Global Imbalances - An assessment, by Raghuram G. Rajan, Economic Counsellor and Director of the IMF's Research Department

October 25, 2005

by Raghuram G. Rajan

Economic Counsellor and Director of the IMF's Research Department

Ronald Reagan International Conference Center, Washington, DC

Tuesday, October 25, 2005

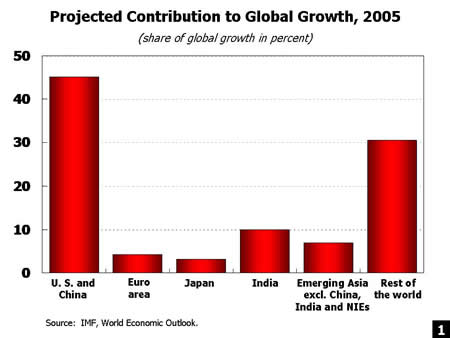

Good morning. The IMF in its latest World Economic Outlook has projected global growth of about 4.3 percent for 2005 and the same for 2006. Even though the overall growth is slightly above trend, there are a number of developments concern us.

These include the excessive dependence of global growth on unsustainable processes in the United States and to a lesser extent in China, the elevated level of asset prices, particularly housing, and the high and volatile price of oil. The downside risks to our forecast are thus considerable.

These varied concerns come together in the growing global imbalances.

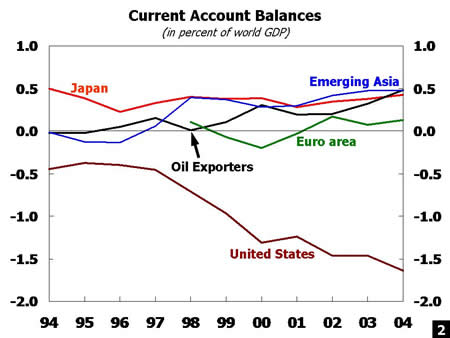

The picture is familiar to most of you. The United States is running a current account deficit approaching 6 1/4 percent of its GDP this year and over 1.5 percent of world GDP. And to finance it, the United States needs to pull in 70 percent of all global capital flows. While the deficit is still increasing, the location of the surplus countries is changing. The current account surpluses of the oil-exporting countries of the Middle East have now surpassed those of emerging Asia, which were already quite high.

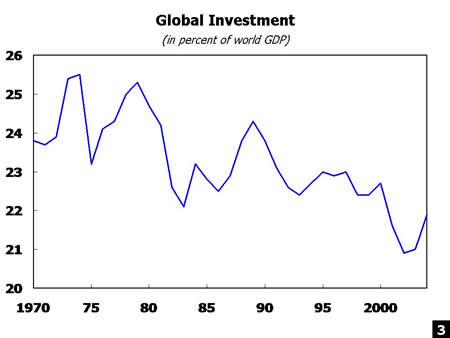

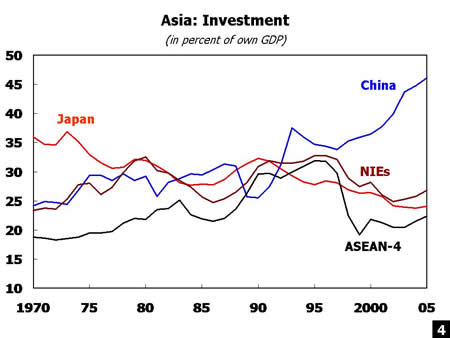

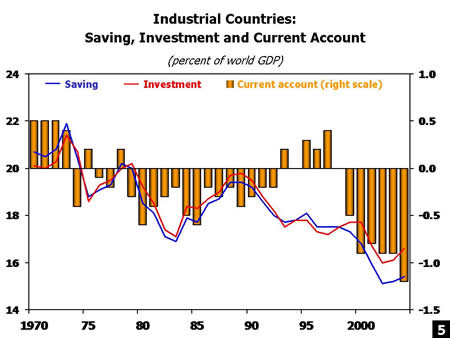

Unlike those who view the imbalances as mirroring a savings glut, I see the problem as the world is investing too little. The current situation has its roots in a series of crises over the last decade that were caused by excessive investment, such as the Japanese asset bubble, the crises in Emerging Asia and Latin America, and most recently, the IT bubble. Investment has fallen off sharply since, with only very cautious recovery.

