Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : New Plan Sets Senegal On Course to Become Emerging Economy

December 24, 2014

- Senegal successfully completed latest IMF-supported program

- Economy underperforms on growth, employment, poverty

- New development strategy aims to make Senegal emerging economy by 2035

A new development plan designed to help Senegal exit a trap of low growth and high poverty can boost the economy if it is consistently implemented, the IMF staff said in its regular review of the West African country.

Basket vendor in Thies, Senegal—where reforms advocated by IMF include steps to improve business climate (photo: Morandi Bruno/ZUMAPRESS/Newscom)

ECONOMIC HEALTH CHECK

The plan presents a unique opportunity to unlock broad-based and inclusive growth that will make Senegal a regional hub and an emerging economy.

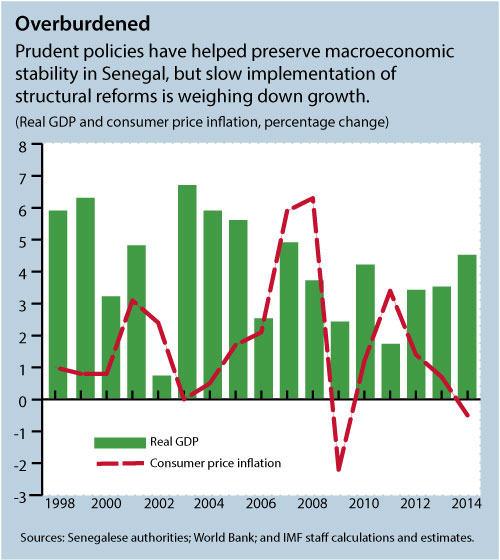

Senegal’s growth in recent years has been sluggish, which has hampered progress toward inclusiveness and poverty reduction. Prudent policies have helped preserve macroeconomic stability in Senegal, but slow implementation of structural reforms is weighing down growth.

A period of relatively strong, although still under-par, growth in 1995–2005 of 4.5 percent led to a substantial decline in poverty from 68 to 48 percent. However, in 2006–2013 growth decelerated to an average of 3.4 percent, reflecting a poor business climate, problems in the energy sector, poor infrastructure, low efficiency of public investment, and unproductive subsidies (see chart).

Series of shocks

In addition, Senegal was hit by a series of externally sourced shocks, such as spikes in food and fuel prices, the global financial crisis, regional droughts and floods, and more recently, the spillovers from the Ebola outbreak. As a result, poverty has declined only slightly in recent years and stands at about 47 percent.

The IMF staff report on Senegal’s economy projects that GDP growth can rise to 4.5 percent in 2014 and reach 7 percent by 2019. Consistent implementation of reforms set out in the new development plan, while preserving fiscal and debt sustainability, are key preconditions for such growth acceleration.

The authorities are taking steps in this direction. The fiscal outlook has improved owing to stronger revenue performance and expenditure control, and the overall deficit is expected to fall to about 5 percent of GDP in 2014. The 2015 budget targets a further reduction in the deficit to 4.7 percent of GDP.

The authorities expect to limit the deficit by holding back appropriations for new public investment projects until feasibility studies are ready. The authorities remain committed to bringing the fiscal deficit in line with the target set by the West African Economic and Monetary Union of 3 percent of GDP in the medium term.

The plan for the future

The “Plan Sénégal Emergent” is the authorities’ plan designed to help Senegal exit the trap of low growth and high poverty of recent years. It intends to make Senegal a hub for West Africa by achieving high rates of equitably shared growth. The plan is articulated around three pillars:

• Higher and sustainable growth through structural transformation;

• Human development and social protection; and

• Improved governance, peace, and security.

The plan envisages structural reforms to attract foreign investment and increase private investment. It also calls for constraining public consumption and increasing public savings to generate fiscal space for higher public investment in human capital and public infrastructure.

Priority will be given to making delivery of public services more efficient, improving the impact of public spending through public financial management reforms, containing public consumption to generate the fiscal space for investment in human capital and public infrastructure, and strengthening social safety nets.

Keep debt sustainable

While welcoming the authorities’ plan, the IMF recommended remaining vigilant and anchoring plan-related scaling up of public investment on long-term debt sustainability within a medium-term budget framework. Creating the fiscal space needed for the development plan will require further strengthening of tax and expenditure policy measures, in particular improved public investment efficiency.

All related investment should be consistent with the authorities’ earlier fiscal consolidation plans and Senegal’s absorptive capacity. Decisions to contract nonconcessional financing should be carefully weighed.

Also, IMF staff underscored that the plan’s success depends on structural reforms of public financing and a strengthening of budget institutions. Reforms in this important area should focus on key areas such as macro-fiscal policy design, development of a medium-term expenditure framework and improved fiscal discipline in budget execution.

Focus on farms

While Senegal’s export base is relatively well diversified, high-quality exports bear a comparatively low weight. Sectors where the quality of exported products is comparatively low, such as food and live animals, constitute a large share of exported products. With Senegal’s labor force concentrated in agriculture, policies fostering agricultural product quality may be useful to supplement foreign investment–driven export diversification.

Other areas of structural reform recommended by the IMF include further improvements in the business climate, governance, investment in human capital and public infrastructure, and strengthening social safety nets. A comprehensive restructuring of the energy sector and increasing export competitiveness will also be important.

Financial sector vulnerabilities, especially the quality of bank assets, should be addressed. Continued vigilance of the high level of nonperforming loans is also needed in close cooperation with the regional central bank, the Banque Centrale des Etats de l’Afrique de l’Ouest, and with the West African Economic and Monetary Union’s Banking Commission, as is better access to financial services.

Experience of peers

An IMF staff paper accompanying the main report reviews experience of other countries and suggests that Senegal’s ambition to rise to emerging economy status within the next two decades is achievable.

Between 1990 and 2013, about 40 countries across the world have achieved average growth in real purchasing power per capita GDP of 5 percent or more. Those that Senegal could emulate include Cape Verde, Guyana, Indonesia, Mauritius, Sri Lanka, Tunisia, Uganda, and Vietnam. Several African countries have already begun the journey traveled by the Asian tigers to move from low-income to middle-income emerging market status.

Experience of peers suggests that structural reforms could lift Senegal’s growth to 7 percent in the medium term, driven by foreign investment–generated exports.

The authorities have already engaged with a few comparator countries to develop an active peer learning effort to roll out the required reforms. A high-level brainstorming on “Transforming Senegal into a Middle-Income Economy” held at IMF headquarters in Washington, D.C. on December 15–17, 2014, was the first step in this direction.