Data Spotlight

Tracking Use of Fiscal Rules

Finance & Development, September 2012, Vol. 49, No. 3

Numerical limits have emerged as a key response to the fiscal legacy of the crisis

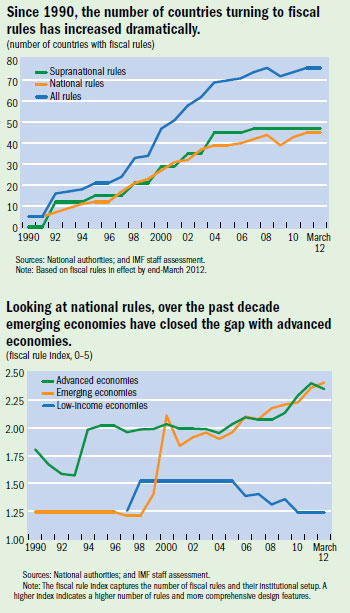

Many countries have adopted long-lasting constraints on key budgetary aggregates through numerical limits on deficits, debt, expenditures, or revenue, a new IMF study finds. These limits, called fiscal rules, can help contain pressures to overspend and thereby ensure fiscal responsibility and public debt sustainability. With public finances in distress in many economies, adopting fiscal rules can help bridge the transition to lower deficits while enhancing the credibility of debt and deficit reduction plans. As of end-March 2012, more than 75 countries were operating under national rules or supranational fiscal rules, compared with only five in 1990.

As part of the response to the global financial crisis, next-generation fiscal rules are being put in place. These rules are designed to strike a better balance between sustainability and flexibility goals because they often account for fluctuations in the business cycle, that is, the ups and downs of economic growth. Moreover, they are often complemented by other institutional arrangements, such as fiscal councils entrusted with monitoring fiscal policies and raising public awareness of their impact. The IMF study has also devised a fiscal rule index that summarizes the number of fiscal rules and the comprehensiveness of their design. The index for national fiscal rules shows that emerging economies have caught up to advanced economies and that, since the crisis, both country groups have launched new rules and strengthened characteristics of existing ones.

However, the next generation rules tend to be more complex, which could create new challenges for implementation, communication, and monitoring. Also, the index measures the institutional setup of rules and not the actual compliance. Nevertheless, the data set provides a basis that will allow researchers to tackle this issue in the future.

About the database

The IMF’s newly compiled data set takes stock of national and supranational numerical fiscal rules in 81 countries from 1985 to end-March 2012. It allows for at-a-glance reviews of trends in the types and number of rules and their main characteristics, such as the legal basis, enforcement, coverage, escape clauses, and provisions for cyclical adjustments. The data set also covers supporting features, including independent monitoring bodies and fiscal responsibility laws, as well as detailed country-by-country descriptions of the rules in place. The data are accessible through an easy-to-operate visualization tool—allowing simple country comparisons—as well as in Excel and Stata files that facilitate the work of researchers. The data set, which will be updated annually, and the study itself can be found at www.imf.org/external/datamapper/FiscalRules/map/map.htm