Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Cheaper Oil And Sanctions Weigh On Russia’s Growth Outlook

August 3, 2015

- Oil price decline compounded by geopolitical tensions and sanctions, leading to fall in investment

- Authorities’ policy response and large buffers are helping to absorb the shocks

- After short-term fiscal stimulus, gradual fiscal consolidation needed

Russia’s economy is expected to contract by 3.4 percent in 2015, although growth should return in 2016. Medium-term growth prospects are modest due to slow progress in implementing structural reforms, according to the IMF’s latest economic health check.

Engineers test oil pipelines for cracks in Siberia: The decline in oil prices has had a major effect on the Russian economy (photo: Jerome Levitch/Corbis)

ECONOMIC HEALTH CHECK

The dual external shock of lower oil prices and geopolitical tensions are key factors exerting downward pressure on Russia’s GDP in the near term. The recovery in 2016 will be supported by the ruble’s more competitive exchange rate, increasing external demand and normalization of domestic financial conditions. However, investment and consumption are likely to remain sluggish and the effects of sanctions in terms of external access to financial markets and new investment technology will linger. IMF staff expect weak GDP growth of around 1.5 percent in the medium term.

“The external shocks, added to pre-existing structural weaknesses, are certainly weighing on Russia’s growth prospects. Maintaining a prudent fiscal policy and reviving slow-moving structural reforms could help unlock Russia’s growth potential,” said Ernesto Ramirez Rigo, IMF Mission Chief for Russia.

Geopolitical tensions

In March 2014, the United States, the European Union, Japan and other countries started imposing sanctions against Ukrainian and Russian individuals and entities in response to developments in Crimea and Eastern Ukraine. The U.S. and EU sanctions targeted financial services and the energy sector, among other areas. In August, Russia imposed counter sanctions on agricultural and food imports.

These developments essentially restricted Russian firms’ access to international markets, with a negative effect on investment. It is very difficult to disentangle the impact of sanctions from the fall in oil prices. However, IMF estimates suggest that sanctions and counter sanctions might have initially reduced real GDP by 1 to 1½ percent. Prolonged sanctions may compound already declining productivity growth. The cumulative output loss could amount to 9 percent of GDP over the medium term. However, the report’s authors underline that these model-driven results are subject to significant uncertainty.

Prudent fiscal policy

The IMF report supports Russia’s decision to apply a short-term fiscal stimulus in the 2015 budget. The stimulus should be followed by gradual fiscal consolidation over the medium term to adjust to lower oil prices, rebuild buffers and safeguard intergenerational equity.

Reforming the pension system could deliver significant fiscal savings over time, the report says. Targeting social transfers better, reducing energy subsidies and reducing tax exemptions could also contribute to making the necessary adjustments. Spending plans should safeguard public investment, education and health care.

Resource-rich countries face complex challenges in managing the long-term value of their natural wealth and the short-term volatility in the revenue it brings. A key tool for Russia is an oil-price based fiscal rule it introduced in December 2012. The report suggests that strengthening the rule to, for instance, account for oil price volatility, could allow fiscal policy to respond more quickly to oil price changes and generate more savings.

Adequate monetary policy response

Responding to the external shocks, the Central Bank of Russia appropriately allowed the ruble to float, setting its medium-term target for inflation at 4 percent. After the warranted initial tightening late in 2014, monetary conditions gradually normalized, and inflation expectations become more anchored, allowing the Central Bank to gradually ease monetary conditions during the first half of 2015.

Going forward, monetary policy normalization should continue at a prudent pace, commensurate with declines in inflation and inflation expectations, while carefully assessing the likelihood of upside risks to inflation. The report says the stage will be set for inflation to fall to about 12 percent by the end of 2015 and close to 8 percent at the end of 2016.

Reform is needed

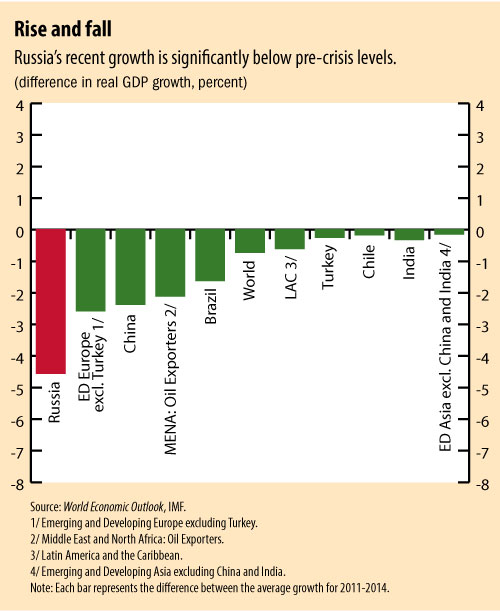

While countries around the world have suffered a drop in growth relative to their pre-crisis performance, Russia’s reversal of fortunes stands out as being particularly pronounced (see Chart). Slow-moving structural reforms, sluggish investment and adverse population dynamics are all part of the picture. In particular, the state continues to leave a large footprint in the economy, and lack of competition and concentration in a number of sectors (among other factors), have contributed to low productivity growth.

There is an array of reforms that could help boost investment and trade. Strengthening governance and the protection of property rights, as well as cutting regulatory red tape would make a difference, as would better customs administration and reduced trade barriers. These measures could increase competition in domestic markets. Public investment could also be made more transparent and efficient.

Risks

Possible additional external shocks could have adverse effects beyond the report’s baseline scenario. If geopolitical tensions escalate, there could be additional balance-of-payment pressures and a significant deterioration in confidence. The ruble could depreciate as capital outflows surge and inflation would increase further.

Greater uncertainty would hurt investment and increase precautionary savings, pushing down domestic demand. Lower and/or more volatile oil prices could further dampen the economic outlook. In addition, the benefits of a more competitive exchange rate are likely to be limited should the authorities pursue inward-looking policies.

Spillovers

Policy actions by the Russian authorities stabilized the economy and helped mitigate spillover effects to other countries. Despite this, a number of countries have close links to Russia through trade, remittances or foreign direct investment and face sizeable negative consequences. The Commonwealth of Independent States, Ukraine, and Baltic countries are most affected.