Watching the Tide

Finance & Development, September 2015, Vol. 52, No. 3

Latin America appears better prepared to handle capital outflows than in the past, but its resilience might soon be tested

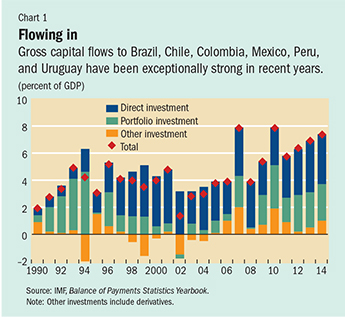

Since 2009, foreign investors have sent a massive $1.7 trillion to the six Latin American economies that are financially integrated with the rest of the world—Brazil, Chile, Colombia, Mexico, Peru, and Uruguay. Foreign purchases of bonds, equities, and other securities—or portfolio investment—alone accounted for about $640 billion.

These capital inflows were significantly higher than the average over the previous decade, even in relation to GDP. And portfolio investment of similar magnitude has not been seen since the early 1990s (see Chart 1).

The recent strong flows to Latin America reflect a global pattern of capital going from advanced to emerging market economies. Many advanced economies have been stuck at low growth and near-zero interest rates since the global financial crisis, prompting investors to look elsewhere for opportunities. As a result, there has been sustained diversification into assets of emerging markets, where growth and interest rates were higher and overall economic conditions appeared more robust.

A mixed bag

This influx of foreign investment has its benefits. Foreign credit may provide recipient countries with critically needed funding for investment or permit a smoother path for consumption than would otherwise be possible. The recent large inflows have also allowed Latin American governments and firms to lower their interest bill by issuing bonds with lower rates and longer maturities. And to the extent that foreign investors take a stake in the domestic economy—and domestic investors simultaneously invest abroad—they effectively start sharing risk, which can help countries that depend heavily on the fortunes of a particular sector, such as commodities in many South American economies.

However, the strong inflows also have potential downsides. Many observers believe that the recent capital inflows could be followed by large-scale, disruptive outflows. Historically, flows into Latin American bond and equity markets have been especially volatile, creating exuberant conditions during good times, but suddenly stopping or even reversing when investor sentiment changes. Past capital outflows have been triggered by such developments as increases in interest rates in advanced economies, rising risk aversion in global financial markets, and bad economic news from within emerging market economies.

It is easy to see why there are concerns about possible outflow pressures in Latin America today. U.S. interest rates are expected to rise; geopolitical risks remain significant; and the prospects for the region remain relatively dim following the recent plunge in commodity prices and sharp slowdown in economic growth.

In addition, history continues to cast its shadow. During the 1980s, 1990s, and early 2000s, Latin America suffered a series of economic and financial crises triggered by sudden stops in capital inflows. A prominent example is Mexico’s “tequila crisis” of 1994–95, when the peso depreciated sharply and growth collapsed after a period of strong capital inflows suddenly gave way to capital flight. Only a few years later, Brazil (in 1998–99) and Argentina (in 2001) suffered similar currency crises. Memories of these and other crises remain alive in Latin America, reinforcing unease over large swings in capital flows.

Increased resilience

And yet the region has come a long way since the 1990s. All of the financially integrated economies today have floating exchange rates, marking a clear break with a history of currency pegs that tended to collapse during bouts of capital outflows. Today, when foreign capital leaves these economies, currencies are allowed to depreciate. Like a plant that bends, rather than breaks, in a storm, this provides resilience. Indeed, weaker exchange rates can help stabilize demand for domestic assets. Compare that with the historical experience of central banks trying to defend pegged (and overvalued) exchange rates by selling foreign exchange reserves. Such defenses can go on for some time, but central banks eventually risk depleting their reserves, leaving them no choice but to accept a disruptive steep devaluation.

Remarkably, although flexible exchange rates have reduced the need for foreign exchange market intervention, central banks’ reserve buffers have grown substantially over the past 10 to 15 years. In almost all of the financially integrated economies, reserves now are large enough to cover more than a full year of external debt service. Buffers of that size—reserve holdings in Brazil and Mexico alone add up to $550 billion—provide reassurance that central banks can intervene to smooth exchange rate movements when necessary, without running out of reserves quickly.

But Latin American countries have gone even further to build resilience. One of the most striking developments is the dedollarization of government debt. As recently as 2000, governments in the region issued most of their debt in U.S. dollars. Doing so was often the only option available, as investors would not have bought debt denominated in domestic currencies that were marred by bouts of high inflation. However, the foreign currency liabilities of governments could wreak havoc on public finances whenever the U.S. dollar appreciated sharply, because the cost of repaying that debt surged. As a result, Latin American central banks have worked hard to establish more credible monetary policy regimes and anchor inflation at low rates. And as investors’ trust has grown, governments have been able to issue increasing amounts of bonds in domestic currency. With these bonds, the currency risk is effectively borne by (foreign) investors, rather than Latin American governments.

