Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Strong and Equitable Growth: Fiscal Policy Can Make a Difference

June 30, 2015

- Fiscal policies can help boost countries’ long-term growth prospects

- Complementary structural reforms magnify growth dividends

- Social dialogue and attention to equity key to building public support for reform

Amid a recovery from the financial crisis that continues to disappoint and growing fear that the global economy is entering a prolonged period of mediocre growth, a new IMF study says that fiscal policy can actually lift potential growth.

Children at Maroroni Primary School in Arusha, Tanzania. Reforms to education spending in Tanzania boosted enrollment rates and led to sustained economic growth (photo: Karen Kasmauski/Corbis)

FISCAL POLICY

The study finds that fiscal reforms, especially when complemented with supportive changes in other economic policies (structural reforms), can support strong and equitable growth. It draws on the lessons from nine country case studies (Australia, Chile, Germany, Ireland, Malaysia, the Netherlands, Poland, Tanzania, and Uganda), as well as an analysis of growth accelerations (defined as increases of at least 1 percentage point in five-year average growth following fiscal reforms).

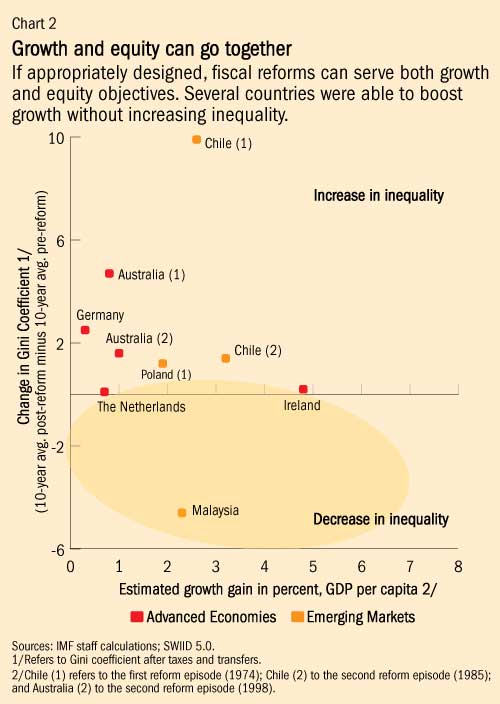

Although the precise effect of fiscal policy is difficult to measure accurately, average growth increased substantially during the decade following reforms in most countries studied: by about ¾ percentage point on average in advanced economies (excluding Ireland) and by even more in emerging markets and low-income countries (Chart 1). Analysis of growth acceleration episodes in 112 countries confirms this encouraging result, by finding that such accelerations occurred significantly more often when countries had implemented fiscal reforms.

Anatomy of successful fiscal reforms

Fiscal reforms can influence growth through four main channels, according to the study:

Employment. A number of fiscal policy measures can promote employment and thus increase the contribution of labor to growth. For instance, cutting labor taxes, especially when they are high, increases take-home pay—and thereby increases incentives to work. Improving the design of social benefit programs and active labor market programs can strengthen work incentives and better assist job seekers. Germany, for example, increased its labor force participation by 8 percentage points between 2000 and 2013 through active labor market programs and other labor market reforms. Targeted measures to support labor market participation of specific groups, such as women, youth, older workers, and low-skilled workers, are often important tools. For instance, India applies a lower effective tax rate on women’s labor income, and most advanced economies subsidize the hiring of unemployed youth.

Investment. Investment is a key driver of growth, and tax policies, in particular, can influence private investment decisions. For example, Ireland saw investment surge after it streamlined and reduced its corporate income tax structure. Taxing all capital income potentially jeopardizes investment, as these taxes reduce the return on savings for individuals and the rate of return on investment projects for corporate investors. Focusing capital income taxation on returns beyond a normal, risk-free rate of return can provide more of a stimulus for private investment. Such a system would also reduce the bias toward debt financing that is created by the tax deductibility of interest expenses.

While tax incentives are often used to attract investment, appropriate targeting is crucial to their effectiveness. Incentives that directly reduce the cost of capital (such as investment tax credits) should be favored over open-ended and profit-based incentives (such as tax holidays). Evidence shows that the latter erode the tax base and undermine revenue collection—without providing noticeable benefits for investment or growth. Apart from tax measures to boost private investment, public investment in infrastructure can also yield significant returns and boost growth. Attention to the quality and efficiency of the investment is critical, however. Between 1985 and 1995, Malaysia more than doubled its existing infrastructure capacity in most sectors—and annual growth surged to close to 8 percent.

