Picture This

Access to Banking Services

Finance & Development, September 2012, Vol. 49, No. 3

Asli Demirguc-Kunt and Leora Klapper

New database shows gaps in how people save, borrow, make payments, and manage risk

Fifty percent of adults worldwide do not have an account in a formal financial institution—a bank, credit union, cooperative, post office, or microfinance institution. These 2.5 billion “unbanked” adults lack a safe place to save and are likely to have only limited access to credit. And without an account in a financial institution, it is more difficult for people to receive wages, remittances, and government payments.

Until now, however, indicators on the banking practices of the poor, women, and young people were lacking for most economies. To address this gap, the World Bank and Gallup carried out a survey in 148 economies during 2011 to find out how adults save, borrow, make payments, and manage risk both inside and outside the formal financial sector.

Huge differences

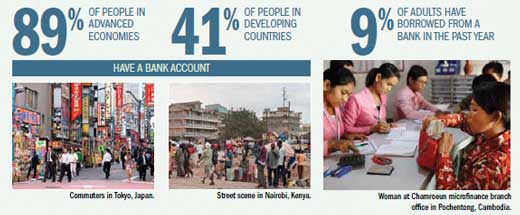

As expected, the data reveal sharp disparities across regions, countries, and individual characteristics (such as gender, education, and age). According to the World Bank’s Global Findex database, 89 percent of adults in advanced economies have a bank account, compared with 41 percent of adults in developing countries. Among the poorest, 23 percent of adults living on less than $2 a day have accounts. Worldwide, 55 percent of men have a bank account, compared with 47 percent of women.

The most common reasons for not having a bank account are not having enough money to use one (cited by 65 percent), banks or accounts that are too expensive or too far away (cited by 25 and 20 percent, respectively), and not having the necessary documentation (18 percent). These reasons suggest that removing physical, bureaucratic, and financial barriers could expand the use of bank accounts and the financial advantages that accompany them.

Saving clubs and friends

Globally, 36 percent of adults said they have saved some money in the past 12 months, but only 22 percent of adults report having saved at a bank or other formal financial institution. About 9 percent of adults around the world have borrowed from a bank in the past 12 months, compared with 23 percent who borrowed from friends or family. In developing countries, community-based saving clubs are another common alternative (or complement) to saving at a bank. Such a club—known as a susu in West Africa and a pandero in Peru—generally operates by pooling the weekly deposits of its members and disbursing the entire amount to a different member each week.

Mobile revolution

There is a bright spot in the expansion of financial services in the developing world: the recent introduction of “mobile money.” Although many are familiar with the money transfer system M-PESA in Kenya, the data show the success of mobile money throughout sub-Saharan Africa, where 16 percent of adults report having used a mobile phone to pay bills or send or receive money in the past 12 months. About half of these adults are otherwise unbanked. However, the global average for mobile money use in developing countries is only 5 percent, suggesting there are still regulatory and other barriers to the introduction of mobile money in other regions. ■

Prepared by Asli Demirguc-Kunt and Leora Klapper of the Financial and Private Sector Development Network of the World Bank. The data are from the Global Findex database, which is derived from more than 150,000 interviews in 148 economies and available at www.worldbank.org/globalfindex