Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Buoyant Africa Needs to Sustain Growth

October 20, 2007

- Strong growth creates favorable climate for reform

- Despite high oil prices, average inflation is under control

- Dramatic price changes for fuel, other commodities could hurt growth forecast

Growth in sub-Saharan Africa (SSA) is expected to hit 6.7 percent in 2008, up from 6 percent this year.

Tea picker in Ikumbi, Kenya: Africa has benefited from strong demand for its commodities (photo: Chris Jackson/Getty)

REGIONAL ECONOMIC OUTLOOK

Average inflation, despite higher commodity prices, is expected to be about 7½ percent in 2007, about the same as in 2006, but should decline to 6.7 percent next year.

"The region looks well-poised to sustain its growth momentum, " Abdoulaye Bio-Tchané, Director of the IMF's Africa Department, told a press briefing in Washington D.C. on October 20. "There's still plenty to do, of course, " he added. "Sustaining the current expansion and reducing poverty ultimately depends on each country's ability to carry forward structural and institutional reforms that increase productivity, boost the economy's resilience to shocks, and attract private investment."

Expansion is widespread

According to the IMF's latest Regional Economic Outlook (REO) for sub-Saharan Africa, SSA has, in recent years, experienced its strongest growth and lowest inflation levels in more than 30 years. Although the economic expansion is strongest in the oil exporters, it cuts across all country groups. It is attributable to rising production in oil exporters and strong domestic investment in oil importers, fueled by continued progress with macroeconomic stability and reforms in most countries.

The region also benefited from strong demand for its commodities, increased capital inflows, and debt relief. The REO, released on October 20, organizes SSA's 44 countries into four groups: oil exporters and non-oil-exporting middle-income, low-income, and fragile countries (those that are generally susceptible to political instability and conflicts).

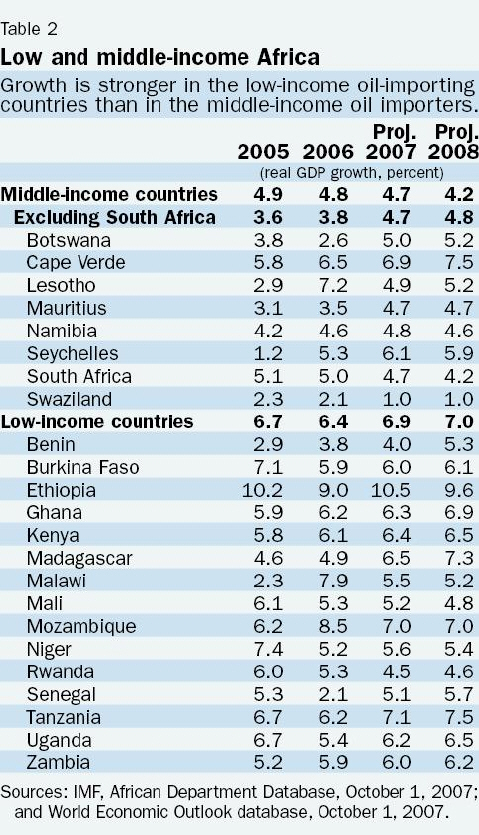

Growth in the oil exporters should accelerate to about 7½ percent in 2007 and is projected to rise to more than 10½ percent next year. (see Table 1). The middle-income countries should grow by slightly less than 5 percent this year, but growth is expected to slow in 2008.

The low-income countries are in line to grow by about 7 percent this year and next, fueled by agriculture and construction (see Table 2). The region's fragile countries should grow by about 5.5 percent next year, up from 3 percent this year (see Table 3).

SSA countries have kept inflation between 6 and 9 percent despite higher commodity prices. Average inflation is expected to drop further in oil-exporting countries, in part because of stabilization gains in Angola and Nigeria. In the middle-income countries, inflation is expected to accelerate to about 6½ percent this year but decline to 6 percent in 2008.

In most low-income countries, inflationary pressures are expected to ease further because of a more plentiful food supply, monetary policies that have helped check inflation expectations and the effects of higher oil prices, rising capital inflows that caused the nominal exchange rate to appreciate in some countries, and low bank financing of the budget deficit in most countries. In the fragile countries, average inflation remains high, albeit with large differences among countries.

Can SSA sustain the growth?

Sustaining growth, the REO says, is one of the region's primary challenges and depends on each country's ability to use higher income to accelerate socioeconomic development. This effort, in turn, will require continued structural and institutional reforms to increase productivity, strengthen countries' resilience to shocks, and create conditions that attract private investment to noncommodity sectors.

In the past, growth episodes in SSA have generally been shorter than in other regions and often ended with a dramatic collapse in output. The causes, says the REO, which is prepared in the IMF's African Department, are volatile terms of trade and other shocks and weak institutions. Historically, terms of trade changes have been significant drivers of growth in Africa.

In the current expansion, though, many oil exporters that have benefited from higher fuel prices have also saved more of the windfall and improved their policies, while many other countries have also continued to grow, even as their terms of trade have stagnated or deteriorated.

The strong growth in the region reflects the fruit of institutional improvements, structural reforms, and more rigorous economic policies that have started to bear fruit in many countries. The number of armed conflicts and the extent of political instability have also declined. Thanks to the region's better economic conditions and greater stability, investment is rising, economic growth is strengthening, and income volatility is falling.

Risks to the outlook

Although the REO describes an outlook of strong growth and reasonable inflation except in a handful of SSA countries, it notes that this outlook is clouded by some external and internal risks. The external risks stem from the possibility of a slowdown in the global economy, the internal mainly from weak policy implementation and the potential for security and political problems.

In particular, the REO states that if the prices of nonfuel commodities were to decline significantly and unexpectedly, the region's output could drop by about 1.5 percent. An unexpected rise in oil prices would worsen the current account and net foreign asset positions of oil-importing countries.

A few SSA countries have enjoyed strong portfolio inflows in recent years. A reversal of these flows would reduce external financing and hurt growth. So far, African markets, except South Africa, have shown little reaction to the recent turbulence in global financial markets, but this could change. Moreover, the repricing of risk might make it more difficult for African countries to raise funds in global markets or to privatize.

Medium-term priorities

The REO notes that some African countries are taking advantage of vigorous global growth and buoyant commodity markets, which create ripe conditions for reform. Still, it is unlikely that more than a handful of SSA countries will succeed in halving poverty by 2015. For many others, it is difficult to even evaluate their progress toward the Millennium Development Goals (MDGs) because statistics are so weak.

To reduce poverty faster and make progress toward reaching the other MDGs, African policymakers need to focus on several priorities: consolidating stabilization gains and reducing their vulnerabilities; improving infrastructure; reducing the costs of doing business, which are among the highest in the world, and boosting productivity; overcoming financing constraints, including increasing the access of businesses and households to formal bank financing and eliminating distortions in monetary and fiscal policy that discourage bank lending; and expanding trade and markets.

At the same time, donors must do more to deliver on their commitments. The doubling of aid to the region pledged at the G-8 summit at Gleneagles in 2005 is not on track, and debt-relief grants are likely to taper off.

Grants to the region, excluding Nigeria and South Africa, are projected to be 3 percent of GDP this year, with a slight rise to the low-income countries. Although official development assistance from the industrial countries has been broadly flat since 2003, emerging creditors, particularly China, are giving more, generally in the form of project assistance and export credits.