On the Edge

Finance & Development, September 2013, Vol. 50, No. 3

How oil markets will adjust to high prices is unclear

Oil prices adjusted for inflation have almost tripled over the past decade. But high prices typically bring an end to booms in commodity markets. That’s what happened in the oil market in the early 1980s. Could the end of the current boom be near?

At a superficial level, the current situation is reminiscent of the early 1980s, when a turnaround in market conditions presaged the oil price collapse of 1986 (Adelman, 1996). Similarly to the early 1980s, global economic growth today has slowed markedly (after a strong postcrisis rebound in 2009–10), and downside risks to global growth dominate. This overall picture is reflected in weaker growth in oil consumption at the same time that new oil supplies in North America are expanding rapidly (see “On the Rise,” in the March 2013 issue of F&D). New supplies also appeared in the early 1980s—from nations that were not members of the Organization of the Petroleum Exporting Countries (OPEC).

What is not clear is whether the similarities between today’s global oil market and that of the early 1980s are real or merely superficial.

An old story

The demand-side story of the early 1980s is simple. After oil prices doubled following the 1979 revolution in Iran, global oil consumption declined through 1983 (see Chart 1). It then grew slowly, but not at the high rates of the 1960s and 1970s. Only in 1987 did global oil consumption return to the 1979 peak; in that eight-year time frame, global real GDP rose 26 percent.

Several factors explain the slump and subsequent shift in global oil consumption in a period of high prices: substitution, a global recession, and increased efficiency. Substitution occurred—primarily in the electric power sector, where the more expensive, crude oil–based fuels were replaced by cheaper alternatives, such as coal. In the United States, for example, consumption of heavy residual fuel oil by utilities fell by two-thirds between 1970 and 1983—accounting for 15 percent of the global decline in oil consumption. The high prices, largely driven by OPEC policies at the time, also led to reductions in consumption that were amplified by recessions in many advanced economies in 1980–82. Petroleum fuel consumption in the transportation sector in the United States, for example, fell by 15 percent between 1979 and 1983. The lower trend growth in oil consumption after 1983 largely reflected greater efficiency, notably in automobiles. Because of the greater fuel efficiency of new cars, much of that improvement was permanent.

But these declines in consumption in the early 1980s occurred only in advanced economies. Consumption continued to grow rapidly in emerging market and developing economies. Today, emerging market economies are the dominant oil consumers, and, at least in the near future, there does not appear to be the type of structural break in their oil consumption patterns that occurred in advanced economies in the early 1980s. Because emerging market economies generally use more oil per unit of output than advanced economies, their rapid growth since the early 1990s has led to an acceleration in their oil consumption. Advanced economies have been using less oil since 2006. As a result, emerging market and developing economies’ share in global oil consumption has risen rapidly—to about 57 percent of world petroleum liquids in 2012, compared with 44 percent in the early 1990s. Even in the advanced economies, the decline in oil consumption has not been as dramatic as it was in the early 1980s.

There are important differences between the early 1980s and today that militate against dramatic changes in consumption. The potential to substitute other energy sources for oil seems more limited. In the power sector 30 years ago, changing the fuel source was easy because existing technologies could handle different types of fuel without many cost implications. But today, utilities are less important users of crude oil–based fuels than 30 years ago—except in Middle East oil-producing countries, where substitution is hampered by the unavailability of domestic natural gas and other fuels are generally not a feasible option. In the global transportation sector, which accounts for more than half of crude oil consumption, the technology for substitution is still limited, and the much higher cost of most alternatives impedes large-scale substitution. In particular, electric cars are still much more expensive than those powered by internal combustion engines. Nevertheless, smaller engines and technological improvements are having some effects. The average fuel efficiency of new cars has started to increase again, although it will take several years to be reflected in the fuel efficiency of the overall car stock.

Fuel subsidies also limited the pass-through of higher oil prices to end users in some economies—and reduced the demand impact of those higher prices. Recent calculations by IMF staff suggest that fuel subsidies in 2011 amounted to about 0.3 percent of global GDP. While this amount is small from a global perspective—less than 10 percent of the value of global oil consumption—in some countries the subsidies represent a large portion of domestic consumption. Moreover, the subsidy systems are often designed in a way that insulates consumers from oil price spikes, which reduces the impetus for substitution that such events should provide.

Demand holds firm

In the short term, then, a significant drop in the global demand for oil is likely only if global economic conditions get much worse. But, over the longer run, things could be different because there is potential for substitution and further efficiency increases in the transportation sector. In a number of countries, relatively cheaper natural gas could become an alternative fuel source. Batteries could be improved so much that vehicles powered by electricity become more attractive. And the fuel efficiency of internal combustion engines is likely to continue to increase, spurred by recent or pending legislation in the United States and the European Union. In addition, carbon taxes on end users of fossil fuels could make it more attractive to use other energy sources instead. Compared with the early 1980s, however, changes in oil consumption are likely to be more gradual.

