Strength in Lending

Finance & Development, September 2013, Vol. 50, No. 3

Tümer Kapan and Camelia Minoiu

Strong balance sheets help banks sustain credit to the economy during crises

Perhaps the most enduring legacy of the recent global financial crisis is a wave of financial re-regulation efforts that repeal old rules and implement new ones.

Many of the newly proposed rules, often still in the proposal stage, are rooted in a widespread concern that before the crisis, banks in developed economies appeared healthy when assessed on the basis of the indicators that were then part of the regulatory framework. For example, most banks had more than enough capital—which serves as the buffer that absorbs a financial institution’s losses to prevent it from failing—to meet the old regulatory standard. This gave the impression that the banking system would be able to withstand an unfavorable turn in the economic environment, which events proved to be false.

The financial crisis forced many banks with seemingly strong balance sheets into bankruptcy, takeovers, or government bailouts. As uncertainty rose and consumers reduced their demand for goods and services, the banking system curtailed the amount of credit it would grant. Because businesses require credit to operate and grow, their inability to borrow exacerbated the economic downturn that was caused by the global financial crisis.

If standard monitors of bank health, such as regulatory capital, did not sound alarm bells before the crisis, does that mean that policymakers, supervisors, and economists were monitoring the wrong indicators? If so, what should they have been looking at? What should be the new regulatory definitions for a strong bank balance sheet? To shed light on these questions, we looked at some of the new regulatory proposals, many of which are embodied in the so-called Basel III regulatory framework that was proposed in 2010 by an international committee of banking supervisors (BCBS, 2010). We then linked several measures of bank health to banks’ lending behavior during the recent financial crisis.

A new stance

The Basel III framework takes a new stance on how to diagnose bank health. It revises the old definitions of bank capital and proposes new soundness indicators, especially those that reflect a bank’s liquidity position—that is, a bank’s ability to come up with cash quickly. The regulators’ hope is that next time a negative shock affects the financial system, banks will be much more resilient. That means that their intermediation function—to transform depositors’ savings into credit to businesses and other borrowers—would be less impaired. The result would be economic downturns that are shorter and less painful.

There is heated debate in academic and policy circles over whether the steps proposed in Basel III are the right ones (for example, see Hanson, Kashyap, and Stein, 2011; and Blundell-Wignall and Atkinson, 2010). Ideally, economists and regulators would like to know whether banks would have better withstood the recent crisis if the new Basel III regulations had been in place. Unfortunately, a confident answer to this question is elusive because it involves assessing something that did not happen—what economists call a counterfactual.

A more modest question that we can ask, though, and one to which we can provide an answer is whether assessing precrisis bank health through the lens of the new Basel III regulations can help distinguish between banks that were better able to maintain credit to the economy and those that were not. We recently explored the link between bank health measures prevalent before the crisis and the supply of bank credit during the crisis (Kapan and Minoiu, 2013).

The Basel III framework tackles many facets of a bank’s operations, but to assess a bank’s strength we focus on the new regulatory standards for capital and liquidity, reviewing several measures of bank health that are under scrutiny by regulators and that capture the degree of a bank’s vulnerability (or resilience) to the 2007–08 financial market turmoil. Our goal is to link these measures empirically to the supply of bank loans during the recent crisis.

We examine two aspects of liquidity—the stability of a bank’s funding sources and the market liquidity of the assets it holds. It is widely acknowledged that traditional deposits are a more stable funding source than are funds obtained through borrowing in the market. Such wholesale funds, as they are called, can evaporate quickly when markets come under stress and lenders either stop making new loans or refuse to renew old ones (Ivashina and Scharfstein, 2010). Wholesale funds were not regulated under Basel II.

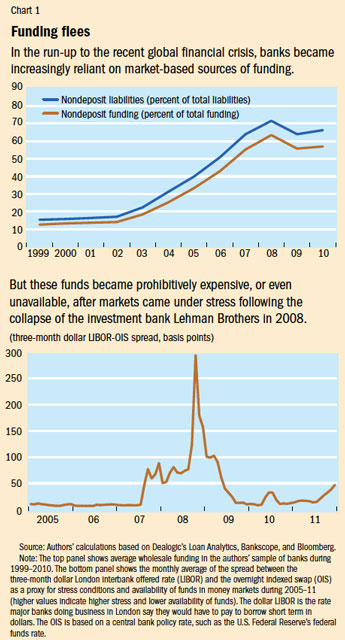

This suggests that one measure of a bank’s vulnerability to financial market shocks is the amount of its nondeposit liabilities (expressed as a share of total liabilities)—a rough measure of the bank’s dependence on market-based funding. Prior to the global financial crisis, banks became increasingly dependent on wholesale funding (see Chart 1, top panel) and, hence, increasingly vulnerable to a sudden rise in the cost or availability of funding, as happened during 2007–08 (see Chart 1 bottom panel). Our first measure of bank balance sheet strength is its reliance on sources of funding other than deposits.

