Overview

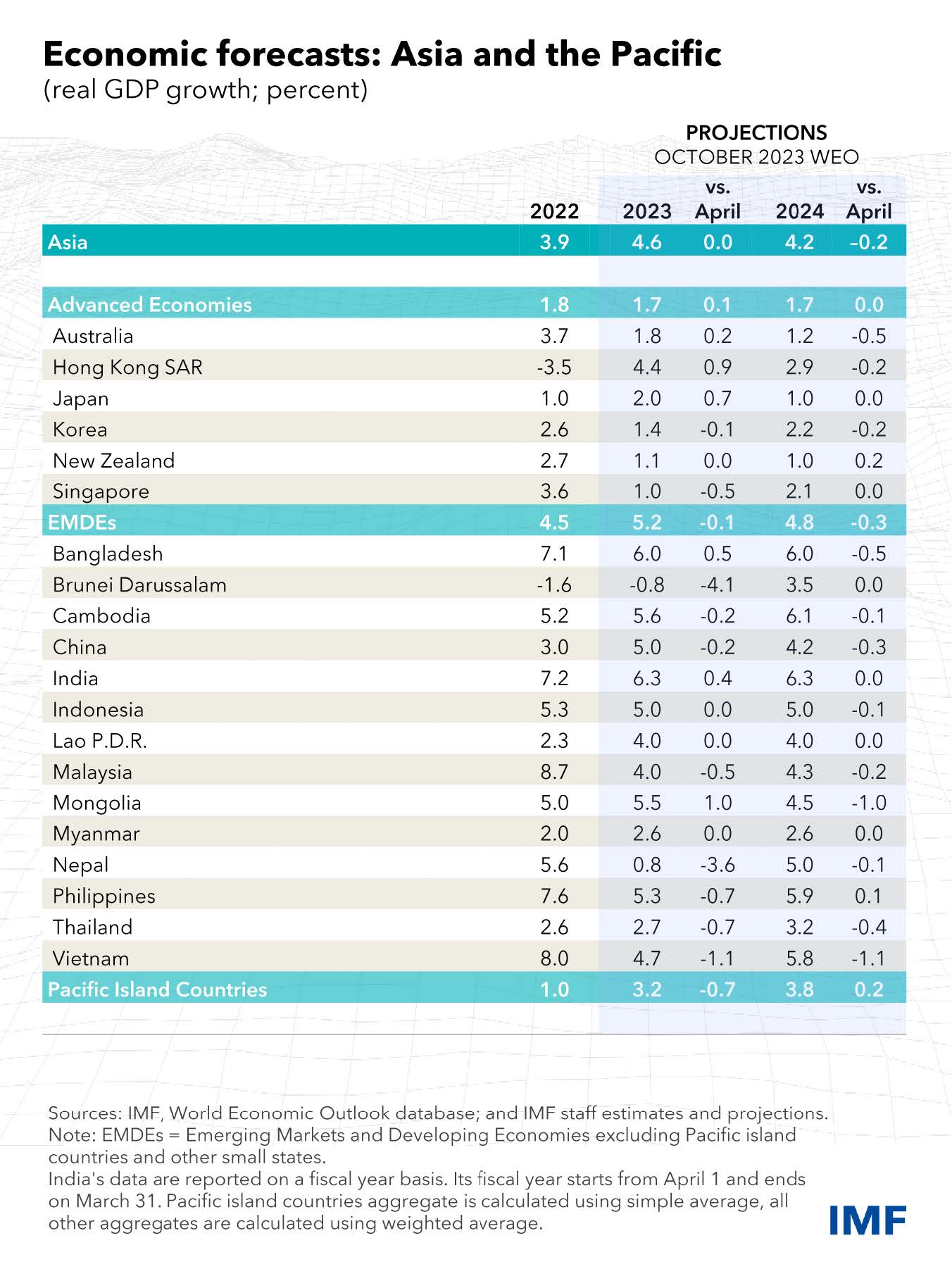

The Asia-Pacific region remains a key driver of global growth in 2023, despite facing headwinds from changing global demand from goods to services and tighter monetary policies. The region is expected to grow by 4.6 percent in 2023, up from 3.9 percent in 2022. However, growth is projected to slow to 4.2 percent in 2024 and 3.9 percent in the medium term, as China's structural slowdown (Chapter 3 explains) and lower productivity growth in many other economies dampen the region's potential. Inflation is expected to decline in 2024 and stay within central bank target ranges in most countries, a faster pace of disinflation than in other regions (Chapter 2 explains.) Risks to the outlook have become more balanced than they were six months ago, although they still lean to the downside.

Central banks should carry through with policies to ensure that inflation is durably at appropriate targets. Tight monetary policy should be complemented with careful financial supervision and modernized resolution frameworks to safeguard financial stability. Credible medium-term fiscal frameworks and consolidation can preserve fiscal space and debt sustainability. Structural measures should tackle risks posed by de-risking strategies across all of Asia while ensuring productivity growth, the green transition, and inclusive and sustained growth.

Press conference on Economic Outlook for Asia and Pacific (Marrakesh, Morocco, October 13, 2023)

Chapter 1: Outlook for Asia and the Pacific: Challenges to Sustaining Growth and Disinflation

Economic activity in Asia and the Pacific remains on track to contribute about two-thirds of global growth in 2023, despite a challenging environment shaped by the rotation of global demand from goods to services and synchronized monetary tightening. A weaker-than-expected recovery in China could have negative spillovers to its trading partners, while a sudden financial tightening in the US or within the region could inhibit growth, especially in highly leveraged economies and sectors. On the upside, a soft-landing scenario is becoming more plausible and would provide scope for monetary easing in 2024. Medium-term prospects are clouded by risks from geoeconomic fragmentation, with de-risking policies of major economies creating a potentially significant drag on growth. Comprehensive reforms in China would boost medium-term growth prospects, especially for smaller and more open economies.

