Remarks by John Lipsky, First Deputy Managing Director of the IMF, at the Federal Reserve Bank of Kansas City’s Annual Economic Symposium

August 22, 2008

in Jackson Hole, Wyoming

I am very pleased to have the opportunity to discuss this timely and thought-provoking paper. Its implications are particularly relevant, more than a year after the onset of the current financial turmoil. In particular, views remain divided on how economic activity is being affected, and how we can best ensure that lessons learned from this period help to strengthen our crisis prevention and management capabilities.

In their paper, Adrian and Shin present a compelling argument why banks and capital markets represent two sides of the same coin in market-based financial systems (Chart 1). They provide a clear explanation for the procyclicality of leverage for market-based financial intermediaries, and link the expansion and contraction of balance sheets of these intermediaries to several factors, including most importantly the Federal Reserve's short-term policy interest rate. They then draw links between the behavior of intermediaries' balance sheets and macroeconomic outcomes. They argue that changes in short-term policy rates have tended to accentuate fluctuations in these balance sheets, with faster balance sheet growth being followed by lower interest rates, and slower balance sheet growth followed by higher interest rates, except during crises. In this sense, monetary policy may have played a pro-cyclical role. Adrian and Shin argue that the potential for financial sector distress should be taken into account explicitly in a forward-looking manner in conducting monetary policy. This would imply leaning against the wind when leverage is rising rapidly during boom periods. One further conclusion they reach is that forward-looking communications by central banks can be counterproductive by excessively compressing uncertainty around the path of future interest rates. This could lead to excessive leverage building up in the financial system, which might then be reversed in a disorderly manner with harmful consequences to economic activity.

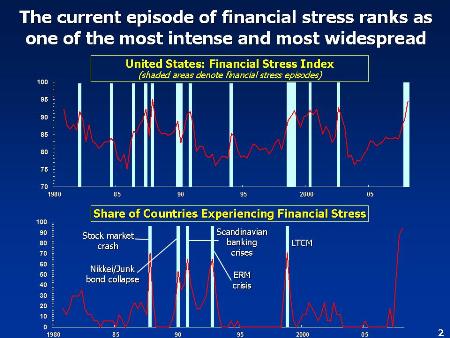

While Adrian and Shin focus on the United States, the same can be examined in an international context. After all, this episode of financial stress is truly global in nature, affecting both advanced and emerging market economies (Chart 2). Based on a cross-country "Financial Stress Index" we have developed, the current episode appears large by past U.S. standards-as seen in the upper panel of this chart-but in addition it has affected a larger share of advanced countries than any other episode since 1980, as shown in the lower panel. Given the global dimension of this crisis, and the importance of understanding the links between stress on financial systems and macroeconomic performance, we are looking at this issue in some detail. In fact, the lead analytical chapter of the October 2008 World Economic Outlook examines the interaction between financial stress and economic performance in a cross country context. Our upcoming Global Financial Stability Report also examines how disruptions in short-term money markets are affecting monetary transmission mechanisms.

Adrian and Shin's analysis complements our own work along several dimensions, and is consistent with some of our own findings, although I will also try to highlight some key differences as well. Adrian and Shin underscore the connection between financial intermediaries and markets by focusing on the "mark to market" practices of investment houses and the procyclicality of leverage for broker dealers in the United States.

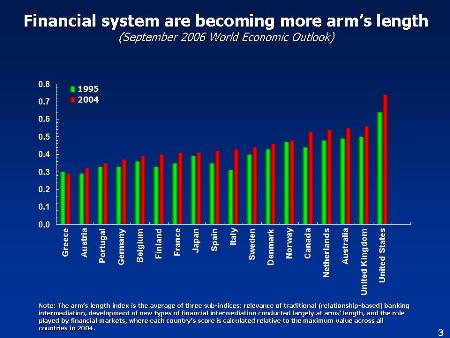

One potential criticism of this approach is that it may overstate the role of investment banks. I believe Adrian and Shin are right to emphasize the general point about the implications of a shift toward more market-based or arms' length intermediation, while also emphasizing that the distinction between broker dealers and commercial banks has become blurred. As a result, the financial system as a whole, both in the United States and to a somewhat lesser extent in other advanced economies, has moved toward greater reliance on arms' length intermediation and fee-generating activities, and away from relationship-based lending (Chart 3).

