Oil Subsidies: Costly and Rising

Finance & Development, June 2010, Volume 47, Number 2

Benedict Clements, David Coady, and John Piotrowski

Reducing subsidies worldwide can bring substantial environmental benefits and create much-needed fiscal space

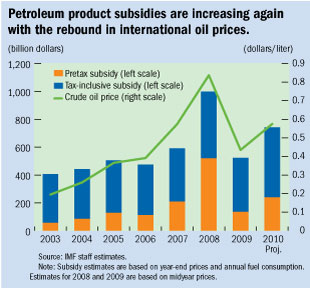

PETROLEUM product subsidies have increased in recent years. In 2003, global consumer subsidies for petroleum products totaled nearly $60 billion. By mid-2008, they had increased more than eightfold—to $520 billion. As international fuel prices surged during this period, many governments chose not to fully pass through these increases to domestic retail prices, resulting in rising subsidies. Although subsidies fell sharply in the second half of 2008 as oil prices dropped, they increased again throughout 2009 as oil prices rebounded, and are projected to reach almost $250 billion by the end of 2010.

But the true economic subsidy is even higher. In principle, petroleum product prices should include taxes both to contribute to government revenue requirements and to address domestic and global environmental damage. If taxes are too low, the result is a consumer “tax subsidy.” Based on a benchmark tax of $0.30 a liter that takes these considerations into account, the global “tax-inclusive” consumer subsidy is projected to reach $740 billion by the end of 2010, equivalent to 1 percent of global gross domestic product (GDP).

Who subsidizes?

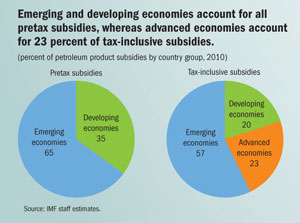

Whereas all pretax subsidies are found in emerging and developing economies, advanced economies account for a sizable share of tax-inclusive subsidies. Of projected pretax subsidies totaling $250 billion in 2010, emerging economies account for 65 percent, developing economies for the remaining 35 percent. Of projected tax-inclusive subsidies of $740 billion in 2010, emerging economies account for 57 percent, developing economies 20 percent, and advanced economies the remaining 23 percent.

Who benefits?

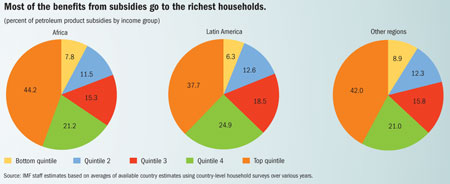

Although subsidies are commonly believed to help the poorest, most of the benefit actually accrues to the highest-income households, which use more petroleum products. For example, in Africa, 65 percent of all fuel subsidies go to the richest 40 percent of households. But the distribution of subsidies also differs substantially across fuel products. The benefits of gasoline subsidies are the most regressive, with more than 80 percent of total benefits going to the richest 40 percent of households.

Promoting better options

Many countries that provided fiscal support to buffer the effects of the global economic crisis now face rising fiscal deficits. Cutting tax-inclusive subsidies in half would decrease the average projected fiscal deficit in subsidizing countries by 1 percent of GDP. In addition, a limit on subsidies could have substantial benefits for the environment: cutting subsidies by half could mean close to a 10 percent reduction in greenhouse gas emissions by 2050.

However, the elimination of even badly targeted subsidies could seriously hurt poor households. Transfers targeted to those who are neediest would be a feasible alternative. For example, countries could eliminate gasoline subsidies while maintaining subsidies on kerosene, which is more important in poor households’ budgets. In addition, some of the budgetary savings from reducing subsidies could be redirected to existing programs that better help the poor, including school meals, lowering education and health fees, and cash transfers. Improving the design of social safety net programs over time can reduce the pressure for fuel subsidies.

Public information campaigns need to emphasize that fuel subsidies are inefficient, inequitable, and costly. Transparently recording subsidies in government accounts can reinforce reform by making fuel subsidies compete with higher-priority uses of public funds. Although a liberalized market-based approach to petroleum pricing is best, countries can adopt an automatic pricing mechanism (a system that adjusts prices regularly in response to changes in international prices) while they develop a competitive supply system and effective means of regulation. Well-designed pricing mechanisms can prevent sharp retail price increases in the short term while incorporating international price changes over the medium term and managing fiscal volatility.

Prepared by Benedict Clements, David Coady, and John Piotrowski. Text and charts based on Petroleum Product Subsidies: Costly, Inequitable, and Rising, published by the IMF in 2010. The report is available at www.imf.org/external/pubs/ft/spn/2010/spn1005.pdf