This is particularly true of emerging Asia and Japan.

The policy response to the slowdown in investment has differed across countries. In the industrial countries, accommodative policies such as expansionary budgets and low interest rates have led to consumption- or credit-fuelled growth, particularly in Anglo-Saxon countries.

Government savings have fallen, especially in the U.S. and Japan, and household savings have virtually disappeared in some countries with housing booms.

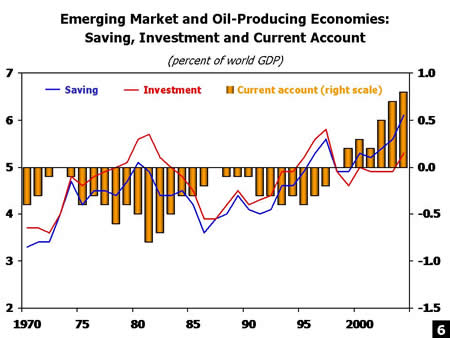

By contrast, the crises were a wake-up call in a number of emerging market countries. Historically lax policies have been tightened, with some countries running primary fiscal surpluses for the first time, and most bringing down inflation through tight monetary policy.

With corporations cautious about investing and governments prudent about expenditure-especially given the grandiose projects of the past-exports have led growth and savings have built up. Many emerging markets have run current account surpluses for the first time. In emerging Asia, a corollary has been to build up international reserves.

Some call this a new world order. I see the situation as a temporary but effective response to crisis. It is somewhat misleading to term this situation a "savings glut" for that would imply that countries running current account surpluses should reduce domestic incentives to save. But if the true problem is investment restraint, then a reduction in world savings incentives will engender excessively high real interest rates when the factors holding back investment dissipate. The world now needs two kinds of transitions.

First, consumption has to give way smoothly to investment, as past excess capacity is worked off and as expansionary policies in industrial countries return to normal. Second, to reduce the current account imbalances that have built up, demand has to shift from countries running deficits to countries running surpluses.

There are reasons to worry whether the needed transitions will take place smoothly. First, we need more investment, especially in low-income countries, emerging markets, and oil producers. China is an exception in needing less, not more, investment. The easy way to get more investment is a low-quality investment binge led by the government or fuelled by easy credit-emerging market countries are only too well aware of the pitfall of that approach. The harder, and correct, way is through product, labor, and especially financial market reforms, which will ensure that high-quality investment emerges. However, and somewhat paradoxically, the emphasis that some governments have placed on strong exports and sound monetary and fiscal policies may have caused them to neglect the structural reforms that would have strengthened investment and helped sustain domestic demand. As a result, these countries are overly dependent on demand from other countries.

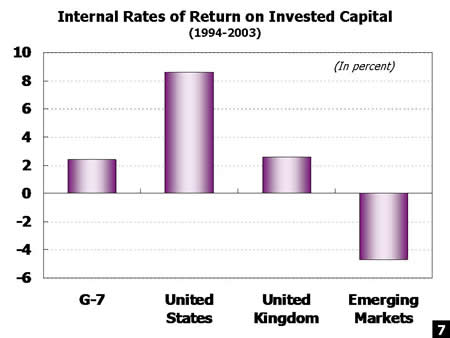

Moreover, the absence of such reforms limits the rate of return on investment in those countries and prevents capital flowing from aging rich countries to younger developing countries. This must change.