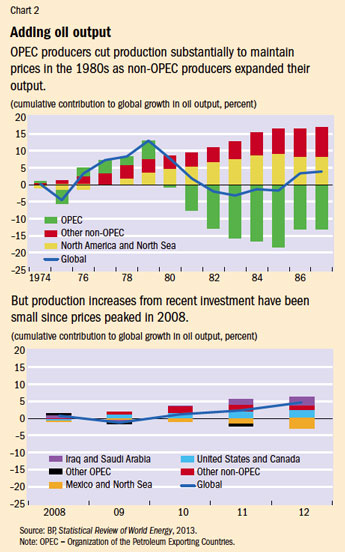

On the supply side, there also are important similarities and differences between the present and the early 1980s. The expansion of supplies in the oil-producing countries outside OPEC is a common feature of both the early 1980s and the past few years (see Chart 2).

The context, however, is different now. In the early 1980s, rapid increases in non-OPEC production in response to high prices undermined OPEC’s pricing power when oil consumption started to slump. Lack of production capacity was not an issue then. In fact, the decline in OPEC sales led to abundant spare capacity in member countries. Today, the critical question on the supply side is whether the recent expansion of non-OPEC production will be sufficient to alleviate the supply constraints that arose in the current oil boom. These constraints became obvious when global crude oil production stagnated during the global economic boom in the mid-2000s.

Many of these supply problems are related to the growing number of maturing large oil fields that have experienced declines in production. While maturation is part of the normal life cycle of oil fields, the fact that it started to affect major producing countries, beginning with fields in the North Sea and Mexico, was new. The resulting pressure on non-OPEC production became evident in the early 2000s, when oil demand from emerging market and developing economies increased and declining spare capacity limited OPEC’s ability to increase production.

Renewed growth in total global oil production requires increased production from newly discovered reservoirs and known but undeveloped reservoirs, as well as through increased recovery from current reservoirs (IEA, 2008). While pessimists doubted that renewed growth was possible, recent experience suggests otherwise. High oil prices have spurred exploratory activity and the discovery of new, sometimes large, oil fields; increased development of both newly discovered and known fields; and elicited more investment in enhanced recovery. Investment projects under consideration in the oil sector could, in principle, more than offset the projected decline from fields now in operation.

Production increase modest

Nevertheless, the increase in global oil production since oil prices peaked in 2008 has been small compared with what occurred when non-OPEC producers boosted output in the late 1970s and early 1980s. Except for increases from OPEC producers such as Saudi Arabia, the most noticeable new production in recent years has come from the development of shale oil or light tight oil in the United States and Canada—which has taken the market by surprise because development took only a few years. Elsewhere, new capacity has been slow to emerge. That partly reflects the time it takes to develop a new field, which can be 10 years or longer—depending on the complexity of the project and the field’s proximity to the sea or existing pipeline networks. The technical challenges involved in developing some of the new resources discovered in deep-sea oil fields (such as in Brazil) and in the Arctic are formidable. The development of light tight oil has been relatively easy in comparison.

A surge in investment costs and unexpected bottlenecks in firms that provide oil investment services, such as drilling wells, and in other industries that supply parts, such as drilling rigs, have also hampered development. As a result, the ratio of the market value of additional reserves to the costs of obtaining them rose by less than what oil prices alone would indicate, suggesting relatively weaker investment incentives. The recent global recession provided some relief, but investment costs remain high and some bottlenecks in oil investment services remain.

Constraints on oil investment capacity increases have also held back capacity increases. In many regions with favorable prospects for exploration and development, foreign investors are restricted or excluded from participation in the domestic oil sector. Such “resource nationalism” has hindered oil investment. Some national oil companies have ramped up capital expenditure in response to higher prices, while others have not because of political interference. The limitations are particularly relevant if the development of new oil sources requires foreign know-how and experience. Barriers to foreign direct investment typically mean that the needed oil investment will not be forthcoming.

Security concerns have hampered exploration and development in some areas—one reason production increases in Iraq, for example, have fallen short of expectations.

Still, the experience of the past few years suggests that extreme supply pessimism does not seem justified either. High prices have spurred new investment and efforts to increase production from existing sources. At current prices of $100 a barrel or higher, the incentives to invest remain fundamentally intact—most new oil projects require oil prices of at least $60 a barrel, in constant 2013 dollars, to be profitable. Nevertheless, as discussed above, developing new resources is more difficult than it was three decades ago.

Against this backdrop, total net production capacity will build only gradually. International Energy Agency forecasts, for example, suggest modest increases in new net capacity over the next five years. Because capacity increases are the main drivers of supply growth, supply increases will likely be equally modest.

Although, over time, the cumulative effect of both supply and demand changes could be large, any dramatic change in oil market conditions and prices in the near term would almost surely be due to dramatic changes in global economic activity or geopolitical developments. ■

References

Adelman, Morris, 1996, Genie Out of the Bottle: World Oil since 1970 (Cambridge, Massachusetts: MIT Press).

International Energy Agency (IEA), 2008, World Energy Outlook 2008 (Paris).