- Excess imbalances remain generally unchanged, increasingly concentrated in advanced economies. Their persistence is fueling trade tensions among countries.

- The configuration of imbalances does not pose an imminent danger. Yet, if unaddressed, it could threaten global stability down the road.

We have just released the latest assessments of the current account balances for the 30 largest economies in our 2018 External Sector Report (ESR). These assessments are a key aspect of the IMF’s mandate to promote international monetary cooperation and help countries build and maintain strong economies. They try to answer the difficult and often contentious question of when current account surpluses and deficits are appropriate or when they signal risks. Before jumping into the results, a bit of background is useful.

To start, surpluses and deficits in and of themselves need not be problematic and may well be appropriate and beneficial. For example, young, fast-growing economies need to invest to grow—so they often tap external resources by importing more than they export and borrowing to cover the implied deficit. In contrast, rich, aging countries may need to save to prepare for when workers retire—so they run surpluses and lend to deficit countries.

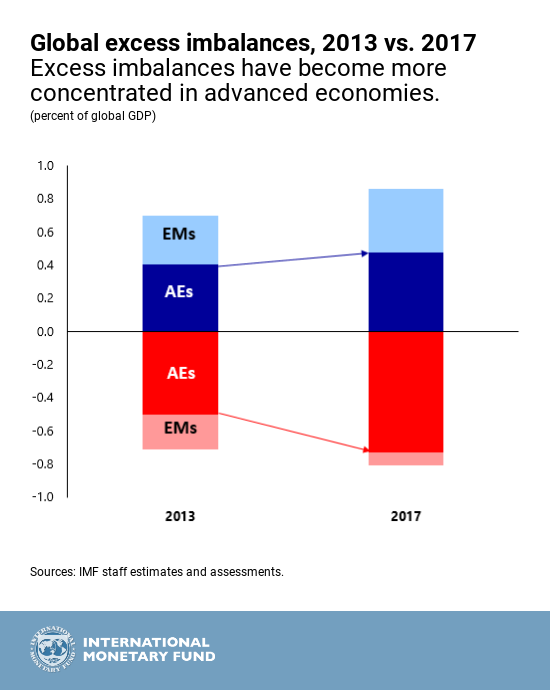

Excess imbalances are increasingly concentrated in advanced economies.

Current account balances can, however, become excessive, that is, larger than warranted by the economy’s fundamentals and appropriate economic policies. Excessive external imbalances—both deficits and surpluses—pose risks for individual countries, and for the global economy.

Just as over-indebted households can lose access to credit, economies that borrow too much from abroad by running current account deficits that are too large may become vulnerable to sudden stops in capital flows that can be destabilizing not only at country level, but also globally, as proven by the long history of financial crises. Countries with excessive surpluses face different challenges—for example, the risk of investing their saving abroad when domestic investments could offer higher social returns. In addition—and importantly—they may become targets for protectionist measures by trading partners.

The analysis of external imbalances is inherently complex, including because it needs to be globally consistent—excess deficits must be matched by excess surpluses. The ESR focuses on each country’s overall current account balance and not its bilateral trade balances with various trading partners, as the latter mainly reflect the international division of labor rather than macroeconomic factors. Our objective is to alert the membership to the potential risks from these imbalances, and highlight countries’ shared responsibility to address them in an appropriate manner. This goal is most relevant in the current conjuncture.

Key findings on excessive imbalances

After narrowing in the aftermath of the global financial crisis, global current account surpluses and deficits have remained relatively unchanged over the past five years at about 3¼ percent of global GDP. Our analysis indicates that about 40 to 50 percent of these global balances are excessive, and increasingly concentrated in advanced economies.

Higher-than-desirable current account balances prevail in northern Europe—in countries such as Germany, the Netherlands, and Sweden—as well as in parts of Asia—in economies like China, Korea, and Singapore. Lower-than-desirable balances remain largely concentrated in the United States and the United Kingdom.

The persistence of global imbalances and mounting perceptions of an uneven playing field for trade are fueling protectionist sentiment. These impulses are misguided. An escalation of protectionist policies would mainly hurt domestic and global growth, without much of an effect on current account imbalances, as this year’s report also finds.

Risks down the road

While the current configuration of global excess imbalances does not pose an imminent danger, we project that, under planned policies, these imbalances will grow over the medium term, eventually posing a risk to global stability.

The planned fiscal expansion in the United States will likely increase the country’s current account deficit—with mirror-image larger surpluses in the rest of the world—and result in a faster pace of US monetary policy normalization. The ensuing tightening of global financial conditions could prove disruptive to emerging and developing economies, especially the more vulnerable ones who have already been subject to some pressure.

At the same time, limited actions by surplus countries to tackle their imbalances suggest their surpluses will linger. Against the backdrop of continued concentration of deficits in debtor countries and sustained surpluses in creditor countries, net foreign asset stock positions will continue diverging, increasing the likelihood of disruptive currency and asset price adjustments down the road in indebted countries. Such developments would diminish global growth, also harming the surplus economies.

Because of the risk that foreign lending dries up, deficit countries face greater pressure to balance their international accounts than surplus countries do to balance theirs. But when the adjustment comes, both debtor and creditor countries lose. The adjustment in the aftermath of the global financial crisis is a not-too-distant reminder of that.

That’s why both surplus and deficit countries must work together to reduce excess global imbalances in a manner supportive of global growth and stability.

How to tackle imbalances?

In the current conjuncture where many countries are near full employment and have more limited room to maneuver in their public budgets, governments need to carefully calibrate their policies to achieve domestic and external objectives, while rebuilding monetary and fiscal policy buffers. In particular:

- Countries with lower-than-warranted external current account balances should reduce fiscal deficits and encourage household saving, while monetary normalization proceeds gradually.

- Where current account balances are higher than warranted, the use of fiscal space, if available, may be appropriate to reduce excess surpluses.

- Well-tailored structural policies should play a more prominent role in tackling external imbalances, while boosting domestic potential growth. In general, reforms that encourage investment and discourage excessive saving—through the removal of entry barriers or stronger social safety nets—could support external rebalancing in excess surplus countries, while reforms that improve productivity and workers’ skill base are appropriate in countries with excess external deficits.

Finally, all countries should work toward reviving trade liberalization efforts while modernizing the multilateral trading system—for example, to promote trade in services, where gains from trade liberalization could be substantial. Such efforts may have small effects on excess current account imbalances, but they can have big positive effects on productivity and welfare, while reducing the risk that current account imbalances trigger counterproductive protectionist responses.