Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : IMF Reforms Policy for Exceptional Access Lending

January 29, 2016

- IMF lending decisions will be better calibrated to countries’ debt vulnerabilities

- Reforms to reduce costs of sovereign debt crises for the member, its creditors, and overall system

- Part of wider IMF work program to efficiently resolve sovereign debt crises

The IMF approved an important reform to the institution’s policy on lending to countries that request large-scale financing.

The revamped lending policy allows more flexibility in determining a country’s debt levels (photo: IMF logo)

IMF LENDING

The broad objectives of the reform—which includes the removal of the “systemic exemption” that was created in 2010—is to help promote more efficient resolution of sovereign debt problems and avoid unnecessary costs for the member, its creditors, and the overall system.

“This latest reform to our lending framework is actually part of a broader reform agenda aimed at more efficiently resolving sovereign debt crises where they occur, as well as to prevent their occurrence in the first place,” said Sean Hagan, the IMF’s General Counsel.

“The reform is carefully designed to preserve the IMF’s ability to continue to provide financing to assist members in resolving their balance of payments problems, including in the presence of contagion risks,” said Hugh Bredenkamp, Deputy Director of the Strategy, Policy and Review Department of the IMF.

Evolution of the “exceptional access” framework

In the late 1990s and early 2000s, the IMF provided financing to a number of its members that were experiencing capital account crises which, on several occasions, involved “exceptional access” to IMF resources—that is, financing amounts that exceeded normal IMF lending limits. The requirements in place at the time to justify these large-scale lending programs were “exceptional circumstances,” and these were not clearly defined. This left the IMF vulnerable to pressure to provide large amounts of funding even when prospects for program success were not as strong as should have been for the level of risk the IMF was assuming.

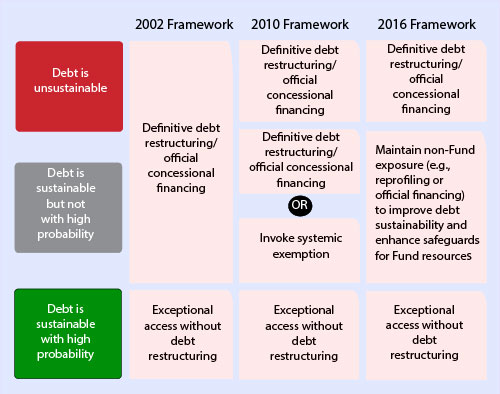

To address these concerns, the IMF established a comprehensive exceptional access policy framework in 2002. Under this framework, the IMF could only provide large-scale financing in capital account crisis if all of four conditions were met, one of which was that there is a “high probability” that the member country’s debt is sustainable. This is the second exceptional access criterion.

The other three exceptional access “criteria” (as they are known as) relate to a member experiencing exceptionally large balance of payments needs; the member having prospects for gaining/regaining access to private capital markets; and the member having the institutional and political capacity and commitment to implement a IMF-supported program.

With respect to the second criterion on debt sustainability, if the high probability bar was met, the IMF could lend without requiring any debt operation. If, however, the bar was not met, a sufficiently deep debt restructuring was typically needed to restore debt sustainability with high probability before the IMF could lend. There was no middle ground between providing financing and requiring a deep debt reduction. Accordingly, for members whose debt was “sustainable but not with high probability,” the debt reduction operation could constitute an unnecessarily drastic measure.

This underlying rigidity in the 2002 exceptional access framework was tested in 2010, in the context of the first IMF-supported program for Greece. Because the IMF did not assess Greece’s debt to be sustainable with high probability, the framework required an upfront debt reduction. However, there were serious concerns at the time that this could lead to severe contagion both in the Eurozone and beyond. Thus, at the time, the IMF created a “systemic exemption” for cases where there were significant uncertainties around debt sustainability. In such cases, the exemption allowed large-scale financing to go ahead without a debt reduction operation if there was a high risk of systemic international spillovers (see figure).

Shortcomings revealed

While the systemic exemption was a step towards greater flexibility, it had several shortcomings, which revealed themselves over time.

• First, the exemption did not prove reliable in mitigating contagion. And this is understandable. Insofar as it left market concerns about underlying debt vulnerabilities unresolved, the exemption was unlikely to instill market confidence in the program and thereby limit contagion.

• Second, by replacing maturing private sector claims with official claims, it increased “subordination risk” for private creditors—that is, the risk that private claims would rank lower than official claims in the case of an eventual default—making it more difficult for the country to regain market access.

• Third, for the two reasons above, the systemic exemption entailed substantial costs and risks for the member country and the IMF. In particular, it delayed the restoration of debt sustainability, impaired the prospects of success for the country’s economic policy program, and eroded safeguards for IMF resources.

• Finally, the exemption had the potential to aggravate “moral hazard” in the international financial system, i.e., the tendency of creditors to overlend to a sovereign at interest rates that do not fully reflect the sovereign’s risky debt situation, since they believe they are likely to be bailed out in the event of a sovereign debt crisis.