Resilience to turmoil

In the Basel III framework, one way to assess banks’ resilience to periods of turmoil in funding markets is the net stable funding ratio (NSFR), a sophisticated measure of liquidity that combines elements from the asset and liability sides of a bank’s balance sheet. This is our second measure of bank health. The NSFR gauges the stability of a bank’s funding sources not in general terms, like the earlier measure, but in relation to the market liquidity profile of its assets. For instance, a bank that holds lots of highly liquid securities (those that can be easily converted to cash) can rely more heavily on market funds because during times of stress it can easily get the cash it may need. However, a bank whose assets are mostly illiquid (such as term loans and complex securities) should rely more on deposits than on volatile market funds. As an indicator of balance sheet soundness, the NSFR can alert regulators to a potential buildup of vulnerabilities in the banking system that stems from the market liquidity of banks’ assets and the funding liquidity of their liabilities.

The third measure of balance sheet strength we consider relates to a bank’s capital—especially the so-called capital ratio, which measures the amount of capital relative to the value of a bank’s assets. The higher the ratio, the more resilient the bank should be—that is, the better able to continue making loans and the less likely to fail.

Regulators have always considered the most fundamental form of bank capital to be shareholders’ equity, the funds that stockholders (the ultimate owners of the bank) have invested and that can be used to offset losses. However, Basel II was permissive in defining regulatory capital. For example, it allowed banks to count goodwill, a somewhat nebulous concept that is the difference between a bank’s value on the books and what would be obtained if the bank were sold. High estimates of goodwill inflate a bank’s capital and, hence, the numerator of the capital ratio, but goodwill cannot be used to write off losses. Regulators also tried to assess the potential losses a bank would face if it had to sell an asset and weighted those assets to reflect any losses expected to be incurred during times of stress. But Basel II was permissive here too. Just as the value of capital could be inflated, so could the denominator of the ratio by underestimating the riskiness of the assets—for example, by treating some assets, such as securities with a triple-A rating, as riskless, something the crisis proved to be untrue.

Basel III reforms capital regulation in two major ways. While it does not abandon the risk-weighting approach, it redefines the risks associated with different types of assets by taking into account their behavior during the global financial crisis. Furthermore, fewer capital instruments now qualify for the numerator of the ratio, and components that earlier could artificially inflate the capital ratio, such as goodwill, have been removed. Basel III proposes not only to clean up the definition of capital by restricting it to capital instruments that have a high ability to absorb losses, but also to raise the minimum required level, which enables banks to better withstand large financial shocks. Basel III also introduces a very simple measure of capital adequacy—often referred to as the simple leverage ratio—that is, the inverse of the share of shareholders’ equity to total (non-risk-weighted) assets. This measure refers only to high-quality capital and is free from the complications associated with weighting assets according to their riskiness.

In our analysis, we used both traditional and new capital ratios, spanning different capacities for loss absorption relative to unweighted or risk-weighted assets.

To examine the relationship between the strength of a bank’s balance sheet and bank credit, we gathered lending and balance sheet information for a large number of banks operating in the syndicated loan market. Syndicated loans—those made by groups of banks to firms and governments—represent a significant source of cross-border funding, especially for borrowers in emerging market countries. Our data set comprises 800 banks from 55 countries that extended loans to firms and public agencies in 48 countries during 2006–10. We aggregated lending to individual borrowers at the country-specific industry level. Examples of country-specific industries in our data set are metal and steel for Germany, construction and building for Spain, telecommunications for Turkey, and health care for the United States.

