Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Asia Can Take Steps to Bolster Resilience Amid Economic Slowdown

October 9, 2015

- Region faces more challenging external environment

- Growth is moderating though still strong relative to rest of world

- Policy accommodation should be considered where there is policy space

Growth is moderating in Asia, but the region will continue to outperform the rest of the global economy, according to an IMF report on Asia’s economy released on October 9 in Lima, Peru, as part of the IMF-World Bank Annual Meetings.

Worker in steel factory in Jiaxing, Zhejiang Province, China: Declining commodity prices are contributing to moderate growth in Asian economies (photo: William Hong/Reuters/Corbis)

REGIONAL ECONOMIC OUTLOOK

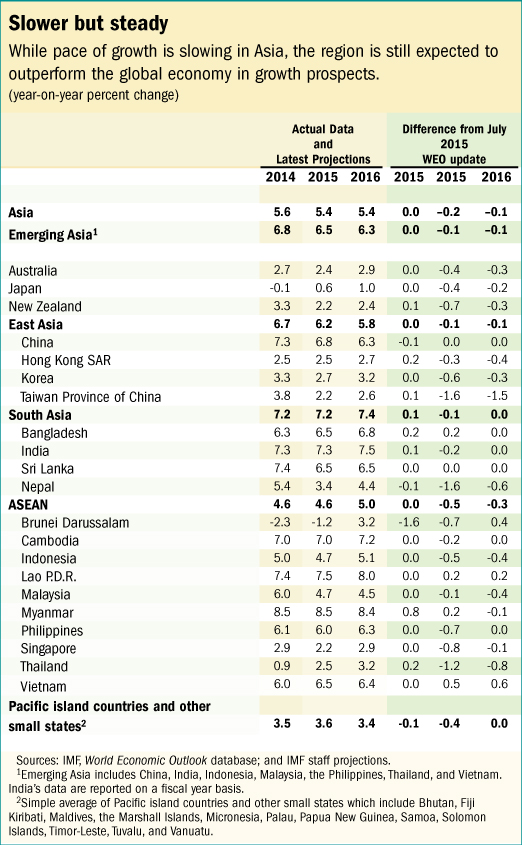

According to the October 2015 Asia and Pacific Regional Economic Outlook Update (REO Update), growth will moderate slightly to 5.4 percent in 2015–16, in line with global developments (see table). “Domestic consumption, supported by robust labor markets and lower energy prices, will be the main growth driver, and the recovery in advanced economies will provide further support,” said Changyong Rhee, Director of the IMF’s Asia and Pacific Department.

The report also notes that negative growth spillovers from China to the rest of the region are probably larger than previously anticipated, and exports continue to fall short of global growth. While the rebalancing in China’s import demand is one cause, a broad-based weakness in global import demand is also a major factor behind the trade slowdown in Asia.

Growth prospects within Asia will likely diverge once again, including among the largest economies. China’s economy will continue to rebalance toward domestic consumption and is expected to grow by 6.8 percent and 6.3 percent in 2015 and 2016, respectively (no change relative to the April 2015 World Economic Outlook). The recent equity market turmoil and the change in the exchange rate regime are not expected to have a significant impact on near-term growth. However, “the policies needed to address vulnerabilities and rebalance the economy are likely to reduce headline growth, while ensuring sustainability over the medium term,” said Rhee.

In Japan, growth is projected to recover to 0.6 percent in 2015 and 1 percent in 2016, supported by a wage-driven recovery in consumption, as well as a modest improvement in investment and exports. Domestic demand should also benefit from lower oil and commodity prices and the Bank of Japan’s accommodative policies.

In India, the ongoing economic recovery is expected to be underpinned by lower oil prices and robust domestic demand, and GDP is expected to grow 7.3 percent in 2015, rising to 7.5 percent in 2016.

Growth in major ASEAN economies is projected to moderate in 2015–16, owing to a number of factors, including lower commodity prices (Indonesia and Malaysia), political uncertainty (Malaysia), and weaker growth in China.

Downside risks continue to dominate

The REO Update points to downside risks to regional growth, especially the possibility of a sharper slowdown in China, as well as the effects of a change in the composition of demand. Further U.S. dollar strength accompanied by a sudden tightening of global financial conditions, weaker growth in Japan, and weaker potential growth in many economies in the region are additional risk factors that could dim Asia’s growth prospects. “High leverage could also amplify shocks, particularly if domestic interest rates spike as global financial conditions tighten,” said Rhee. Lower commodity prices represent another downside risk, with adverse implications for corporate investment in key commodity-producing sectors, according to the authors of the REO Update.

Policy recommendations

“Accommodative policies should be considered where policy space is available, but trade-offs will come to the fore,” said Rhee.

Given the slowdown across most of the region, and the challenging global economic environment, the REO Update recommends policies to support demand while lowering vulnerabilities. Accommodative policies should be considered, particularly for countries that have policy space and where the decline in growth has a clear cyclical or temporary component. But policies should also focus on boosting potential growth and should aim to reduce vulnerabilities.

With this in mind, the report recommends that structural reforms should remain a priority to bolster medium-term growth by facilitating investment and job creation, and helping to reduce near-term vulnerabilities. In China, reforms should continue to help rebalance the economy away from debt-fueled investment. This would include, among other moves, leveling the playing field between state-owned-enterprises (SOEs) and the private sector, and improving the management of local government finances.

“Steady progress on implementation will be key to help reduce policy uncertainty and allow the growth-enhancing benefits of the reforms to materialize,” said Rhee. In Japan, monetary easing needs to continue, and the implementation of a concrete medium-term fiscal plan and structural reforms (e.g., in product and labor markets) should be accelerated. In frontier economies such as Vietnam and Mongolia, banking sector and SOE reforms to improve efficiency and the allocation of capital remain priorities, while in India, further steps will be needed to address long-standing supply bottlenecks and achieve faster and more inclusive growth.

The REO Update also emphasizes aggregate demand policies to support growth and bolster resilience. Automatic stabilizers should be allowed to operate fully, except where fiscal consolidation needs are more evident. In economies with fiscal space––such as those with low debt and cyclically adjusted fiscal surpluses––targeted fiscal stimulus to counter temporary shortfalls in demand could be deployed. Elsewhere, gradual fiscal consolidation should continue, especially in commodity exporters, but attention should also be paid to the composition of any fiscal adjustment.

The analysis in the REO Update also supports the use of monetary policy to shore up demand in economies where inflation is low, especially if fiscal space is limited. Policy rates are broadly in line with fundamentals in a number of major Asian economies, suggesting that rates could be lowered should growth disappoint and negative output gaps emerge or widen. At the same time, weaker exchange rates might limit the scope for monetary easing.

The report also notes that exchange rate policy and macroprudential tools will remain important to help manage external adjustment and bolster financial stability. Exchange rates should be a major shock absorber, with foreign exchange reserves used judiciously to manage temporary exchange rate volatility. Moreover, foreign exchange intervention should not hinder the needed exchange rate adjustments. Macroprudential policies should be employed to ensure financial stability, with efforts geared at strengthening supervisory and regulatory frameworks, particularly as the credit cycle turns.