Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Gulf Countries Should Refine Policies to Ensure Financial Stability

March 19, 2014

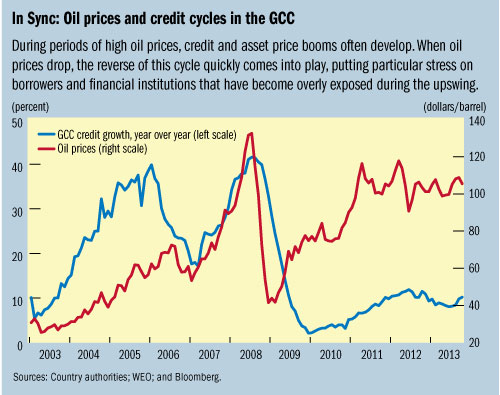

- Gulf countries remain susceptible to boom and bust of credit and asset prices

- Reliance on oil revenues, importance of real-estate sector are sources of risks

- Refining macroprudential policy is key to better manage financial cycles

The experience of the boom and bust in 2008-09 demonstrates the vulnerability of the member countries of the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates—to credit and asset price cycles, and makes macroprudential policies especially important, says IMF.

Dubai, United Arab Emirates. The real estate sector remains a source of financial vulnerabilities in the member states of the Gulf Cooperation Council (photo: Ian Cumming/Newscom)

Financial Stability in Gulf States

Higher oil revenues increased liquidity in the banking sector. The increase in government spending and bank lending boosted activity in the non-oil sectors of the economy, particularly construction in some countries. Credit and asset prices rose, moving closely with the oil price cycle.

The credit and asset price boom came to an abrupt end as the global financial crisis hit the member countries of the Gulf Cooperation Council in late 2008. Real estate prices fell significantly (particularly sharply in Dubai), lending cost increased, and external funding conditions tightened.

The experience of the Gulf countries during the crisis brought home the importance of expanding central banks’ traditional mandate to include financial stability as a key objective.

An IMF team, comprising Ananthakrishnan Prasad, Zsofia Arvai, and Kentaro Katayama, looks at the role of macroprudential policies in these countries.

In an interview, the three authors explain the role of macroprudential policies and why they are important for this group of countries, discuss the group’s experience with macroprudential policies so far, and recommend a framework for more sound implementation of the macroprudential policies going forward.

IMF Survey: What is macroprudential policy and what does it cover?

Arvai: Macroprudential policy is the set of tools that financial authorities and regulators use to preserve stability in the financial system as a whole and, hence, reduce the frequency and severity of financial crises. A general goal of macroprudential policy is to limit the risk of system wide distress that has significant macroeconomic costs to the economy. The other major objective is to strengthen the resilience of the financial system to unfavorable developments.

The list of macroprudential policy tools includes, for example, loan-to-value or debt-to-income ratios, countercyclical capital buffers and provisions, or sectoral capital requirements. These tools aim to contain rapid credit growth, which— if unchecked— could destabilize the financial system, and, ultimately, bring about a recession and drive up unemployment as we have seen during the global financial crisis. Macroprudential policy tools differ from micro-prudential measures that target individual financial institutions.

Macroprudential policy can improve the authorities’ grip of the linkages between financial institutions, financial markets, and the macro-economy. It looks at a wide range of indicators to assess the resilience of the financial system to shocks, the availability of funding in financial markets, connectedness of market participants, private sector debt, and international capital flows.

IMF Survey: Why are macroprudential policies important for the member countries of the Gulf Cooperation Council?

Prasad: Several characteristics of the economies, financial sectors, and policy frameworks in the member countries of the Gulf Cooperation Council make macroprudential policy particularly important. Most local currencies in those countries are pegged to the U.S. dollar, which constrains the independence of monetary policy. Fiscal policy, particularly government spending given limited domestic taxation, is the key tool for managing economic cycles. However, due to implementation time lags and expenditure rigidities, fiscal policy is not flexible enough to prevent credit booms and the build-up of systemic risk in the financial sector. Thus, macroprudential policy needs to play a major role in managing financial cycles associated with oil prices.

In addition, the heavy reliance on volatile oil revenues, the importance of real estate as a major asset class for investment, and the shortcomings in crisis resolution frameworks all underline the importance of having a deep macroprudential policy in the toolkit in the member countries of the Gulf Cooperation Council to limit systemic risk in the financial system.

IMF Survey: Can you briefly explain the region’s experience in using macroprudential policy tools so far?

Katayama: Central banks in member countries of the Gulf Cooperation Council have been using several macroprudential instruments for a long time.

For example, as a result of high retail credit growth in early 2000s, the share of retail loans to total loans reached high levels in some of those countries. To mitigate the risk of high leverage for banks and individuals, financial authorities in most of these countries put in place personal lending regulations already before the global financial crisis. They have been ahead of many other countries in imposing loan-to-deposit ratios. These ratios helped contain liquidity risk and the reliance on wholesale funding. However, constant loan-to-deposit ratios failed to sufficiently slow credit growth in the run-up to the crisis as the deposit base was expanding due to high liquidity in the financial system.

While limits on real estate exposures were in place in banking systems, the definition of real estate in the regulations did not cover real estate-related lending and financing activities adequately. As a result, banks’ actual exposure to the real estate sector turned out to be higher than suggested by the regulatory limits.

IMF Survey: What are the Fund’s recommendations for the member states of the Gulf Cooperation Council to enhance their macroprudential policy framework going forward?

Arvai and Prasad: The member countries of the Gulf Cooperation Council were ahead of many countries in implementing some macroprudential measures. However, there is still scope for refining the existing macroprudential institutional and policy framework to better manage financial cycles. In particular, further steps could be taken to build appropriate buffers and to limit credit booms in good times. Such steps would include the following:

First: Strengthening the institutional arrangements. Macroprudential policies have been implemented by central banks without a formal framework or adequate legal backing. A more formal and transparent macroprudential institutional and policy framework would help ensure that responsibilities and coordination among regulators and other relevant parties are well-established. It is recommended to give central banks the formal mandate to ensure financial stability, since they can bring the expertise and incentives to the task of mitigating systemic risks.

Second: Developing effective early warning systems further and conducting regular systemic assessments (e.g. macro stress testing).

Third: Refining the existing macroprudential toolkit by:

• Building and maintaining sizeable capital buffers in the banking sector

• Introducing time varying loan-to-deposit and loan-to-value ratios to help alleviate booms in credit and asset markets during good times

• Using sectoral exposure limits, particularly for real estate and personal loans, to limit the build-up of excessive exposure to targeted sectors or borrowers

Fourth: Implementing structural measures to support macroprudential policy by:

• Developing domestic interbank money and debt markets to support liquidity management

• Modernizing the insolvency regimes, and strengthening crisis management and resolution systems