A Ride in Rough Waters

Finance & Development, September 2016, Vol. 53, No. 3

Raju Huidrom, M. Ayhan Kose, and Franziska L. Ohnsorge

Emerging markets buoyed the world after the global financial crisis, but are now in a major slowdown

Emerging market economies were once conferred darling status. And seemingly rightly so. In the two decades after the mid-1980s, emerging markets, with their record-high growth, transformed the global economic landscape. Their resilience during the global financial crisis provided a much-needed anchor for the world economy. Emerging markets bounced back from the crisis when the majority of advanced economies went through historic recessions.

This striking story, however, has taken a somewhat different turn of late. Since 2010, growth in emerging market economies has slowed and, at 3.8 percent in 2015, is below its long-term average (see Chart 1). The current slowdown in emerging market economies is unusually synchronous and protracted and is comparable to earlier episodes of global turmoil. In particular, the current slowdown affects some of the largest emerging markets—the diverse group of countries dubbed BRICS (Brazil, Russia, India, China, and South Africa)—with India the notable exception. The slowdown reflects easing growth in China, persistent weakness in South Africa, and steep recessions in Russia since 2014 and in Brazil since 2015.

External and domestic as well as cyclical and structural factors have contributed to the slowdown in emerging markets. The growth slowdown, which began in 2011, was initially driven by external factors, such as weak world trade, low commodity prices, and tightening financial conditions. But since 2014 domestic factors—including a steady slowdown in productivity growth, bouts of policy uncertainty, and tighter government budgets that have made it difficult to stimulate economic activity—have become increasingly important. Decelerating potential growth—that is, the speed at which an economy could grow—accounts, on average, for one-third of the slowdown in emerging market growth since 2010. Much of the decline resulted from a slowdown in productivity growth, which, in part, reflects an aging population.

Widespread effects

The slowdown in major emerging markets could significantly hurt the rest of the world. An important reason is their size—these economies now account for a sizable share of global output and growth. During 2010–14, even though their economies were slowing, the BRICS accounted for about 40 percent of global growth, up from about 10 percent during the 1990s. They now represent more than one-fifth of global economic output—as much as the United States and more than the euro area. In 2000, they were responsible for about a tenth of global activity. China is by far the largest emerging market, twice as large as the other BRICS economies combined and two-thirds the size of the other emerging markets combined.

The rising importance of the BRICS in the global economy is also reflected in their increased participation in international trade and finance. In particular, cross-border economic links between BRICS and other emerging and frontier markets (those slightly less developed than emerging markets) have grown significantly since 2000 (World Bank, 2016). In addition to trade, the BRICS have begun to play a major role in a wide range of global financial flows—including foreign direct investment, banking and portfolio investment, remittances, and official development assistance. Furthermore, the BRICS—in particular China, and to a lesser extent India—are major sources of demand for key commodities. Slower growth in the BRICS could therefore affect other economies through trade and financial channels and through commodity prices.

We examine the extent of economic effects on other countries (or spillovers) from the current slowdown in the BRICS by looking at the size of global spillovers, the effect of individual BRICS on countries in their respective regions, and the implications of a slowdown that coincides with financial stress.

Global spillovers from the BRICS: We employ a set of simple economic models to quantify growth spillovers from the BRICS (Huidrom, Kose, and Ohnsorge, forthcoming). Our models trace the responses of growth in other economies to declines in growth in BRICS economies, after controlling for global activity and financing conditions and commodity prices. We use quarterly data from the second quarter of 1998 through the second quarter of 2015.

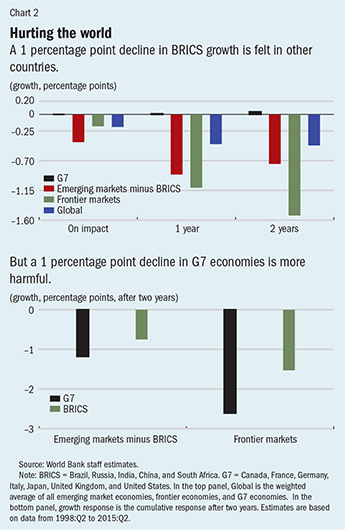

On average, a 1 percentage point decline in growth in the BRICS could, over the subsequent two years, reduce global growth by 0.4 percentage point, growth in non-BRICS emerging markets by 0.8 percentage point, and growth in frontier markets by 1.5 percentage points (see Chart 2, top panel). Specifically, between 2010 and 2015, the slowdown in the BRICS accounted for a sizable share of the growth slowdown in other emerging and frontier markets.