Human capital. A key ingredient of an economy’s growth potential is the talent of its workforce. Fiscal policy is vital in ensuring that all citizens have an equal opportunity to reach their full potential. The education and health outcomes of the poor tend to be better in a more equal society, and this can lead to faster accumulation of human capital. Thus, improving access to health care and education, especially for disadvantaged groups—through increasing investment in primary education, providing a basic health care package, and reducing user charges for poor households—is a priority. Tanzania increased its education spending significantly over 1998–2005, from 1.8 percent of GDP to 3.5 percent of GDP, including measures targeted to less-developed regions. The reforms helped boost enrollment rates and spur sustained economic growth.

Innovation. Innovation enhances productivity, which in turn increases growth. When carefully designed, targeted tax incentives, such as tax credits and deductions, can promote investment in new technologies. In particular, tax incentives for research and development (R&D) have been shown to have some positive impact on productivity in advanced economies, especially in R&D-intensive industries, such as pharmaceuticals and telecommunications.

How to pay for growth-friendly reforms

Implementation of growth-friendly fiscal reforms will sometimes require additional resources, which need to be made available in a way that is the least harmful for growth. On the revenue side, preferred measures include: broadening the tax base by eliminating tax exemptions and preferential tax rates for certain types of income; shifting the tax composition from direct taxes to indirect and property taxes; and improving revenue administration. In Poland, for example, reducing the share of direct taxes in overall revenue helped generate a significant increase in investment and employment; and in Chile, simplifying taxpayer forms and streamlining filing and payment procedures improved enforcement and tax collection. Introducing environmental taxes to price negative externalities can also generate substantial fiscal resources while boosting environmentally sustainable growth.

Expenditures can be reduced by improving the targeting of spending and increasing its efficiency. For instance, countries may aim to lower the government wage bill while protecting the quality of public services, as did Germany, Ireland, Malaysia, and the Netherlands among the countries studied. Similarly, they may opt to eliminate generalized subsidies (such as those on energy products) that disproportionately benefit higher-income groups in favor of targeted measures that tie benefits more closely to those in need.

Countries that have little or no room for measures to increase revenue or trim expenditure can still focus on budget-neutral fiscal reforms and boost growth simply by changing the composition of taxes and spending.

The “how” matters

How fiscal reforms are designed and implemented is an important determinant of their success in generating strong and sustained growth. First, inclusion of fiscal measures in a package with other complementary reforms increases the likelihood of success. In the majority of the countries studied, successful fiscal reforms were implemented together with other structural reforms and macroeconomic policies. For example, to boost employment, countries combined strengthened work incentives with labor market reforms aimed at facilitating job creation, such as streamlined hiring and firing procedures, changes in wage bargaining, and minimum wage cuts. In other cases, reducing government debt and deficits to create room for corporate tax decreases was pursued simultaneously with economic deregulation and privatization.

Second, social dialogue with relevant stakeholders enhances the likelihood of reforms being implemented and sustained, especially where they may be politically difficult. Watershed social partnership agreements in the Netherlands (the Wassenaar agreement in 1982) and Ireland (the tripartite agreement in 1987), for example, helped pave the way for fundamental economic turnarounds. A number of strategies can help foster public support. For example, effective communication with stakeholders that emphasizes the intended benefits of reforms—or the cost of maintaining the status quo—can help mitigate resistance to reforms. Also, inclusion of compensatory measures for those expected to be worse off can be effective in building broad public support for reform packages.

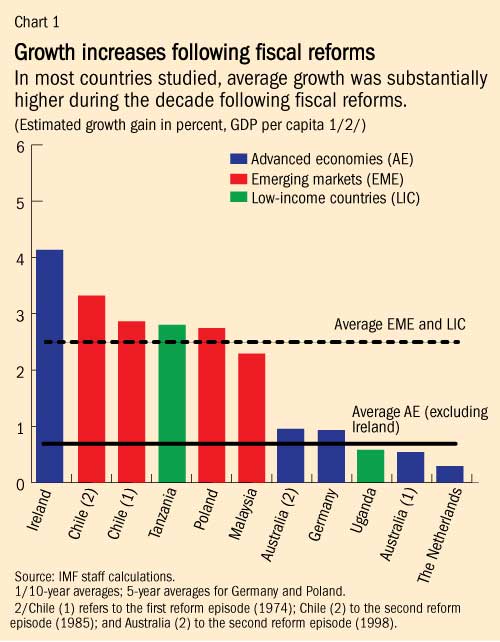

Finally, countries need to balance efficiency and equity considerations, as some reforms that increase efficiency may have adverse distributional consequences. Evidence from the country studies suggests that such trade-offs can be avoided (Chart 2). For example, a tax reform that increases the share of consumption taxes is likely to hurt lower-income households. However, if the proceeds are used to finance higher health and education spending from which these households benefit, they may be better off overall.