Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : Oil Price Drop Highlights Need for Diversity in Gulf Economies

December 23, 2014

- Decline in oil prices highlights need to diversify Gulf economies

- Oil revenues distort incentives for region’s firms and workers

- New export markets, better education, fewer government jobs will be key

Countries of the Gulf Cooperation Council (GCC) will have to adjust the incentives of workers and firms to encourage them to work and produce in the non-oil tradable sector if these economies are to succeed in diversifying their economies, a new IMF study says.

Construction workers in Kuwait City: Greater diversification of the Gulf countries’ economies would lessen exposure to oil market price swings, IMF says (photo: Reuters/Jassim Mohammed)

GULF COOPERATION COUNCIL

With oil prices declining by 40 percent since June, the importance of diversification is once again highlighted.

While governments in the region have made some progress toward economic diversification in recent years, much remains to be done. The strategies pursued thus far have yielded mixed results, according to the report.

To make significant progress toward reducing their reliance on oil, GCC governments need to change the incentive structure of the economy to encourage individuals to work in the private sector and induce firms to look beyond domestic markets for new export opportunities, the authors say.

New growth model needed

The GCC growth model—which relies on oil as the main source of export and fiscal revenues—has delivered strong economic and social outcomes. Over the years, GCC governments have increased public sector employment and spending on infrastructure, health, and education. This has helped raise standards of living and support private sector activity, particularly in such sectors as construction, trade and retail, transport, and restaurants.

But the current growth model has weakness, the report points out. Greater diversification would reduce exposure to volatility in the global oil market, help create private sector jobs, and establish the non-oil economy that will be needed in the future when the oil revenues dry up.

Why have the diversification policies pursued to date by GCC governments fallen short of their goal? The paper examines the experience of other oil-exporting countries and draws possible lessons for the GCC.

Case studies in success

Historical experience offers few examples of countries that have been able to successfully diversify away from oil, particularly when their oil production horizon is still long. A number of obstacles often stand in the way of diversification, such as the economic volatility that is induced by the reliance on oil revenues or the corroding effect that oil revenues have on governance and institutions. Economies rich in oil also often see a decline in competitiveness of other economic sectors caused by the appreciation of the real exchange rate as resource revenues enter an economy, a phenomenon known as Dutch disease.

Success or failure appears to depend on the implementation of appropriate policies ahead of the fall in oil revenues. Malaysia, Indonesia, and Mexico offer perhaps the best examples of countries that have been able to diversify away from oil, while Chile has had some success in diversification away from copper.

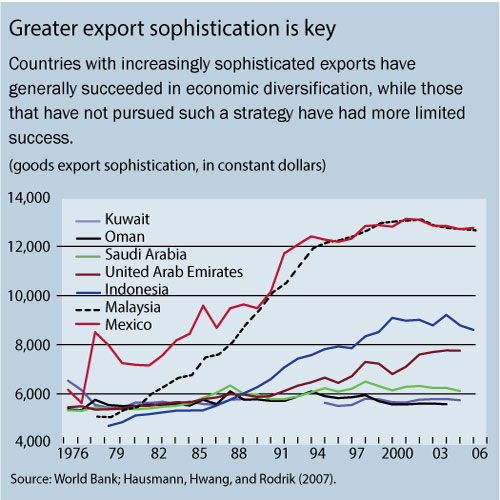

While each of these four countries followed its own path, a number of common themes are evident. First, diversification took a long time and took off only when oil revenues began to dwindle. For example, Malaysia started its export-oriented strategy in the early 1970s and experienced rapid growth in export sophistication in the 1980s–90s. It took more than 20 years to reach a level of sophistication comparable to some advanced economies.

Second, successful countries focused on putting in place the incentives to encourage firms to develop export markets and to support workers in acquiring the skills and education to get jobs in these new expanding areas. In addition to focusing on creating a stable economic environment and a favorable climate for doing business, this entailed:

• Making investments in high-productivity industrial clusters, even when there was no prior comparative advantage. The early experience of Malaysia, Mexico, and Indonesia showed that import substitution or reliance on labor intensive manufacturing led to inefficient firms with limited scope for income and productivity gains. Changing their approach and despite starting from a low-technology base, these countries increased their export sophistication by focusing on specific manufacturing clusters that led to an upgrading of technology (see chart). Chile used export subsidies and public-private partnerships to establish new firms and upgrade technical skills in specific sectors.

• Developing horizontal and vertical linkages from industrial clusters. Creating networks of local suppliers around existing export industries can expand the employment potential of a given sector, although care should be taken that the local source sectors are efficient and do not lead to a loss in competitiveness. Malaysia entered downstream and upstream activities based on rubber and palm oil to build linkages with the rest of the economy and upgrade research capabilities and technology. Mexico developed linkages around the automobile sector.

• Using foreign capital to promote technological transfer. In the 1980s, Indonesia attracted foreign capital through the creation of free trade zones, provision of tax incentives, and the easing of tariff restrictions and non-tariff barriers. Similar policies were implemented in Malaysia and Mexico. In Mexico, accession to the North American Free Trade Agreement played an important role in attracting foreign direct investment that facilitated the development of the automobile sector.

• Using export subsidies, tax incentives, and access to finance to facilitate risk-taking by entrepreneurs, especially small and medium-sized enterprises. Entering new sectors is risky for private sector firms. To some extent, export subsidies and tax incentives can help reduce the risk for entrepreneurs in infant industries. In addition, financing and support provided by development banks, venture capital funds, and export promotion agencies can also reduce risk.

• Making investments in training to ensure the availability of high-skilled workers. Creating industry clusters necessitates human capital and skills relevant to the sector, along with required infrastructure and industrial facilities. For instance, Malaysia and Mexico focused on training and skill-upgrade of workers, and sponsored workers for foreign training. Over time, these investments in training paid off in terms of building a high-skilled work force.

Lessons for the GCC

What can the GCC countries learn from these experiences? Greater economic diversification will require realigning incentives currently facing firms and workers, the IMF report says.

To date, policies to support diversification have focused on securing a stable economic environment, improving the business climate, and investing in infrastructure and education. These policies are all important steps in the right direction and they have achieved some degree of diversification of GDP, but they do not tackle the distortive effect that the distribution of oil revenues has on incentives.

In particular, high wages and generous benefits encourage nationals to seek employment in the public rather than the private sector, while high government spending in a relatively protected domestic environment encourages firms to produce non-tradable goods and services. In short, despite some progress, these policies have not achieved much diversification in exports, which are still mostly oil.

Measures to alter incentives are critical to spur diversification. These should include moving away from using the public sector as the employer of first and last resort, ensuring that the education and training systems provide workers with the skills needed for private sector employment, and developing stronger social safety nets to guarantee minimum income levels and support job search activities.

On the firm side, measures are needed to address the lack of competition in some domestic markets, reduce incentives for low productivity production, and encourage exports, the report says.