Economic activity in Latin America continues to rise, but at a slower rate than previously anticipated.

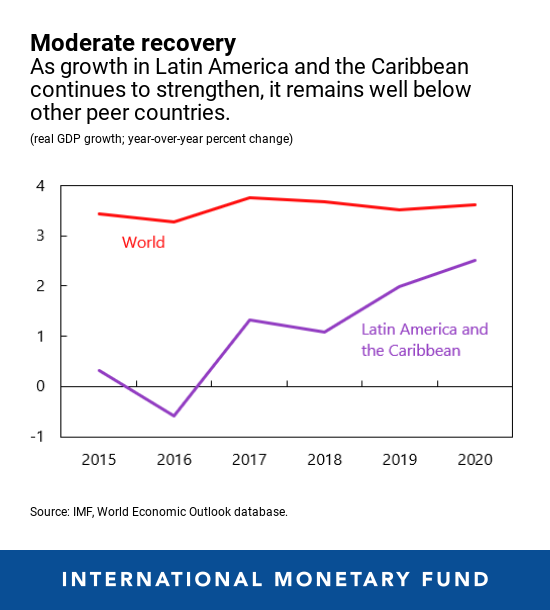

The weakening global economy and rising policy uncertainty are contributing to slowing Latin America’s growth momentum. Overall, the region is expected to advance by 2 percent in 2019 and 2.5 percent in 2020—still well below peer countries in other regions.

A tightening of global financial conditions and lower commodity prices brought on by U.S.-China trade tensions have contributed to the region’s slowdown. In addition, monetary policy was tightened in some economies to contain inflationary pressures stemming partly from currency depreciation, which further dampened growth.

Looking at fiscal policy—which has also become less accommodative—about half of the region’s economies reduced their primary deficits as a percent of GDP in 2018. But this has not been enough to put public debt on a downward path—except for Argentina.

Policy uncertainty clouds the outlook

Following a series of highly-anticipated elections throughout Latin America, policy uncertainty in some of the region’s larger economies has risen—weighing on the outlook.

For example, in Mexico, the halting of an airport construction project and some backtracking in energy and education reforms have increased policy uncertainty in the country. In Brazil, a fragmented Congress could create hurdles to the implementation of the ambitious structural reform agenda, fiscal consolidation, and pension reform.

Continued policy uncertainty could discourage future investment and harm growth prospects for the region.

Risks: global and domestic

Several risks could further harm the outlook for Latin America and the Caribbean. For instance, escalating trade tensions between China and the United States, or a slowdown in some major economies, could result in lower trade growth for the region.

The region would also suffer if global financial conditions tighten further—including spikes in global financial volatility, higher U.S. interest rates, and a stronger U.S. dollar.

Additionally, higher volatility in global markets could result in less capital flowing to the region—potentially harming investment potential.

Domestic risks include lower confidence due to policy uncertainty in Brazil and Mexico, and election-related uncertainty in Argentina.

In Brazil, market sentiment could deteriorate with lack of progress in pension system reforms or fiscal consolidation. Mexico’s business confidence could suffer if the role of the public sector in the economy expands, the fiscal position deteriorates, or there are setbacks in the new trade pact with the United States and Canada. In Argentina, the upcoming general elections in 2019 could reduce reform appetite.

Policies to support the expansion

As the global economy slows, the narrow window of opportunity in the region to complete reforms—the fixing of the metaphorical roof—is closing.

Debt and deficit reduction will need to continue in several countries to ensure debt sustainability. These policies should minimize the adverse effects on economic activity and poverty, including by protecting infrastructure investment and well-targeted social expenditure, while cutting non-priority spending.

Further, monetary policy will need to manage the trade-off between supporting growth and keeping inflation expectations anchored in the face of currency depreciation and volatile commodity prices. Maintaining exchange rate flexibility is critical to withstand shocks.

South America

In Argentina, the economy fell into recession in 2018. While a severe drought significantly reduced agricultural output and exports, the strong peso depreciation around mid-2018 fueled inflation, reducing disposable income and investor confidence. The government’s stabilization plan, based on revised and strengthened monetary and fiscal policies, helped reduce the financial turmoil and stabilized the exchange rate. Inflation and inflation expectations have been on a downward trend since October, and look set to continue a slow decline in 2019. This should allow a gradual fall in interest rates, which together with higher real wages and stronger exports is expected to trigger a recovery of economic activity starting from the second quarter of 2019.

In Brazil, growth is projected to rise over 2 percent in 2019-20 for the first time since 2013. The new administration’s market-friendly reformist agenda has helped boost business confidence and improve the near-term growth prospects. The key policy priorities are to reform the pension system and reduce the budget deficit to ensure public debt sustainability.

Growth in Chile will remain strong in 2019-20, led by robust private consumption and buoyant investment. The monetary policy normalization that started in October 2018 is expected to proceed gradually. A moderate narrowing of the structural deficit is expected, guided by the announced fiscal targets. The implementation of the authorities’ structural reform agenda would lead to a more favorable growth outlook.

Colombia’s economic growth is projected to increase—led by continued monetary policy support, election-year spending by subnational governments, implementation of the 4G infrastructure agenda, and a positive impact of recent tax policy changes on investment. A Financing Law approved last December comprising revenue-enhancing tax reform including increases to VAT, consumption and personal income taxes, is expected to help achieve the fiscal target for 2019. But a lower corporate tax burden, while potentially boosting investment and growth, may result in weaker tax revenues from 2020 onwards.

Peru’s economy is estimated to have expanded nearly 4 percent in 2018 supported by higher commodity prices and countercyclical fiscal and monetary policies. Growth is projected to stay close to 4 percent in 2019-20, with robust private domestic demand offsetting a gradual fiscal consolidation.

In Venezuela, the economic and humanitarian crisis has continued. Real GDP is projected to decline further in 2019, bringing the cumulative decline since 2013 to over 50 percent—driven by plummeting oil production and worsening conditions for the non-oil sector. Hyperinflation and outward migration are also projected to intensify in 2019. Evolving political developments add another layer of uncertainty to the country’s outlook.

Mexico, Central America, and the Caribbean

In Mexico, the outlook continues to be clouded by uncertainty. Growth projections for 2019 and 2020 were revised down to 2.1 and 2.2 percent, respectively, due to weaker growth momentum in 2018, uncertainty around the new administration’s policies, and tighter-than-expected monetary and financial conditions. Strict implementation of the prudent 2019 budget, which seeks to maintain the primary surplus at 1 percent of GDP, will be crucial in demonstrating the new administration’s commitment to fiscal responsibility and the continuing reduction of the public debt ratio. Advancing much-needed structural reforms can boost medium-term potential growth.

In Central America and the Dominican Republic, economic activity is projected to pick up in 2019-20, but at a slower pace than originally anticipated. The major revisions took place in Costa Rica where a fiscal reform bill was passed in December. While this was a critical step towards re-establishing fiscal sustainability, it will lower growth in the near term. In Nicaragua, social unrest and political uncertainty have also hurt growth prospects.

Economic activity in the Caribbean is still projected to pick up in 2019-20—thanks to robust tourism from the U.S., reconstruction from the devastating hurricanes of 2017 in some tourism-dependent countries, and higher commodity production in some commodity exporters.