Potential pressure points

Still, balance sheet vulnerabilities have not disappeared; instead, the corporate sector may have become the principal source of risks. In recent years, Latin American firms have taken advantage of favorable market conditions to issue large amounts of foreign currency bonds. Although some of these bonds have replaced bank loans, overall corporate indebtedness in the region has gone up (Rodrigues and others, 2015). Some firms with particularly high debt may feel the pinch now that weaker economic growth weighs on their earnings. To make matters worse, a sudden rise of the U.S. dollar could cause corporate debt burdens to soar. Thus far, there is little evidence of significant financial pressure on Latin American firms, despite the dollar’s recent strength. Country authorities also point out that firms typically protect against exchange rate movements—by owning dollar-denominated assets, making financial hedges, or earning foreign revenue. Nonetheless, corporate currency exposures must be monitored, and managed carefully.

Moreover, capital outflows could still make life more complicated for Latin American governments, even though they have much less dollar-denominated debt. The reason is the very success governments have had in attracting foreign bond buyers. In Mexico, nearly 40 percent of domestic currency government bonds are held by nonresidents, up from 20 percent at the end of 2010 (see Chart 2). Foreigners have also purchased large amounts of Colombia’s domestic bonds since their weight in several global benchmark indices was increased last year. Given the size of foreign holdings in some Latin American bond markets today, trading conditions could become very volatile, and interest rates could rise sharply, if many international investors attempted to pull out at once. This underscores the benefits of establishing deep markets with a diversified investor base (IMF, 2014a).

To further gauge the region’s vulnerability to capital outflows, it is instructive to examine how the large inflows of recent years have been used. As Chart 3 shows, from 2009 until 2012, the first four years of the latest inflow episode, there was a more favorable pattern than during the inflow boom of the early 1990s, which ended with Mexico’s tequila crisis. In particular, the inflows from 2009 to 2012

● Were more heavily geared toward foreign direct investment, which gives investors a management stake. Such direct investment has proved to be less prone to reversals than portfolio inflows.

● Were not used primarily to finance current account deficits, which shows that some of the foreign capital was saved, rather than spent.

● Coincided with a rise in official reserve buffers and sizable purchases of foreign assets by domestic investors. Both represent a buildup of external wealth that in principle can be drawn down to smooth future capital outflows. For official reserves, this buffer function is obvious. But studies have shown that privately held foreign assets can have a similar effect (Adler, Djigbenou, and Sosa, 2014; IMF, 2014c). For example, during the global financial crisis, as foreign investors withdrew money from Latin America, some domestic investors sold their foreign assets (at favorable exchange rates) and repatriated the proceeds. In the process, they helped stabilize their countries’ financial accounts.

These facts may be comforting, but the concern is that trends worsened during 2013 and 2014. Portfolio investment has edged up and current account deficits have increased, while the buildup of reserves has slowed. Consequently, vulnerability to outflows may have grown.

Fundamentals matter

What can policymakers do to mitigate the risks? It is important to recognize that in countries with open capital markets (in which investors may move funds in and out of a country with minimal restrictions) there is no absolute insurance against episodic large outflows. As seen at the height of the global financial crisis, there are times when foreign investors retrench almost indiscriminately. Most of the time, however, economic fundamentals do matter. Specifically, countries with solid fiscal and external balances, low inflation, sound banking systems, and more credible policy institutions tend to fare better when markets discriminate—as they ultimately did again, for instance, during the “taper tantrum” of mid-2013, when the U.S. Federal Reserve indicated it was considering phasing out its program of large-scale bond purchases (IMF, 2014b). Investors fretted that an end to the program would raise U.S. interest rates and make emerging market investments less attractive.

Dealing with episodic outflow pressures, in turn, is easier when flexible exchange rates help with the adjustment. This requires domestic balance sheets to be robust enough to withstand a depreciation of the currency. Accordingly, policymakers should stay focused on preventing excessive buildup of open currency positions in private companies. Even then, adequate official reserves will be important to allow the authorities to intervene occasionally to stabilize their currency when trading conditions turn disorderly.

In the words of noted U.S. investor Warren Buffett, “Only when the tide goes out, do you discover who’s been swimming naked.” With sound macroeconomic policies and a vigilant eye on balance sheet risks, Latin American policymakers should be able to avoid overly awkward moments. ■

References

Adler, Gustavo, Marie-Louise Djigbenou, and Sebastian Sosa, 2014, “Global Financial Shocks and Foreign Asset Repatriation: Do Local Investors Play a Stabilizing Role?” IMF Working Paper 14/60 (Washington: International Monetary Fund).

International Monetary Fund (IMF), 2014a, Global Financial Stability Report, Chapter 2 (Washington, April).

———, 2014b, Regional Economic Outlook Western Hemisphere, Chapter 3 (Washington, April).

———, 2014c, World Economic Outlook, Chapter 4 (Washington, October).

Rodrigues Bastos, Fabiano, Herman Kamil, and Bennett Sutton, 2015, “Corporate Financing Trends and Balance Sheet Risks in Latin America: Taking Stock of ‘The Bon(d)anza,’” IMF Working Paper 15/10 (Washington: International Monetary Fund).