Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Asian Real Estate Markets: On Bubble Alert?

June 2, 2010

- Real estate prices in Asia are rebounding quickly

- Policymakers taking measures to cool down property markets

- Delicate balance needed between containing bubble risk and ensuring solid recovery

While much of the world continues to grapple with the housing bust, housing prices and sales in some Asian economies have recovered quickly, which might pose risks to financial stability, according to a recent IMF study.

Highrises in downtown Hong Kong SAR: property prices in Asia are recovering quickly (photo: Newscom)

Global Financial Stability Report

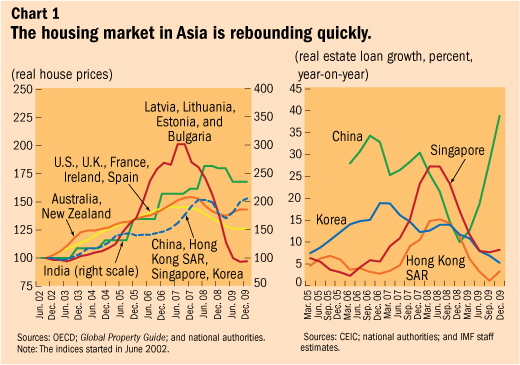

Housing prices and transactions volumes recovered in the second half of 2009 from their 2008 downturn in eastern Asian economies (notably China, Hong Kong SAR, Korea, and Singapore) and closely linked advanced economies (Australia and New Zealand; see Chart 1, first panel). In particular, prices for high-end properties in major metropolitan areas exceeded their 2008 peaks, gradually spilling over to the broader market.

The rebound has been mainly driven by unprecedented policy measures to mitigate the impact of the global financial crisis and the ensuing return of risk appetite. First, mortgage rates are at historical lows in Asia as central banks have cut policy rates. Second, reviving real estate loan growth helped pull the markets out of the trough, especially in China (see Chart 1, second panel). Third, governments in China and Korea introduced housing-related tax initiatives in late 2008 to revive domestic real estate markets. Finally, capital inflows have played an important role. In Hong Kong SAR, for example, an influx of buyers from mainland China pushed prices up, especially for luxury apartments.

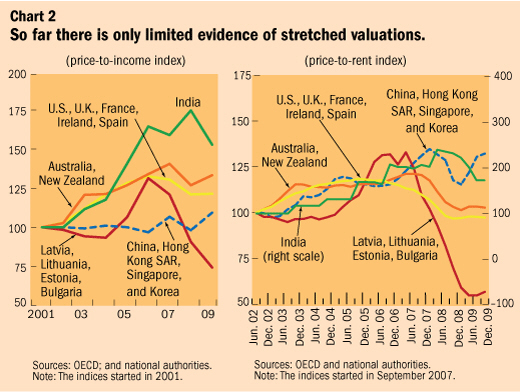

Measures of affordability are mixed, but on balance suggest that house prices may be stretched. Although the average price-to-income index for east Asian economies has risen only modestly, the price-to-rent index is elevated (see Chart 2). As typically happens in housing bubbles, many purchasers may have been buying in the expectation of further price appreciation, rather than simply for dwelling purposes.

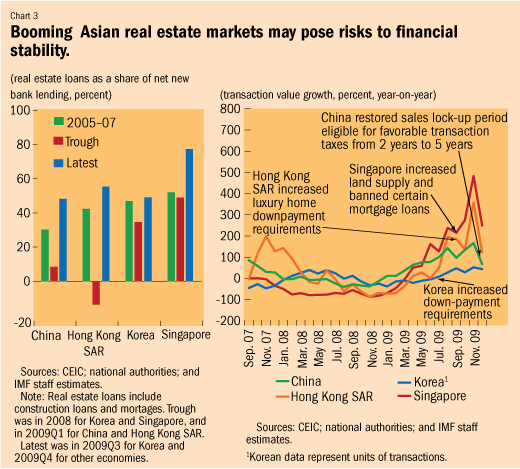

The booming Asian real estate markets may pose risks to financial stability as banks are increasingly vulnerable to a price correction (see Chart 3, first panel). In addition, because the majority of mortgage loans in Asian economies carry floating rates, the widely anticipated rate hikes in the region may increase the burden on household balance sheets.

In light of these potential risks, policymakers in the region have taken measures to cool real estate markets, including tighter requirements on mortgage lending, increasing land supply, and reimposition of higher transaction taxes. The average loan-to-value ratio of new mortgage loans in Hong Kong SAR has dropped significantly from its peak in June 2009, and banks in mainland China have started to tighten their mortgage criteria. Furthermore, growth rates of transaction values in these booming markets all slowed down sharply in December (see Chart 3, second panel). More recently, China introduced another wave of cooling measures, designed in part to rein in real estate speculation. These include limitations on the number of home purchases by individuals, raising minimum down payment requirements and mortgage rates in certain speculative market segments, and the exit of state-owned companies from noncore property business.

But the jury is still out on whether these cooling measures will be able to take a bite out of the booming property market. The authorities may also need to fine-tune their policies in response to new market developments to maintain a delicate balance between leaning against housing bubbles and ensuring a solid economic recovery.