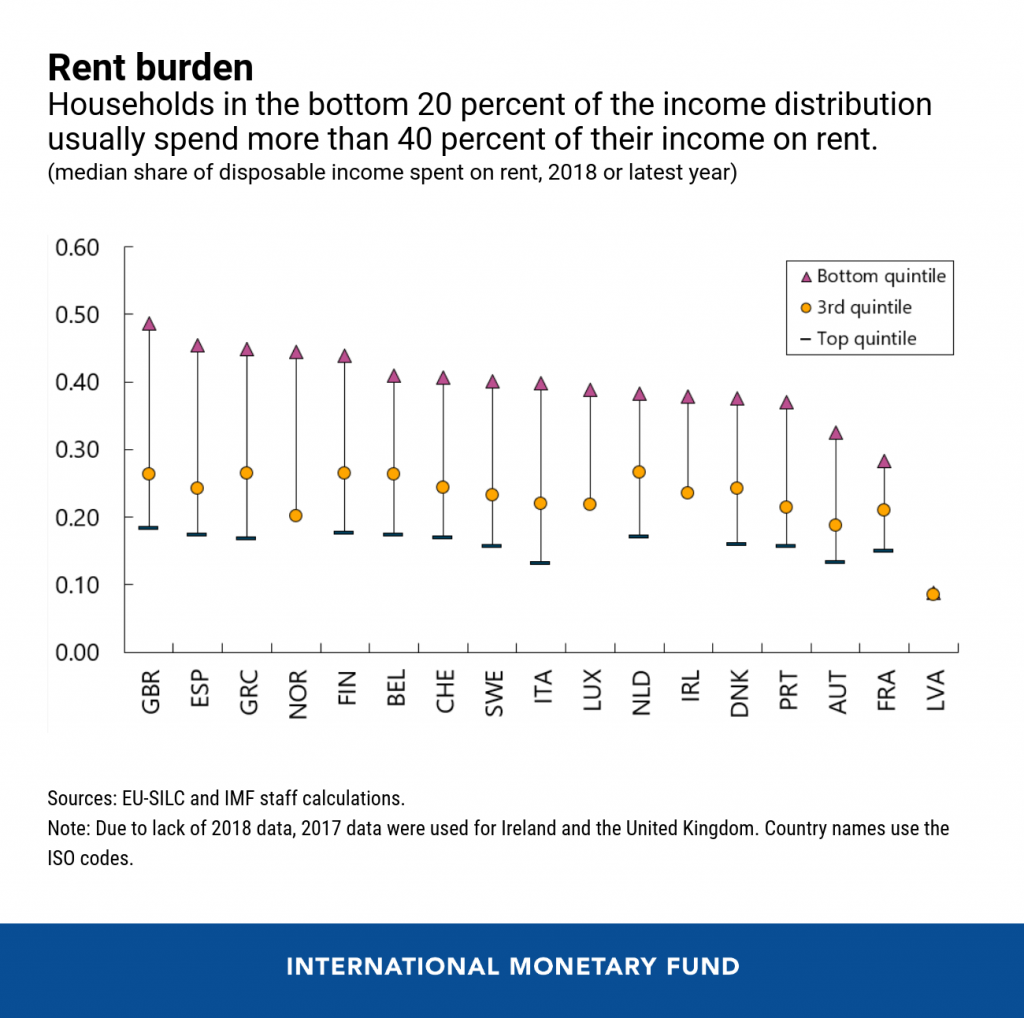

During the past decade, rental housing has become less affordable across many European economies. In our recent study of 17 advanced European economies, a typical renter household spent about 25 percent of its income on rent in 2018, while a young family paid nearly one-third of their earnings on renting. For a household in the lowest 20 percent of the income distribution, the share of income needed for rent was much higher, at 40 percent.

This number—40 percent—is generally the threshold for a household to be considered overburdened by rent payments. It is jarring that in nearly three quarters of the countries analyzed, about half or more low-income renters were overburdened in 2018. The rates were particularly high among the 16-29-year-olds and in major cities. During 2013–18, in some capitals rental price increases surpassed country-level rent growth by multiple times, for example, in Lisbon, Dublin, Madrid, Reykjavik, Stockholm, and the City of Luxembourg.

In contrast to renters, housing costs for homeowners have dropped since 2014. A renter typically spends over one and a half times what a homeowner spends on housing when measured as a share of disposable income. And this discrepancy has widened between 2011–13 and 2016–18, particularly for the poorest—those in the bottom 20 percent of the income distribution—by about 4 percentage points. This is shown by the green bars in the chart. That means, while homeowners generally benefited directly from the low interest rates during this period, renters did not.

Reasons behind rising rental affordability pressures

Our analysis finds that rising economic output did not translate into disposable income gains that compensated sufficiently for rising rental costs, particularly for low-income households. In addition, greater urbanization, structural transformation toward high-skilled employment in services, and a higher incidence of tourism have increased affordability pressures for renters, especially those with lower incomes. In other words, poorer households have not been able to reap much of the benefits of their changing and growing economies.