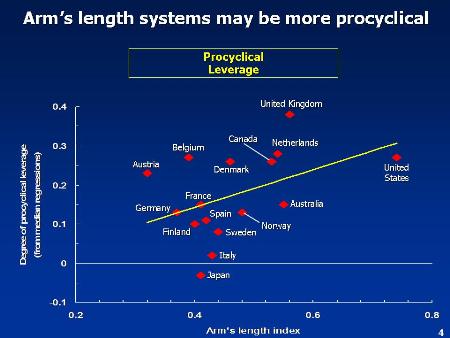

Thus, we find that the procyclicality of leverage that arms' length financial systems generate is a broader phenomenon across financial systems (Chart 4). We see this trend becoming increasingly prominent in a broad range of countries over time.

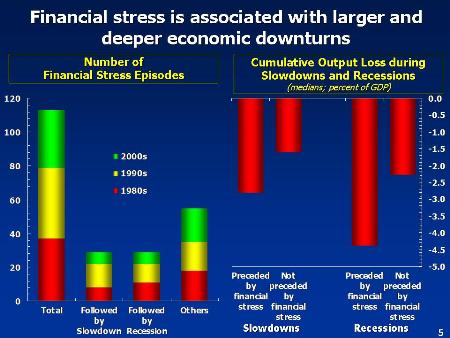

One could argue, as the authors themselves acknowledge, that the apparent economic impact of broker-dealer variables on macroeconomic performance may reflect the priors that underlie the specification, namely that the balance sheets of financial intermediaries they examine should matter for real economic growth. In this regard, controlling for endogeneity of the variables, and accounting for missing variables-such as the balance sheets of other institutions-remain areas for further exploration. Moreover, the estimated size of the impact itself appears quite small, as reflected in the coefficients. A broader analysis of the entire financial system's leverage may provide larger estimates. In fact, our own work supports the conclusion that financial stress has a substantial economic impact, even controlling for other factors that may affect the economy (Chart 5). As can be seen on the right panel, the cumulative output losses in both slowdowns and recessions are substantially higher when they are preceded by financial stress. Moreover, we find that even in financial systems that are more market-based, banks continue to play a very important role. Indeed, our analysis shows that banking-related financial distress on average has higher output costs than other types of financial stress, such as those restricted to securities markets or foreign exchange markets.

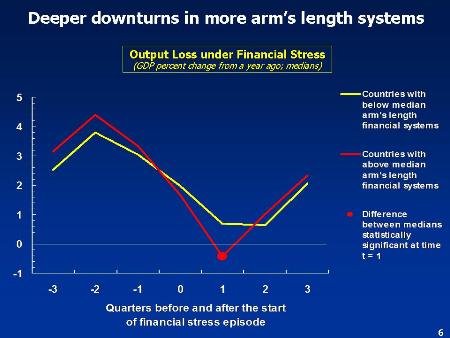

One implication of Adrian and Shin's paper is that the procyclicality of leverage in market-based systems amplifies the economic consequences of financial turmoil. Indeed, from a cross-country perspective, we find supporting evidence that arms' length financial systems appear to be more vulnerable to sharper downturns once a shock hits the system (Chart 6).

An important issue raised but not addressed by Adrian and Shin's paper is to what extent the economic impact of swings in the availability of credit depend on the initial conditions-in particular the balance sheets of households and firms that are the ultimate users of financial intermediation services. Moreover, other initial conditions-such as the build up of asset prices (including for housing) and credit-also could play a role in explaining the impact of a financial system shock on economic activity.

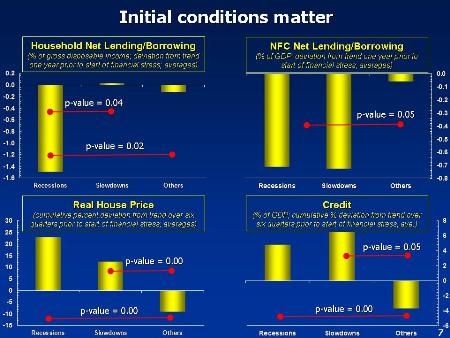

Our research indicates that initial conditions do matter. Specifically, we find three key results regarding the importance of initial conditions: First, both house prices and credit-to-GDP ratios tend to rise significantly faster during the upswing of the financial cycle in those stress episodes that eventually are followed by downturns (Chart 7). Second, episodes of financial stress followed by downturns tend to be characterized by non-financial firms being more heavily dependent on external sources of funding in the run up to the financial stress episode. A higher initial reliance on external funding makes firms more vulnerable to a downswing, setting the stage for a larger impact on the real economy as firms are forced to adjust their spending plans in the aftermath of financial stress. Third, periods of financial stress followed by recessions seems to be characterized by greater household sector reliance on external financing.

