Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Experts Confer on State of China’s Housing Market

January 29, 2016

- New data sheds light on demand/supply imbalance in China’s housing markets

- Mortgage data reveals financial soundness of Chinese homeowners

- Conference is part of IMF’s enhanced surveillance of global housing markets

The steady increase in China’s house prices at the national level masks tremendous variation at the city level, conference participants stressed in Shenzhen last month.

Beijing, China. Beijing has experienced one of the greatest booms ever seen in housing markets (photo:istock/luxizeng)

GLOBAL HOUSING WATCH

House prices in China have been on a long upward march over the past decade prompting questions about what the future holds (see Chart 1). At a conference last month in Shenzhen leading analysts of China’s housing markets provided some answers.

Organized by the IMF in cooperation with the Chinese University of Hong Kong, Shenzhen and Princeton University, the conference—International Symposium on Housing and Financial Stability in China—spotlighted new data sets on China’s housing markets, which provide informed views of what might happen next.

The conference was part of a series of conferences organized as part of the Global Housing Watch initiative, which also provides a quarterly update on conditions in housing markets. The latest update, released today, shows how China’s house price changes compare with those around the globe.

Demand-Supply Imbalances

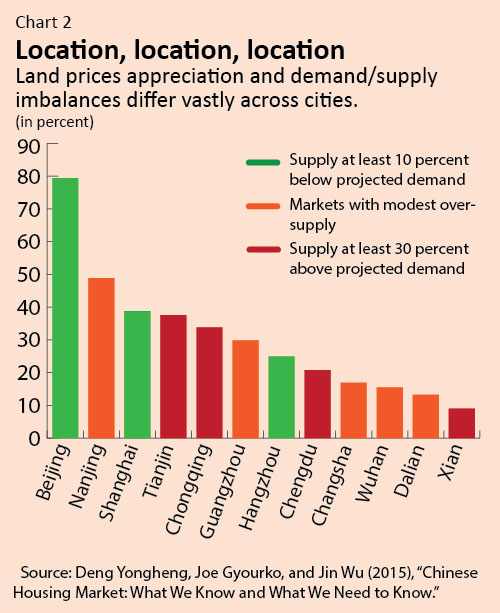

Participants at the Shenzhen conference stressed that the steady increase in China’s house prices (see Chart 1) at the national level masks tremendous variation at the city level. Beijing has “experienced one of the greatest booms ever seen in housing markets,” according to real estate expert Joe Gyourko (University of Pennsylvania), but the situation is different elsewhere. With his co-authors, Gyourko has constructed a residential land price index for 35 large cities in China based on government sales of land to private developers. These data show that prices have increased in inflation-adjusted terms by about 80 percent a year in Beijing over the past decade but by only 10 percent a year in Xian (see Chart 2).

Whether this pattern of price increases will continue depends on the balance between supply and demand, which varies across cities as well. At the conference, Gyourko presented estimates of the balance between housing supply and demand in the 35 cities. He concluded that in 20 percent of the cities—among them major ones such as Beijing, Hangzhou, Shanghai and Shenzhen—supply remains “below our projected demand.” In Chart 2 such cities are shown in green. In contrast, in 40 percent of the cities, including Xian, supply is “at least 30 percent above projected demand” (shown in red in the chart). The remaining 40 percent of cities are “modestly over-supplied,” said Gyourko.

Housing demand and incomes

Does this mean house prices in Beijing, and other big cities where oversupply is not a problem, are likely to keep increasing? Not necessarily, according to conference participants Wei Xiong (Chinese University of Hong Kong and Princeton University) and Hanming Fang (University of Pennsylvania). They have used a comprehensive data set of mortgage loans from 2003 to 2013 from a major bank to study the financial soundness of Chinese homeowners.

Fang said that, on the positive side, the Chinese housing boom has been accompanied by strong growth in income and by high down payments on mortgage loans. For a decade, household disposable income has grown annually by 9 percent. Homeowners also put a down payment of over 30 percent on mortgage loans.

Nevertheless, there are reasons for concern. The house price-to-income ratio—a commonly-used measure of housing affordability—is very high for low-income home buyers. The ratio is around eight in smaller cities and greater than ten in the largest cities, according to Fang. At such high ratios, even small changes in the profile of income growth for these households could spell trouble for their ability to stay current on their mortgage. Richard Koss (Global Housing Watch Initiative) contrasted the experience of U.S. and Chinese housing markets. “In the United States, the expectations that house prices could never fall turned out to be the fatal flaw,” said Koss. “In China, the risks could lie in markets having irrational expectations of short-run income growth.”

Another source of risk is the links between the housing market and local government debts. Yongheng Deng (National University of Singapore) noted that, unlike local governments in many advanced economies, local Chinese governments are prevented from directly issuing debt to fund mandated capital projects. Therefore, local governments sell public land to raise funding. In fact, future land sales revenue is committed to repay the local government’s debt and land parcels are the most widely-used collateral for local government debt. Hence, “a substantial drop in housing or land prices may increase the risk level of local government debt,” said Deng.

In opening remarks to the conference, IMF Deputy Managing Director Min Zhu said that, short-term risks notwithstanding, China’s long-run goals should be kept in mind. Since the global financial crisis, growth in China “had relied heavily on credit and investment, particularly real estate investment.” But it was now in a process of rebalancing that would make growth more sustainable.

Comparing China with other countries

Picking up on this theme, conference participants also discussed longer-term prospects for the Chinese housing market. Haizhou Huang (China International Capital Corporation) said that an important question for Chinese policymakers was whether China should “follow the European or Japanese model of a few cities that have a large share of the population” or develop more megacities sprinkled throughout the country. Huang expressed a preference for the latter model so as to relieve the pressure on the provision of housing and other amenities in the big cities.

Providing a cross-country perspective on housing market developments is one of the aims of the Global House Watch initiative. The Shenzhen conference was the fourth in a series of conferences that have brought together housing sector experts from around the world. The first two conferences, in Dallas and Frankfurt respectively, focused on housing markets in advanced economies; the third, held in Bangalore, expanded the coverage to emerging markets. In his speech at the Frankfurt conference, Deputy Managing Director Zhu had noted that this enhanced surveillance of housing markets reflects the view that the “era of benign neglect of house price booms is over.”