The pandemic is likely making matters worse

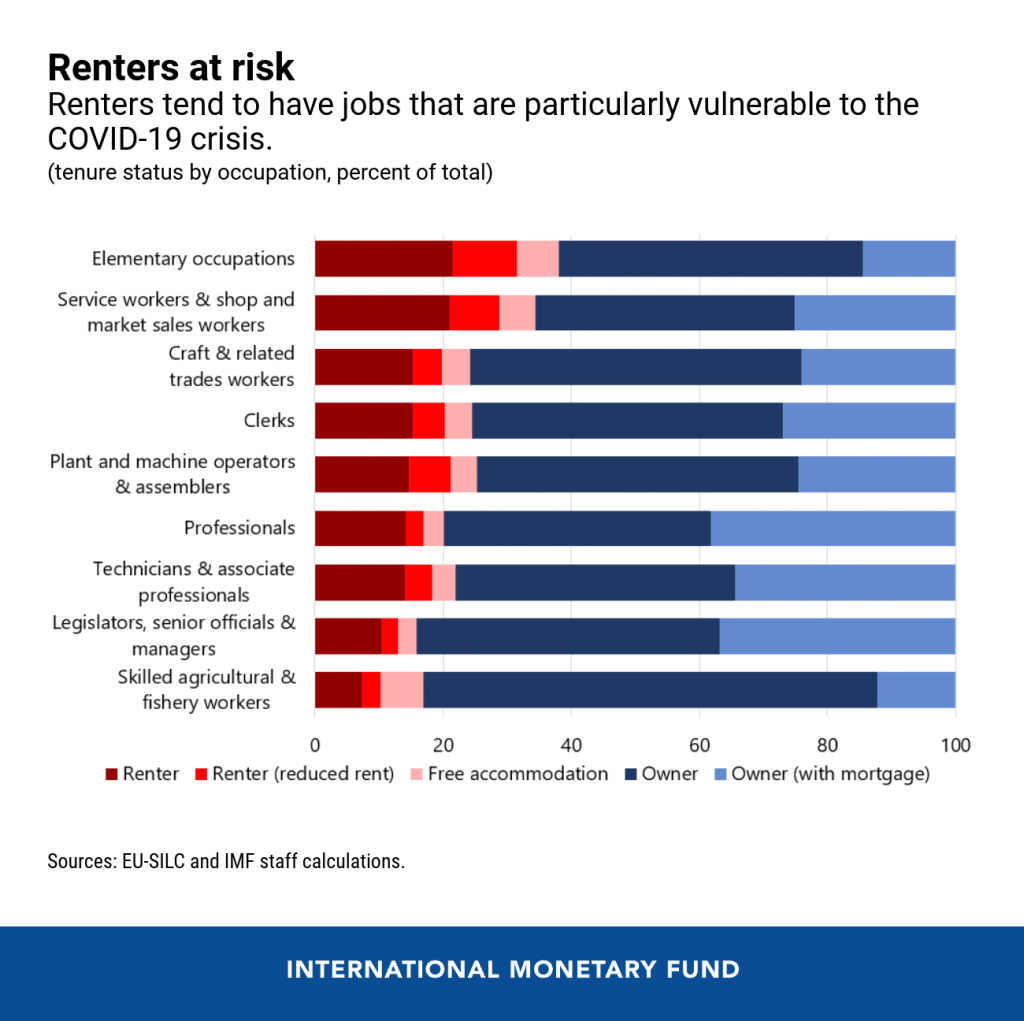

Many people who rent are particularly vulnerable to the COVID-19 crisis as they work more frequently in contact-intensive industries, are in the early stages of their career with little job security, and generally have lower access to telework. Their incomes are expected to take several years to recover, and a return to normal will likely take longer for those who need to transition into new sectors.

Lower rental costs would partly offset these income losses, but so far, rent reductions have been observed mostly in some tourist hotspots and mainly for high-end properties. Moreover, it is highly uncertain how widespread and long-lasting behavioral changes that could moderate rental costs would be. As a result, the trends of economic divergence and inequities that were already in place before the pandemic will likely intensify.

Policies to make rental housing more affordable

Addressing rental affordability is difficult because housing policies are complex. They often address multiple goals, among which affordability, well-balanced landlord-tenant regulations, and equal access to opportunities are only some aspects.

In general, effective policies should include efforts that enhance long-term income opportunities for low-income households and the young, so that they benefit from the structural transformation of the economy.

The most powerful immediate policy tool is to raise the levels and coverage of portable housing allowances, which can be used flexibly across locations. This measure lends itself to quick deployment and effective targeting. It would provide support during the recovery and beyond, and reduce the rent expenses of low-income families anywhere in the private market.

Governments should also launch initiatives that increase the supply of affordable housing to alleviate demand pressures more permanently. In particular, governments could invest more in social rental housing—accommodation that is provided at subsidized rents—especially where the stock has been falling and is low. They could also adjust financial incentives, for example, by taxing vacant properties and shifting some housing subsidies away from those that favor high-income homeowners toward private investment in rental housing development.

In the European Union, funding from the Next Generation EU package provides an opportunity to make investment in social housing and public infrastructure an integral part of the pandemic recovery strategy. Greater housing investment would support inclusive growth by creating employment, providing more affordable rental housing and facilitating access to jobs across locations.

The pandemic is expected to worsen the affordability of rental housing and inequality trends that were already present before COVID-19 hit Europe. Governments need to step up efforts urgently to avoid low-income renters and the young from being left further behind.

This blog draws on a joint paper by Khalid Elfayoumi, Izabela Karpowicz, Jenny Lee, Marina Marinkov, Aiko Mineshima, Jorge Salas, Andreas Tudyka, and Andrea Schaechter.

,