Chapter 2: Recent Inflation Experiences in Asia and the Pacific

Inflation in Asia and the Pacific is expected to decline in 2024 and stay within central bank target ranges in most countries, a faster pace of disinflation than in other regions. This chapter explores the factors contributing to Asia’s lower inflation compared to other regions as well as the divergence in inflation within the region. The differences between regions reflect the ways inflationary shocks manifested. External shocks to food, fuel, and supply chains were important, but Asian economies generally felt these pressures less than elsewhere, partly because of the type of products and services dominant in their economies, and because of direct policies to restrict price increases. Pandemic responses set off a complex mix of demand and supply shocks that varied over time. Lockdowns were generally longer lasting in Asia-Pacific countries, dampening demand and inflation. Policy support during the pandemic varied across the region. However, recent fiscal and monetary policies have helped manage and reduce inflation rates.

Chapter 3: How Will Trend Growth in China Impact the Rest of Asia?

Major forces such as catching-up effects and demographics will partly determine China’s future growth, but key structural policy drivers, including domestic reform momentum and international geoeconomic developments, may alter this path significantly. Given China’s importance for the region, different paths may carry sizable spillovers for Asia. This chapter assesses the potential spillovers from an upside scenario of domestic reforms in China and a downside scenario from de-risking between China and Organisation for Economic Co-operation and Development (OECD) economies. Productivity-enhancing reforms in China can lift growth in Asia, especially in smaller and more open economies with strong global value chain links with China. Non-OECD Asian countries can benefit from the trade diversion effects of “friend-shoring” by both China and the OECD. However, those benefits largely dissipate once the global slowdown caused by friend-shoring trends and the “reshoring” dimension involved in de-risking strategies are considered.

Publications

-

March 2024

Finance & Development

-

ECONOMICS

How should it change?

-

September 2023

Annual Report

- COMMITTED TO COLLABORATION

-

Regional Economic Outlooks

- Latest Issues