Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Harnessing the Power of Fiscal Policy to Mitigate Inequality

September 25, 2015

- Fiscal policy is a powerful and adaptable tool for achieving distributional objectives

- Considering tax and spending programs together enhances the effectiveness of fiscal redistribution

- Improving both distributional outcomes and economic efficiency is possible

The appropriate design of fiscal policies can mitigate income inequality, without hurting growth, or even while increasing it, according to a recently published IMF book, Inequality and Fiscal Policy.

Slums aside an upscale neighborhood in Mexico City: Conditional transfer programs, such as Mexico’s Oportunidades, can help reduce income inequality by alleviating poverty, while controlling fiscal costs (photo: Stringer/Mexico/Reuters/Corbis)

IMF Book

Over the last few decades, income inequality has been on the rise in three-quarters of advanced economies and about half of the developing world, including fast-growing and densely populated countries such as China and India. This trend, together with the legacy of the global economic and financial crisis, has brought distributional issues to the forefront of the economic policy debate.

Many governments around the world now face the challenge of addressing concerns over high or rising inequality, while still promoting efficiency and growth. How can governments effectively and efficiently design redistributive fiscal policies, the book asks, especially when fiscal space is limited and concern about economic growth is also high on the policy agenda?

The analysis presented in the book builds on and extends recent IMF work, including a paper prepared for the IMF Executive Board in 2014 and a wide set of contributions on fiscal issues, such as energy subsidies, pensions, health care reform, jobs and growth, and taxation.

The book also includes contributions from leading academics. As the book highlights, inequality issues have long commanded the IMF’s attention, reflecting their relevance for macroeconomic stability and sustainable economic growth—issues at the core of the Fund’s mandate. With increased interest among policymakers, the IMF’s analytical work in this area has expanded.

Taxes and public expenditure substantially reduce income inequality

Fiscal policy, as the book shows, offers a powerful tool to achieve governments’ distributional objectives, affecting household welfare both directly (through transfers and taxes) and indirectly (by modifying incentives to work and produce). Direct taxes (that is, taxes levied on income and wealth, such as the personal income tax, in contrast to indirect taxes, which are levied on exchanges and consumption, such as sales or value-added taxes) and cash transfers (direct payments from governments to eligible individuals) are two important tools at policymakers’ disposal.

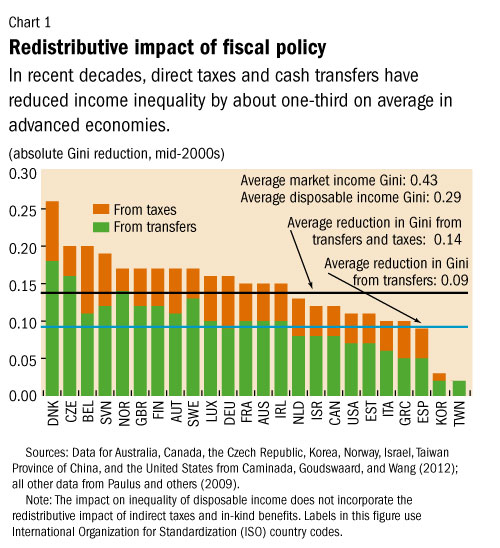

In recent decades, together they have reduced income inequality (as measured by the Gini index, a common statistical measure of a country’s income distribution) by about one-third on average in advanced economies (as measured in the mid-2000s, with Belgium, the Czech Republic, and Denmark registering particularly large reductions). About two-thirds of the reduction has been due to transfer programs and the remaining third to progressive taxation (Chart 1).

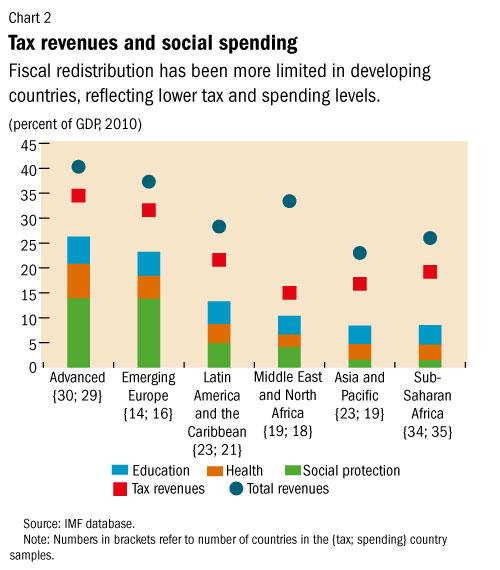

In-kind transfers (that is, government spending on goods or services offered to the public, mainly health and education) has reduced inequality in those countries by another 15 percent. Developing countries have shown more limited fiscal redistribution, reflecting lower tax and spending levels (Chart 2) and the less progressive composition of both taxes and spending.

Careful design promotes desired effects

Although the appropriate composition and design of fiscal policies varies from country to country, some aspects are key to ensuring policies are equitable and efficient. In advanced economies, effective targeting of spending programs and avoiding design flaws that undermine incentives to work are important. In economies with high administrative capacity, income taxes generally offer better opportunities than indirect taxes to make the tax system progressive.

This points out a fundamental consideration for policymakers: fiscal policy instruments should not be assessed in isolation; instead, tax and spending should be analyzed in tandem. For instance, accurately gauging the distributional impact of a particular tax instrument requires taking into account the effects of the spending it helps finance. As to the composition of tax revenue, many countries, both advanced and developing, have room for expanding the role of recurrent property taxes and increasing the progressivity of personal income taxes.

A comprehensive approach is particularly important for developing countries, whose revenue is generally more tilted toward regressive indirect taxation, while public spending on health, education, and social insurance and assistance is low. Social insurance spending in these countries primarily benefits higher-income households, as the poor are often working in the informal sector and outside the scope of the formal pension system. For example, in the early 2000s, the share of elderly receiving a pension was about 40 percent in the Middle East and North Africa and in Latin America and the Caribbean and about 25 percent in Asia and the Pacific and in sub-Saharan Africa—in contrast to Europe, where it was 90 percent.

Appropriate combination of reforms is important

Enhancing redistributive outcomes in developing countries therefore requires a mix of reforms.

First, effectively scaling up spending on health and education (with special attention to increasing low-income groups’ access to quality services) can improve income distribution in both the short and the medium term, as investment in human capital takes time to display its full effects.

Second, well-targeted transfer programs should replace expensive universal subsidy schemes, such as the provision of gasoline at controlled prices below those prevailing in international markets. These and other energy subsidies have been shown to benefit higher-income individuals far more than the poor while resulting in a misallocation of resources that reduces efficiency.

Conditional transfer programs (such as those introduced in Brazil and Mexico) can help alleviate inequality and poverty and link income transfers and in-kind benefits; the use of appropriate eligibility design also helps contain fiscal costs. Third, raising tax ratios (tax revenue as a percentage of a country’s GDP) is a prerequisite for higher spending. It requires that governments adequately strengthen tax compliance through better administration, which can allow more effective taxation of corporate and personal income, including of high-wealth individuals.

During the past decade, many developing economies have started raising tax ratios. The median change has been about 3 percent of GDP in Asia and Pacific and Latin American and Caribbean countries, 2 percent in Sub-Saharan Africa, and 1 percent in the Middle East.

While it is true that fiscal policy matters for inequality and growth, there is no universal recipe for all countries: details of policy design, it turns out, matter the most. Inequality and Fiscal Policy offers policymakers and others practical guidance on such design.