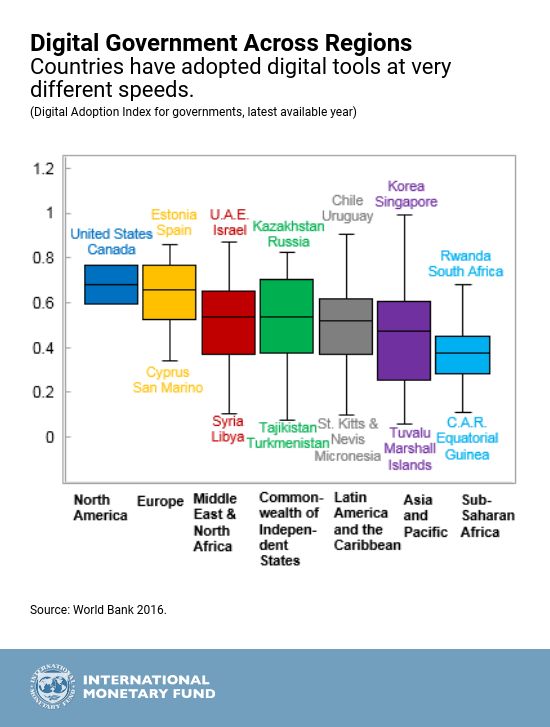

In Rwanda, digitally-monitored drones deliver blood supplies to hospitals. In Estonia, it takes five minutes to file taxes and 99 percent of government services are available online. Singapore was the first city to implement electronic road pricing to manage congestion. The world is becoming digital, and reliable, timely, and accurate information is available at the push of a button. Governments are following suit, using digital tools for tax and expenditure policy, public financial management, and public service delivery.

With better information, governments can build better systems, as well as design and implement better policies. Our new Fiscal Monitor shows both the opportunities and challenges at play as technology transforms fiscal policy.

Place a bet

The gamble? Going for the digital payoff despite the potential for fraud, breaches of privacy and cybersecurity, and the cost of adopting new technologies.

The innovators have been quick to take advantage of digital tools to facilitate the lives of citizens. Effortless tax season? Check. Kenyans pay taxes on their smart phones; Norwegians have their tax returns prepopulated by their government. Better public services? Done. Indians receive social benefits through electronic transfers to bank accounts linked to their biometric identification.

Countries can now tackle tax evasion with digital solutions. British customs are using big data to detect fraudulent behavior of importers at the border. We estimate that adopting such methods could increase annual indirect tax collection at the border by up to 1-2 percent of GDP.

The Panama and the Paradise papers have exposed the substantial wealth sheltered in low-tax jurisdictions—an average of 10 percent of world GDP. With digital cross-country information exchange about taxpayers comes the prospect of more effectively tracking down this wealth before it is hidden away.

Avoid the gamble?

Why would a government not bet on new technology?

Reasons vary. Citizens don’t trust their government to safeguard their personal information. In the United States, less than a third of people believe the government can keep their digital records secure.

Many poor households lack access to digital tools and could be left behind. Fewer than half of the population of Africa subscribes to a mobile phone.

New fraud opportunities abound: authorities in Korea recently raided the country’s largest cryptocurrency exchanges for alleged tax evasion. Cash-strapped governments with low capacity face greater challenges in managing these risks.

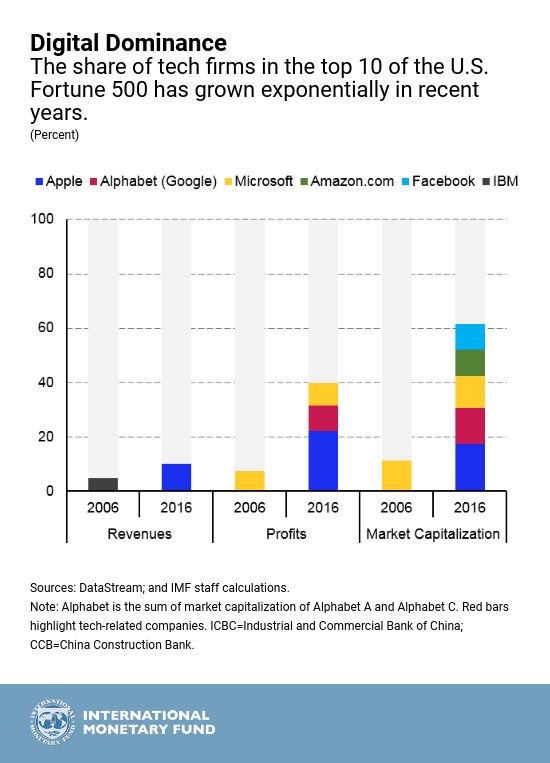

Digital firms are all around

Some challenges are policy related. Firms like Google, Apple, Facebook and Amazon are in the public eye but digital firms are all around us. They generate sales with little physical presence. They benefit from value created by users—using apps on our smart phones produces free yet valuable information. Can and should governments tax such value where the consumer resides, even when the firm has its physical home elsewhere?

The sheer scale of digital activities has raised concerns about the fairness of the current allocation of international taxing rights. Some countries—Israel, Italy—have introduced specialized tax measures targeting digital firms but such uncoordinated solutions cannot provide the answer. As the whole economy becomes digital, global solutions are required.

The way forward

People are replacing taxis with Uber, hotels with Airbnb, and cash with PayPal. Can governments stay on the sidelines of such a transformation?

Probably not. Overcoming challenges will require:

-

A proactive and comprehensive reform agenda that addresses political and institutional weaknesses to manage digital risks and ensure inclusion. In India, this meant not only introducing biometric identification to deliver income support to the right beneficiaries, but also reforming the design of the program itself.

-

Adequate resources in the budget . Korea secured budget resources for multi-year plans early on in its digitalization process.

-

International cooperation . In some cases, confronting these challenges calls for international resolve. For example, reducing evasion to low-tax jurisdictions or forming a consensus on the taxation of the digital economy will require multilateral efforts.

Digitalization will not solve all the problems faced by policymakers—it may even create some new ones. But governments can’t lay odds against this trend. Resist at your peril, or embark on a journey to shape the way forward.