Before and after

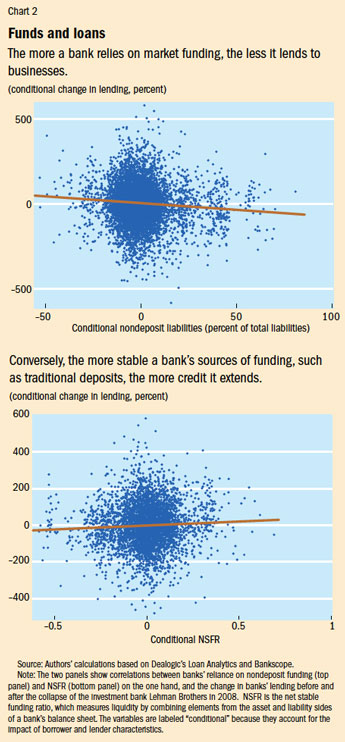

We focused on the change in bank credit before and after the 2008 collapse of the investment bank Lehman Brothers, the event that is widely perceived as the most important trigger of the global financial crisis. Specifically, we compared, for each country-specific industry, the change in loan amounts received from a number of banks with varying degrees of reliance on wholesale funding. This approach allowed us to account for the fact that borrowers may have reduced their demand for bank credit at the same time that banks were reducing the supply of loans. We found that banks that were less reliant on wholesale funding, and therefore less vulnerable to the financial sector shocks of 2007–08, managed to maintain the supply of credit better than other banks (see Chart 2, top panel). Specifically, we found that a 1 percentage point increase in the share of nondeposit funding led to a decrease in the supply of syndicated credit by between 0.7 and 0.9 percent.

A similar pattern emerged when we investigated the relationship of NSFR with the supply of bank credit: banks with a higher NSFR before the crisis—that is, banks with more stable funding sources—had a higher growth rate of bank loans during the crisis (see Chart 2, bottom panel). We found that each percent increase in the NSFR increased lending by close to half a percent during the crisis.

We also found that the negative link between dependence on market funding and the supply of loans is weaker for well-capitalized banks. Banks that were more vulnerable to liquidity shocks reduced credit supply less than other banks if they had more capital in the form of shareholders’ equity relative to total assets—that is, more of the highest-quality capital.

We estimated that every percentage point increase in the ratio of nondeposit funding to total funding reduced the supply of credit by 0.7 to 0.8 percent. But that reduction was partially offset if a bank had a higher level of quality capital. The capital of the average bank in the sample was 6.9 percent of assets. For each percentage point increase above that the adverse effect on credit was reduced by 10 percent. This suggests that capital plays a bigger role than safeguarding banks against failure. Rather, among banks that survived the recent financial crisis, those that were better capitalized before the crisis also continued lending to businesses. Importantly, this mitigating effect of capital is present only when capital is measured with variables closest to the Basel III definition (such as the simple leverage ratio) and not when the measures of regulatory capital are based on the Basel II definition.

Our finding that bank capital played a mitigating role in the transmission of financial sector shocks to the real economy helps put in perspective the recent debate on the costs and benefits of banking regulation. In particular, many argue that the new regulatory requirements, including those on capital, will hurt banks’ intermediation function, reducing their ability to extend credit. Were that the case, the new requirements could have a perverse economic effect by slowing the recovery. But our analysis suggests that a credit crunch is less severe when the banking system is well capitalized. As a result, the regulations may be costly during normal times, but they can pay off during crises, much as insurance contracts do.

The next crisis

The recent global financial crisis showed that assessing the financial soundness of banks and their resilience to economic shocks is not a simple matter. In the aftermath of the crisis, to better monitor and supervise the banking system, regulatory efforts are focusing on rethinking the definition of a strong bank. However, the efficacy of the newly proposed measures of bank health will remain unproved until the next financial crisis.

We have examined the link between bank balance sheet strength and the supply of bank loans during a crisis through the prism of both old and new measures. We found that the measures proposed in the Basel III framework for bank regulation are helpful in distinguishing the healthier banks—those that maintained lending to businesses after the 2007–08 financial turmoil—from the less healthy ones, namely, those that curtailed lending. This gives us confidence in the new regulations’ ability to create a safer and more resilient banking system. ■

Tümer Kapan is a Portfolio Risk Manager at Fannie Mae, and Camelia Minoiu is an Economist in the IMF’s Research Department.

References

Basel Committee on Banking Supervision (BCBS), 2010, Basel III: International Framework for Liquidity Risk Measurement, Standards and Monitoring, BIS Report (December).

Blundell-Wignall, Adrian, and Paul Atkinson, 2010, “Thinking beyond Basel III: Necessary Solutions for Capital and Liquidity,” OECD Journal: Financial Market Trends, Vol. 2010, No. 1, pp. 1–23.

Kapan, Tümer, and Camelia Minoiu, 2013, “Balance Sheet Strength and Bank Lending during the Global Financial Crisis,” IMF Working Paper 13/102 (Washington: International Monetary Fund).

Hanson, Samuel G., Anil K. Kashyap, and Jeremy C. Stein, 2011, “A Macroprudential Approach to Financial Regulation,” Journal of Economic Perspectives, Vol. 25, No. 1, pp. 3–28.

Ivashina, Victoria, and David Scharfstein, 2010 “Bank Lending during the Financial Crisis of 2008,” Journal of Financial Economics, Vol. 97, No. 3, pp. 319–38.