Lab scientist in Cape Town, South Africa; the IMF study finds South Africa has one of the most gender-equal environments in the region (photo: Resolution Productions Blend Images/Newscom)

New IMF Study, Data Tool, Assess Fiscal Policies to Tackle Gender Inequality

July 28, 2016

- Spending and tax policies can promote fair treatment of men and women

- IMF study highlights how countries have adjusted fiscal policies to fight bias against women

- New IMF online database measures gender equality around the world

Related Links

The IMF project outlines the economic rationale for gender budgeting—the use of fiscal policy and administration to promote gender equality and girls’ and women’s development. An overview highlights successful gender budgeting practices, summarizes key country case studies, and offers fiscal policy implications. Six regional country surveys present case studies for countries where gender budgeting was undertaken.

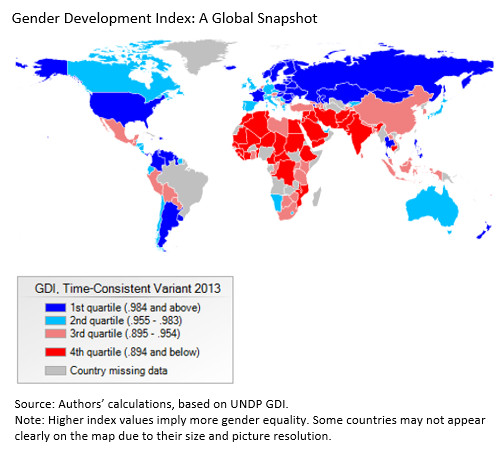

Researchers and students have free access to the online toolkit, which includes data on 60 case studies on gender budgeting efforts along with two time-consistent indices of gender equality, spanning 1990–2013 and covering most countries in the world (see map). The toolkit can be used to investigate the relationship between countries that have implemented policies to improve gender equality and the gender equality indices.

Gender inequality in economic opportunities persists worldwide, according to IMF research, which finds eliminating gender inequality can lead to faster economic growth, a higher quality of life, and women’s economic and political empowerment.

Promising results

The study finds that gender budgeting can promote gender equality through well-structured fiscal policies and adequate and properly monitored spending on gender-related goals. The specific policies vary, depending on a country’s level of development and fiscal structure. In some countries, gender budgeting has inspired fiscal policies in key areas of the budget, such as education, health, and infrastructure, that contributed to the achievement of gender-related goals; and improved systems of accountability for public spending for gender-related purposes.

Successful gender budgeting efforts share the following key characteristics, according to the study:

Gender budgeting goals are aligned with other national development plans. For developing countries, aligning the goals of gender budgeting efforts to national development plans (e.g., Rwanda and Uganda) helps ensure that gender-related objectives are clear and ambitious, and have support to be incorporated into budget policies and programs.

Ministries of finance play a critical role, as do parliaments and spending ministries. Gender budgeting efforts led to meaningful fiscal policy changes only when they had the support of the political center of fiscal decision making (e.g., Austria and Kerala state, India).

International organizations, civil society, and academic researchers provide crucial technical assistance and financial support. Civil society and academic researchers also play a supporting—and, at times, catalytic—role (e.g., Mexico and Tanzania).

Policies are underpinned by strong monitoring: Effective gender budgeting efforts rely on governments improving policies and programs over time, so monitoring progress is crucial (e.g., Rwanda).

Gender goals

In developing countries, gender budgeting efforts should continue to address key gender-related education and health goals as well as public infrastructure deficiencies, such as household access to clean water or electricity, that impose high unpaid work burdens on girls and women. Gender budgeting efforts can also contribute to improved administration of justice, law, and order, to help reduce violence against girls and women. And finally, gender budgeting can highlight the role that restructuring of income tax and indirect tax systems can play in the achievement of gender-related goals.

Strengthened commitment by fiscal policymakers and governmental bureaucracies to incorporating gender equality goals into fiscal policies and programs has the potential to reap large rewards for individual countries and the global economy.

The gender inequality indices were derived from modified approaches to two UNDP gender equality indices, using data from the World Bank’s gender data portal.

The project is part of a broader IMF program on macroeconomic policy in low-income countries, supported by the United Kingdom’s Department for International Development.

IMF staff will present the results of the study at an IMF conference on Fiscal Policies and Gender Equality on November 7, 2016.