Half Empty or Half Full

Finance & Development, September 2010, Vol. 47, No. 3

Andrew Berg and Luis-Felipe Zanna

Does aid work? The net impact of aid surges depends on country-specific factors

WHETHER foreign aid helps poor countries grow is a matter of dispute. Although there is evidence that aid has a positive effect on social indicators such as infant mortality and primary school enrollments, its effectiveness on growth is an unresolved matter among economists. “It is difficult to discern any systematic effect of aid on growth,” Rajan and Subramanian (2008) concluded, for example, while Arndt, Jones, and Tarp (2009) found that “aid has a positive and statistically causal effect on growth over the long run.”

Less controversial is the view that aid flows, and in particular aid surges, can have both positive and negative effects on recipient countries. Aid surges may induce real exchange rate appreciation, which hurts growth-promoting exporting industries (see Rajan and Subramanian, 2010), but they may also help finance much-needed public investment in infrastructure, which is necessary for growth (see Collier, 2006). What makes the mixed empirical evidence unsurprising is that the final growth impact of aid is likely to depend on a number of country-specific factors, such as the macroeconomic policy response, the uses to which the aid is put, the efficiency of public investment, and various structural characteristics of the economy.

Scenario assessments

We have embraced this country-specific view in a joint project of the IMF and the United Nations Development Programme (UNDP) that provides macroeconomic assessments of scenarios that involve increases in aid for several African economies. The IMF was asked to provide macroeconomic assessments of scenarios that correspond to the commitments made by the Group of Eight industrial countries (G-8) at Gleneagles, Scotland, in 2005 to double aid to Africa by 2010. The scenarios and spending plans are based on sector-level analyses that the UNDP prepared in coordination with the World Bank, the African Development Bank, and country authorities. So far, 10 scenarios have been conducted—for Benin, Central African Republic, Ghana, Liberia, Niger, Rwanda, Sierra Leone, Togo, Tanzania, and Zambia. Five more assessments are to be completed in the coming months. (Three of these cases are available at www.imf.org/external/np/pp/eng/2008/091908a.pdf; the rest will be published soon.)

The assessments use a common framework that was developed at the IMF (see Berg and others, 2010). The framework is based on a dynamic small-open-economy quantitative model that can be useful for both policymakers and IMF staff by supporting more coherent policy discussion and macroeconomic analysis. The model is designed to capture the main mechanisms and policy issues in low-income countries experiencing aid surges. The framework focuses on the short- and medium-term macroeconomic effects of aid surges to shed light on aggregate measurements such as inflation and real exchange rate and medium-term productivity and growth. The assessments suggest that, depending on country-specific factors and policy responses, increased aid can have a positive medium-term impact on economic growth and that the negative effects on inflation and real exchange rates can be manageable.

The framework is designed to capture the key macroeconomic issues facing aid recipient countries. First, a larger traded sector can make for faster productivity growth. The idea is that there may be a “learning-by-doing” effect, or externality, whereby firms that compete in export markets learn (say, about manufacturing and management techniques) and this learning spills over to other firms. This special role for the traded sector means that a real exchange rate appreciation, associated with the aid surge, may harm productivity and growth. Second, public capital is important in production, so that government investment spending can raise output, both directly and by raising the return to private investment (and hence encouraging more). However, public investment spending is not always efficient, and not all government investment spending becomes useful public capital. Third, on the policy front, the framework allows for separate fiscal spending and reserve accumulation responses to aid surges, permitting a variety of policy combinations. It distinguishes between spending the aid, which is controlled by the fiscal authority, and absorbing the aid—financing a higher current account deficit—which is influenced by the central bank’s reserve accumulation policies.

The application of the model to specific cases requires “calibration”—the use of available empirical evidence to assign values to the parameters that determine the behavior of the model. For example, firm- and sectoral-level analyses are available on the strength of learning-by-doing externalities. Studies have also estimated the efficiency and determinants of rates of return to public investment. However, the available information is partial, and substantial judgment is required in filling in the gaps. More generally, the model is incomplete in many ways, and by itself it does not produce accurate forecasts. But the “Gleneagles aid scaling-up scenarios” project has shown that such a model can help organize thinking, offer a way to systematically incorporate various sorts of empirical evidence, and provide a vehicle for transparently producing alternative aid scaling-up scenarios and comparing results across countries.

Aid lessons

Even though the model embeds country-specific factors, a few critical lessons from its application to different countries have emerged. We believe these lessons are applicable to all countries.

First, it is important to distinguish between the efficiency of public investment based on aid-surge funds and the historical efficiency of public investment. We find that it is the efficiency of the aid-surge-related public investment relative to historical investment efficiency that determines how much impact aid-financed public investment has on growth. Low aid-surge-related investment means that the aid will create only a small amount of additional public capital. But low historical efficiency also means that there was very little public capital to begin with, so even this small addition to public capital can make a big difference to output.

This result has interesting implications. If a country has a lot of trouble converting investment spending into useful capital—in other words, both historical and aid-related investment efficiency are low—this may not influence the growth effects of a given aid surge. But it matters a lot if a country’s investment efficiency declines with the aid surge (for example, because it cannot handle the larger aid volume) or increases (for example, because it or the donors improve management practices).

Second, a real exchange rate appreciation and a reduction in the size of the traded sector are generally natural and appropriate counterparts to the aid surge. These changes shift resources from the traded sector, which now is less competitive internationally, to the nontraded sector, which is mainly local. In other words, such an appreciation puts those resources to work at home while also allowing the import of much-needed capital. And even with the appreciation and reduction in the traded sector that accompanies the use of the aid, the result is a higher public capital stock, more private investment, and higher output.