In contrast, the estimated impact on growth of the BRICS slowdown was on average negligible in the so-called Group of Seven (G7) countries—Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. This reflects both policy actions to fight economic slowdown taken by G7 countries and their net oil-importing status. G7 central banks tend to respond to external shocks, including those from the BRICS, with accommodative monetary policies to encourage spending. Furthermore, as net oil importers, G7 economies tend to benefit from the lower oil prices induced by a BRICS slowdown.

Sizable as they are, spillovers from the BRICS affect other emerging and frontier markets less than spillovers from major advanced markets (see Chart 2, bottom panel). Stronger spillovers from G7 economies reflect their larger economic size. While the BRICS account for one-fifth of global GDP, G7 economies account for almost half. In addition, G7 countries account for a larger share of global trade and play a central role in global finance. Financial flows can quickly transmit shocks originating in G7 economies around the world. Thus, despite the rise of the major emerging markets, advanced economies remain the dominant player in the global economic arena.

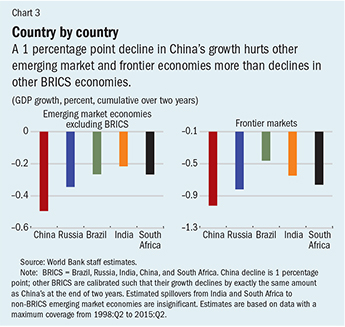

Spillovers from individual BRICS: The magnitude of spillovers varies across the BRICS, but those from China are the largest (see Chart 3). On average, a 1 percentage point decline in China’s growth could reduce growth in other emerging market economies by 0.5 percentage point and in frontier markets by 1 percentage point over two years. A similar shock in Russia would reduce growth in other emerging markets by 0.3 percentage point. Spillovers from Brazil to other emerging markets would be much smaller, and negligible to frontier markets. In general, estimated spillovers from India and South Africa to other emerging markets and frontier markets would be mostly negligible.

The difference in the magnitude and reach of spillovers from the individual BRICS reflects their size and integration. In current dollar terms, China’s economy is more than four times the size of the next largest BRICS economy (Brazil); its imports are six times the size of Russia’s; and its demand for key primary energy and metals is four to ten times that of India. The rapid rise in China’s participation in global trade since it joined the World Trade Organization in 2001 has increased its potential to generate global spillovers.

Commodity markets are a key avenue for transmission of spillovers from China to other emerging market and frontier economies. A growth slowdown in China, by reducing global commodity demand, could have adverse effects on commodity prices. As a result, growth in commodity exporters could slow by somewhat more than in commodity importers in response to a slowdown in China.

Despite the sizable spillovers from China, a simultaneous slowdown in the BRICS would have larger negative spillover effects than a slowdown in China alone and would deal a sharper blow to emerging market, frontier market, and global growth. Compared with China alone, these effects reflect the special role the broader group of BRICS plays. The BRICS include some of the largest and most regionally integrated emerging markets in their respective regions. Activity in trading partners of China that are also closely linked to BRICS in their region would face a double whammy.

Spillovers from individual BRICS within their respective regions: The BRICS drive much of the intraregional trade and are important sources of remittances from workers who migrate to the regional giant and send some of their earnings back home. As such, spillover effects from a growth slowdown in the BRICS could be particularly large within their respective regions:

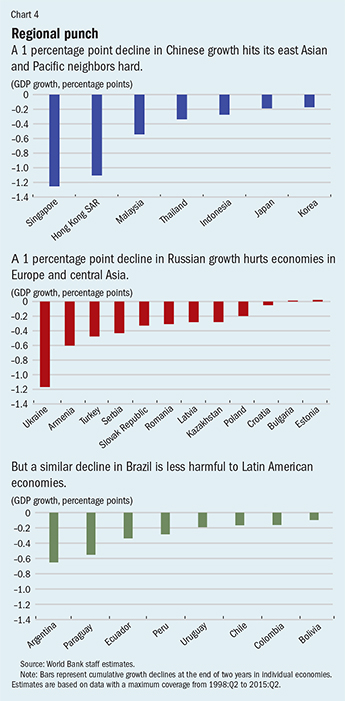

China: Spillovers from growth fluctuations in China are sizable and affect a wide range of economies in the east Asia and Pacific region. A one-time 1 percentage point decline in China’s growth is particularly harmful to growth in the trading hub of Singapore and in Hong Kong SAR (see Chart 4). Strong spillovers from China are transmitted primarily through trade channels: China is now the top trading partner of most major economies in the region.

