Construction of light rail in Addis Ababa, Ethiopia. Development funding in low-income countries must be balanced with repayment capacity (photo: Yannick Tylle/Newscom)

Understanding Debt: A Better Tool for Low-Income Countries

October 2, 2017

The IMF and the World Bank are looking to update the framework for assessing debt-related risks in low income countries by mid-2018. The framework consists of a number of tools to help governments analyze risks and make sound decisions on how much debt to take up, including for public investment that can support development.

Here are some basics about the debt sustainability analysis the IMF and the World Bank plan to undertake.

Why is the issue of debt and its sustainability particularly pertinent for low-income economies?

Low-income countries have grown significantly over the last decade, but they still have considerable and crucial investment needs, which will need to be financed through borrowing from the rest of the world. The World Bank estimated that the infrastructure needs in Africa would be over $90 billion per year over the next decade, out of which only $45 billion is currently being met.

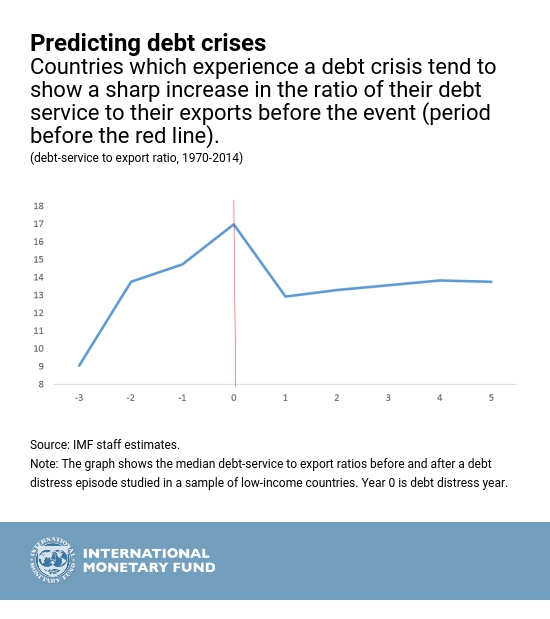

Investment can of course have a high return and pay for itself, but sometimes projects do not work out as expected, or a country can be hit by an external shock, creating a broader problem. That can make it difficult for a country to service its debt, which, in turn, can dwindle the availability and worsen the terms of new borrowing for the country. Such a situation, often referred to as debt distress, can in an extreme lead to default.

Because of the uncertainty, countries and creditors need to ensure a prudent pace of debt accumulation, in line with the growth the borrowing can generate, and a prudent structure of debt, to avoid vulnerabilities that shocks could expose. Sustainable and smooth growth goes hand in hand with sustainable debt.

What is the debt sustainability framework and why is it necessary?

The debt sustainability framework for low-income countries was introduced by the IMF and the World Bank in April 2005 to help guide countries in their borrowing decisions. The framework aims to give a balanced assessment because too little borrowing might unnecessarily restrict public investment, while letting debt grow too much might expose the country to a risk of debt distress.

To assess debt sustainability, the framework uses a number of indicators that have been important in predicting debt distress, such as the ratio of a country’s debt payments to its exports. Since countries have different capacities to handle debt—higher international reserves, for example, have been associated with greater resilience to shocks—the framework brings in these additional considerations to help assess risks. While the primary focus of the debt sustainability analysis has been on external debt (debt the country owes to the rest of the world), the framework also considers risks stemming from high levels of total public debt (debt owed by the government).

How have the previous analyses been useful?

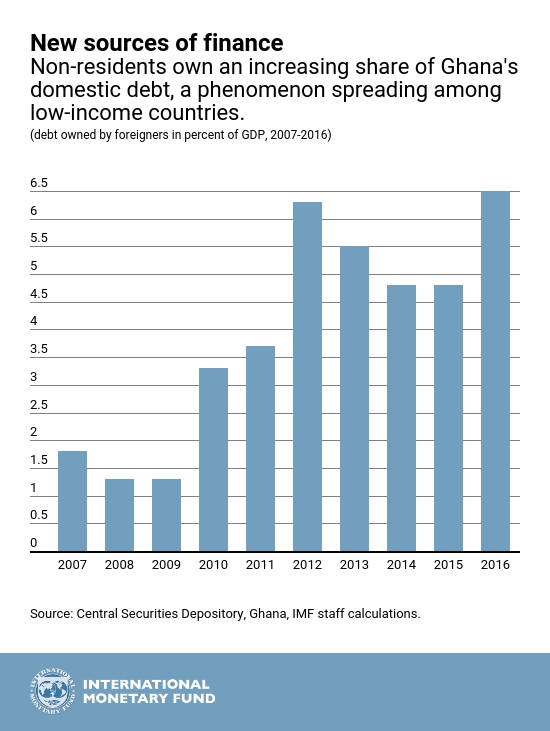

Debt sustainability assessments have provided valuable early warning signals that sustainability was at risk, for example, in Ghana. Our analyses presaged the country’s stress episode in 2012-14 by pointing to vulnerabilities from higher levels of unsubsidized borrowing, greater foreigners’ participation in the domestic debt market, and growing liquidity needs. Debt sustainability assessments similarly signaled the impending debt difficulties in Mongolia and Chad.

Why is the update to the framework needed?

The IMF reviews the debt sustainability framework periodically to keep up with developments in low-income countries.

This latest review needed to respond to the particular challenges posed by new kinds of financing risks in low-income countries: a wider range of creditors are participating in the financing of low-income countries, the share of low-income countries’ borrowing on commercial, non-subsidized terms has grown rapidly, and countries are increasingly taking up credit through tradable bonds. Many low-income countries have also seen more external investors participate in their domestic debt markets.

In addition, the adoption of the 2030 Development Agenda of the United Nations has focused attention on how countries can meet the Sustainable Development Goals. The IMF has stepped up its policy advice and capacity building in member states, focusing on domestic revenue mobilization and building resilience to shocks among other initiatives. Still with public investment plans expected to be more ambitious, and countries expected to take up major projects, it is now even more crucial for a stronger debt sustainability assessment tool to help ensure the solidity of state finances.

More complete, transparent, and simpler

The updated methodology keeps the structure of the current debt sustainability analysis but introduces some new features to make the debt sustainability evaluation more complete, more transparent, and simpler.

- More complete: new tools will help improve the accuracy of forecasts and ensure that key relationships, such as growth and fiscal adjustments or investment plans, are properly accounted for. Other tools have also been added to help countries assess risks related to specific scenarios such as natural disasters, commodity price volatility, contingent liabilities, and market shocks.

- More transparent: the new framework will use more information to assess countries’ ability to carry debt, and will provide clear guidance on how to consider factors not captured by the framework’s statistical models to ensure consistency across countries.

- Simpler: the new framework has been streamlined via the removal of redundant indicators.