However, this real appreciation raises the specter of “Dutch disease,” whereby the associated shrinkage of the traded goods sector may harm overall growth because there is less learning through international competition and exporting.

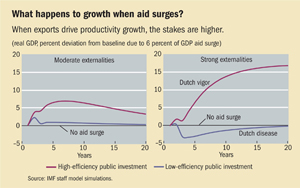

These learning externalities do not necessarily make aid harmful. But they raise the stakes for aid efficiency as they cut both ways: if aid is invested well, the externalities raise the productivity of the traded sector, so aid can produce even greater gains in terms of growth—producing what we term Dutch vigor. If it is not invested well, the externalities induce declines in productivity relative to the no-aid-surge baseline, and the aid can indeed harm growth. The chart illustrates this conclusion. It compares the effects of aid on real gross domestic product (GDP) when there are moderate positive externalities associated with the traded sector (left panel) and under strong externalities (right panel), while varying the efficiency of public investment. The chart assumes a temporary but persistent increase in aid equivalent to 6 percentage points of GDP, on average, that subsides to its previous level for the following five years. In addition, the aid surge is assumed to be fully spent and absorbed.

Under moderate externalities, as might be consistent with standard firm-level studies, the aid surge induces higher growth—more so with higher relative efficiency. When the traded sector is especially important for productivity growth and aid is efficiently used, we see Dutch vigor. Higher public capital accumulation induces higher private investment, which eventually helps raise output in the traded sector above its trend despite a real exchange rate appreciation. This higher traded sector output amplifies the positive medium-term effect of public and private capital investment. On the other hand, when aid is poorly used, strong externalities lead to a short-term drop in GDP, and the brunt of this drop falls on the traded sector, which loses competitiveness. Traded sector productivity growth falls as a result. Meanwhile, there is no boost in investment and productivity, because without much new public capital there is no increase in private investment. In this Dutch disease scenario, aid actually reduces growth.

Third, concerns about competitiveness and real appreciation have frequently caused authorities to accumulate some of the aid flows as international reserves while still spending the local currency counterpart of these flows (see Berg and others, 2007). This response mitigates the appreciation pressures on the domestic currency, because by holding on to the aid-related reserves the central bank lowers the supply of foreign currency in the foreign exchange market. But holding reserves crowds out private consumption and investment, hurting medium-term growth. The underlying cause of the crowding out is the attempt to use the same aid resources twice. When the government spends the local currency counterpart to the aid flows, the aid dollars can be used to buy up (sterilize) this monetary emission, thereby in effect financing the spending. If the aid dollars stay in reserves, then the central bank needs to sell bonds instead and these bond sales amount to domestic financing of the spending, with the attendant risk of crowding out.

Fourth, in circumstances of low efficiency and strong externalities that affect traded sector productivity, accumulating some of the aid flows in reserves may be justified despite crowding out the private sector; but better options are available. In these circumstances, aid is bad for growth, and a reserve accumulation policy can mitigate the Dutch-disease-type effects of appreciation and contraction of traded sector output. Such a policy more than compensates for private sector crowding out. However, there are better ways to respond to aid surges. The reserve accumulation policy could be accompanied by partial spending of aid. And if aid were used more efficiently, or allocated more toward investment that helps the traded goods sector, then the GDP effect of scaled-up aid would always be positive—more so if the government does not accumulate reserves.

Natural resources

The analysis we describe here can be extended to examine surges in other sorts of resource flows, including those that—unlike aid—are materializing in many countries. Natural resource discoveries have many features in common with aid surges. The usual developed country analysis of natural resource discoveries assumes that the country can always borrow to finance public investment, so there is no link between this investment and the resource discovery. But such a link can be crucial in credit-constrained developing countries, and has been analyzed using a variant of the model described here (see Dagher, Gottschalk, and Portillo, 2010). Meanwhile, many countries are considering increased use of nonconcessional foreign borrowing to finance needed public investment. Ongoing work is adapting the framework to look at this problem and the debt sustainability problems that may arise.

Andrew Berg is an Assistant Director and Luis-Felipe Zanna is a Senior Economist in the IMF’s Research Department.

References

Arndt, Channing, Sam Jones, and Finn Tarp, 2009, “Aid and Growth: Have We Come Full Circle?” Discussion Paper No. 09–22 (Copenhagen: University of Copenhagen, Department of Economics).

Berg, Andrew, Shekhar Aiyar, Mumtaz Hussain, Shaun Roache, Tokhir Mirzoev, and Amber Mahone, 2007, The Macroeconomics of Scaling Up Aid: Lessons from Recent Experience, IMF Occasional Paper No. 253 (Washington: International Monetary Fund).

Berg, Andrew, Jan Gottschalk, Rafael Portillo, and Luis-Felipe Zanna, 2010, “The Macroeconomics of Medium-Term Aid Scaling-Up Scenarios,” IMF Working Paper 10/160 (Washington: International Monetary Fund).

Collier, Paul, 2006, “African Growth: Why a ‘Big Push’?” Journal of African Economies, Vol. 15, Supplement 2, pp. 188–211.

Dagher, Jihad, Jan Gottschalk, and Rafael Portillo, 2010, “Oil Windfalls in Ghana: A DSGE Approach,” IMF Working Paper 10/116 (Washington: International Monetary Fund).

Rajan, Raghuram, and Arvind Subramanian, 2008, “Aid and Growth: What Does the Cross-Country Evidence Really Show?” Review of Economics and Statistics, Vol. 90, No. 4, pp. 643–65.

———, 2010, “Aid, Dutch Disease, and Manufacturing Growth,” Journal of Development Economics, forthcoming.