The policy implications of Adrian and Shin's paper are particularly interesting, and perhaps somewhat provocative. In particular, I would like to focus on three policy conclusions:

First is that the potential for financial distress should be explicitly taken into account in a forward-looking manner when conducting monetary policy. They argue that the most powerful tool in relaxing aggregate financing constraints is lowering the target policy interest rate. Since the financial system as a whole holds long-term, illiquid assets financed by short-term liabilities, lowering the short-term rate can raise the profitability of intermediation, and thus mitigate a sharp pullback in leverage that would have adverse macroeconomic consequences. Adrian and Shin support this claim by citing the timely reduction in target rates during the financial stress episode of 1998. Furthermore, their conceptual framework suggests that even if some financial institutions can adjust their balance sheets flexibly downward, there will be some who cannot-their so-called "pinch points" of the financial system. Therefore, acute financial stress, particularly that resulting from a sharp retraction in leverage, will show up somewhere in the system. In this regard, monetary policy and financial stability policies are linked.

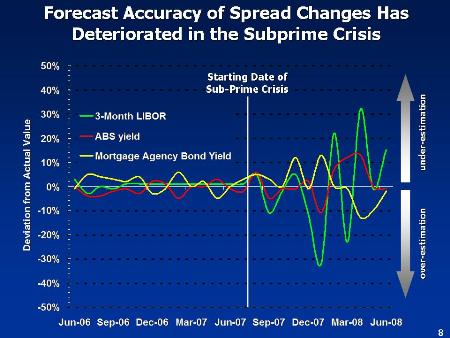

The work in our upcoming Global Financial Stability Report corroborates this conclusion. With a more arms-length financial system, instability in one market may be more easily transmitted to others, making the job of monetary policymakers more difficult. Chart 8 shows that changes in the spreads between the Fed Funds target rate and other rates become far less predictable during crises. Focusing in on the last two years, the elevated variance in the spread of Fed Funds rates to rates offered by near-banks-arguably the most leveraged institutions-is particularly dramatic, though so far the rates for end-users-households and corporates-have been less affected. The more bank-based financial system in Europe has also seen less volatility in the relation between the ECB's Euribor rate and other borrower rates.

I agree that monetary policy's possible role in contributing to booms and busts in leverage is an important issue. Indeed, there may be merit in explicitly leaning against the wind if leverage is rising unusually rapidly. However, the historical evidence suggests that there is a large structural component to rising leverage, as suggested by Figure 3 of their paper. As a practical matter, separating structural and cyclical trends would seem to be quite difficult. Therefore, I consider monetary policy to be a relatively imprecise instrument in this respect, and see greater merit in the use of macroprudential policies to reduce procyclical tendencies. In this regard, I agree with Adrian and Shin that a closer look at the role of risk-based capital requirements may be in order, and this should be high on policymakers' agenda.

Adrian and Shin stress two other policy implications. First, they make a case for the informational content of investment bank balance sheet variables for the conduct of monetary policy. While the money stock is a measure of the liabilities of deposit-taking banks, and may have been useful before the advent of the market-based financial system, this quantity will be of less relevance in financial systems such as that of the United States. Instead, they argue that measures of collateralized borrowing would be more useful, such as the weekly series on repos of primary dealers. My own take would be that central banks need to (and in many cases already do) monitor the broader trends in liquidity and leverage across the whole financial system.

Finally, Adrian and Shin argue that if central bank communication compresses the uncertainty around the path of future short rates, this would reduce the risk associated with taking on longer-term assets financed by short-term debt. If such a compression raises the potential for disorderly unwinding later in the expansion phase of the cycle, then this may not be desirable from the point of view of stabilizing real activity. Therefore, forward-looking guidance may compress volatility excessively and be counterproductive.

I would argue that in general, central bank transparency has delivered great benefits across a wide range of countries, and we should be careful in interpreting the findings of this paper as suggesting that central bank communication should be more ambiguous than at present. While excessive certainty about the future path of interest rates may contribute to greater than optimal build up in leverage, and the risk of a disorderly unwinding later, I think the real problem is one of incentives in the financial system. As a result, measures to prevent this build up in vulnerabilities perhaps should be designed more around regulatory policies aimed at aligning the incentives of market participants with sound approaches to risk management.

In sum, this paper makes an important contribution to the debate on the link between the financial sector and economic activity, as well as on the appropriate role of monetary and regulatory policies. A thorough debate is warranted on the changing linkages between markets, policies and economic outcomes as financial systems world-wide continue to evolve into more arms-length based systems.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6220 | Phone: | 202-623-7100 | |