A reformed, more calibrated, but appropriately flexible framework

The reformed policy, developed by IMF staff in a series of papers in 2013, 2014 and 2015, seeks to improve the existing framework in two important ways.

First, it removes the systemic exemption, for the reasons noted above.

Second, it gives the IMF appropriate flexibility to make its financing conditional on a broader range of debt operations, including the less disruptive option of a “debt reprofiling”—that is, a short extension of maturities falling due during the program, with normally no reduction in principal or coupons.

The reformed policy—like the old one—prescribes that when debt is clearly sustainable (let us call it the “green” zone), the IMF will continue to use its catalytic role and provide financing support to the member without requiring any debt operation. When debt is clearly unsustainable (the “red” zone), a prompt and definitive debt restructuring will continue to be required to restore debt sustainability with “high probability”.

However, for countries where debt is assessed to be sustainable but not with a high probability (i.e. the “gray” zone), the new policy allows the IMF to grant exceptional access without requiring debt reduction upfront, as long as the member also receives financing from other creditors (official or private) during the program. This financing should be on a scale and terms that (i) helps improve the member’s debt sustainability prospects, without necessarily bringing debt sustainability to the green zone at the outset; and (ii) provides sufficient safeguards for IMF resources.

The new policy does not automatically presume that a reprofiling or any other particular option would be implemented at the outset when debt is in the gray zone. Instead, the choice of the most appropriate option, from a range of options that could meet the two conditions noted above, would depend on the member’s specific circumstances.

In situations where the member retains market access, or where the volume of private claims falling due during the program is small, sufficient private exposure could be maintained without the need for a restructuring of their claims.

In situations where the member has lost market access and private claims falling due during the program would constitute a significant drain on available resources, a reprofiling of existing claims would typically be appropriate. This could allow a somewhat less stringent adjustment path while also reducing the required amount of financing from the IMF. Although a reprofiling is a form of debt restructuring, it will likely be less costly to the debtor, the creditors, and the system than a definitive debt restructuring.

Where a reprofiling is undertaken, the scope of debt to be reprofiled would be determined on a case-by-case basis, recognizing that it would not be advisable to reprofile a particular category of debt if the costs for the member of doing so—including risks to domestic financial stability—outweighed the potential benefits. For instance, short-term debt instruments (by original maturity), trade credits, and local currency-denominated debt have typically not been included in most past restructurings.

Under the new policy, financing from official bilateral creditors, where necessary, could be provided either through an extension of maturities on existing claims and/or in the form of new financing commitments.

The new policy would also allow the IMF to deal with rare “tail-event” cases where even a reprofiling is considered untenable because of contagion risks so severe that they cannot be managed with normal defensive policy measures. In these rare cases, the IMF could still provide large-scale financing without a debt operation, but would require that its official partners also provide financing on terms sufficiently favorable to backstop debt sustainability and safeguard IMF resources.

This could be done through assurances that the terms of the financing provided by other official creditors could be modified in the future if needed (say in the event of downside risks materializing). If official partners could not provide such assurances (or if the member’s debt was deemed unsustainable at the outset), the terms of official financing would have to be sufficiently favorable to bring debt to the green zone.

In essence, all these options illustrate appropriate flexibility that the new framework embodies (see figure above).

In addition to the improvements to the second exceptional access criterion, the reformed policy also modified the third, or “market access”, criterion. The Board confirmed that the third criterion, which requires a member to have prospects for gaining/regaining market access remains binding even when there are open-ended commitments of official support for the post-program period. It also clarified that the timeframe within which a member is expected to gain/regain market access has to be consistent with the start of repayment of its obligations to the IMF, not just when the last one is due, as could have been implied by the old formulation of the criterion.

Putting it all together

The above reform is a central component of a four-pronged work program on sovereign debt crisis resolution endorsed by the IMF’s Executive Board in 2013. The reforms follow a series of Board discussions and consultations with stakeholders over the last three years. Before this latest reform to the exceptional access policy, the IMF had already completed two of the four components:

• In October 2014, the Executive Board endorsed key features of enhanced collective action clauses in international sovereign bond contracts to reduce their vulnerability to holdout creditors in case of a debt restructuring. Many members now include clauses consistent with these key features in new international debt issuances.

• In December 2015, the Board approved the reform of the IMF’s policy on non-toleration of arrears to official bilateral creditors, which allows the IMF to lend in the presence of arrears to official bilateral creditors under carefully circumscribed circumstances.

Later this year, the IMF will consider the final component of the sovereign debt restructuring work program, which intends to discuss, inter alia, issues related to debtor-creditor engagement, including the IMF’s lending-into-arrears policy for private creditors.

Together, these four workstreams will help facilitate the resolution of sovereign debt crises, thus benefiting the international financial system as a whole.