Russia: In Europe and central Asia, there are strong regional trade and financial links, including through remittances, that are reflected in sizable spillovers from Russia. The estimates suggest that a 1 percentage point decline in Russian growth reduces growth in other countries in Europe and central Asia on average by 0.3 percentage point over two years (see Chart 4, middle panel). The estimated impact is larger in neighboring countries and countries in the South Caucasus.

Brazil: Spillovers from Brazil to neighboring countries in Latin America and the Caribbean are moderate. Growth declines in Brazil tend to have measurable or statistically significant spillovers in its South American neighbors (see Chart 4, bottom panel). Spillovers from Latin America’s main trading partners outside the region, however, tend to be considerably larger than those within the region.

India and South Africa: Within-region spillovers in south Asia are generally small. Its integration with the global economy is low, and integration within the region is even more limited. Although within-region spillovers in sub-Saharan Africa are generally small, South Africa can significantly affect immediate neighbors that are tightly integrated through currency and customs unions.

In other words, the potency of spillovers varies across regions. In some, strong regional trade and financial links are reflected in sizable spillovers—for example, in Europe and central Asia from lower growth in Russia and in east Asia and the Pacific from a slowdown in China. Spillovers from Brazil, India, and South Africa to other economies within their respective regions are generally insignificant. For many countries, spillovers originating in distant major advanced economies overshadow within-region spillovers from their large emerging market neighbors.

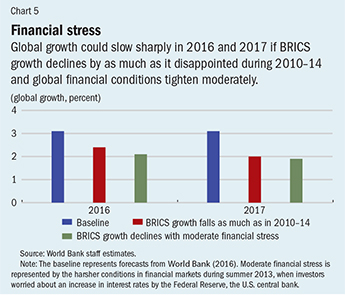

Financial stress and the BRICS slowdown: Slower-than-expected growth in the BRICS could coincide with bouts of global financial market volatility. Even though any interest rate increases from the Federal Reserve are expected to proceed smoothly, have long been anticipated, and are associated with a robust U.S. economy, they nonetheless carry significant risk of financial market turmoil. Investor sentiment could deteriorate sharply on weakening emerging and frontier market growth prospects. As a result, risk spreads for emerging and frontier market assets could widen steeply and raise overall financing costs for those markets, further dampening growth.

A synchronous slowdown in the economies of the BRICS could have much more pronounced spillover effects if it is accompanied by such financial market stress. If BRICS growth slows further, by as much as it disappointed on average during 2010–14, and if financial conditions tighten moderately—as during summer 2013, when financial markets were upset by potential Federal Reserve tightening of monetary policy—global growth could shrink by about a third in 2016 (see Chart 5).

Mitigating spillovers

If the largest emerging markets sneeze, the rest of the world could catch a cold. The current slowdown in major emerging market economies could spill over significantly to the rest of the world through trade and financial channels given those economies’ size and connection to the global economy. The spillovers would be more pronounced in a slowdown accompanied by financial market stress.

Policymakers must be ready to counteract painful spillovers from the slowdown in the largest emerging market economies. The appropriate policy response depends on country-specific features and the nature of the shock and spillovers: a cyclical downturn in the BRICS would generate temporary harm that could be mitigated by countercyclical fiscal and monetary policies such as spending increases and interest rate cuts.

A structural downturn in potential BRICS growth would require more permanent reforms. Because the recent slowdown in the BRICS was partly cyclical and partly structural, both countercyclical fiscal or monetary policy and structural reforms—in the BRICS and in other countries—could support activity. A fresh structural reform push focused on governance and labor and product markets could help lift growth prospects. ■

Raju Huidrom is an Economist, M. Ayhan Kose is a Director, and Franziska L. Ohnsorge is a Lead Economist, all in the Prospects Group of the Development Economics Vice Presidency of the World Bank.

References

Huidrom, Raju, M. Ayhan Kose, and Franziska Ohnsorge, forthcoming, “Growth Spillovers from the Major Emerging Markets,” World Bank Working Paper (Washington).

World Bank, 2016, Global Economic Prospects (Washington, January).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.