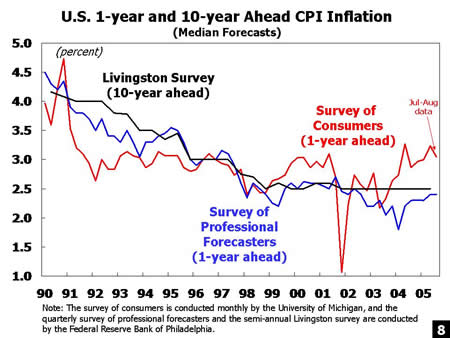

Second, easy financial conditions and trade may have allowed economies more rope so that traditional signals like inflation, interest rates, and exchange rates have not guided transitions thus far. But while more rope allows one to drift further, adjustments when one reaches the end of the tether tend to be abrupt. Perhaps the central concern has to be about consumption growth in the United States, which has been holding up the world economy. Higher energy prices in the United States could eat into disposable incomes and consumer confidence, leading to an abrupt fall in consumption. Another risk is that the higher energy prices start to feed more permanently into inflation and inflationary expectations, which have remained well anchored so far, causing the Fed to tighten either faster or further.

This would have several negative effects. First, it could mean higher interest payments for households, reducing available income for consumption. Second, more broadly, it could put a lid on house price growth. For several years now, the wealth gains for increased home equity have been a strong support to consumer spending. Lastly, it could hinder investment just when it should be taking over as the source of growth from consumption. Thus my greatest worry is not that U.S consumption will slow-it has to because it is being fuelled by unsustainable forces. My worry is that it will slow abruptly, taking away a major support from world growth before other supports are in place.

A second concern has to be about the financing of the U.S. current account deficit. If it narrows slowly, will foreign investors continue to buy U.S. assets without hiccups for the time it takes for the real side to adjust?

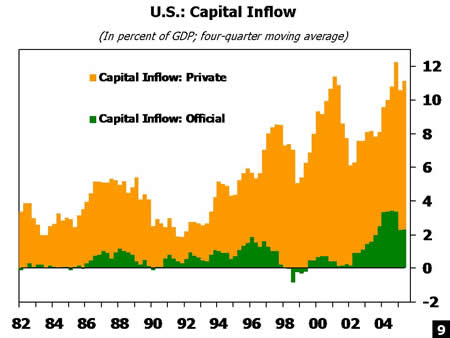

Let us look at the composition of capital flows into the United States for some clues to the answer. Overall, the bulk of U.S. assets sold to foreigners are still to the private sector. This may come as a surprise to some of you who believe that the U.S. current account deficit is being financed by foreign central banks. The reality is that while the foreign official sector has increased its purchases, it still only amounts to less than one-third of the total inflows into the United States. So where is the rest going if, as was the case till recently, foreign central banks were putting in enough to nearly match the deficit? The answer is that it comes out again as U.S. investors buy foreign assets.

It is therefore entirely correct to say the U.S. current account deficit is more than fully financed by foreign private investors while U.S. private investment abroad is partly financed by foreign central bank investment in the U.S.. From the evidence we have so far, foreign central banks do not appear to vary their purchases of U.S. Treasuries in a systematic way with changes in the trade-weighted dollar. Profits are less important to central banks, and they are less likely to make a rapid shift in the composition of their reserve portfolio - though given their size, they have the ability to roil markets if they do, or if politicians hint they will. But before central banks turn decisively, foreign private investors who have no motive to buy dollars other than returns will have fled. It is they who are key to the financing of the U.S. current account deficit.

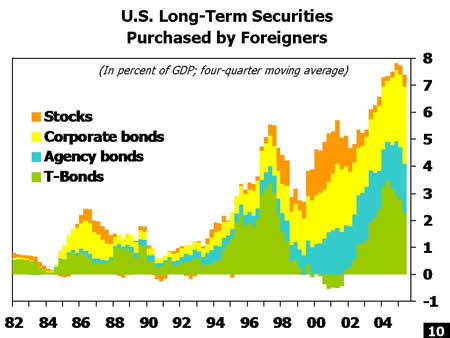

Given this, it is worth noting that both foreign direct investment and net purchases of equities by non-residents have declined markedly since 2000. Foreign direct investment has staged a partial recovery since then, but remains below 1 percent of U.S. GDP. The decline coincides with a drop off in M&A activity in the United States and overleveraged balance sheets in the Euro area and Japan. At the same time, net purchases of fixed income securities have increased substantially, with most of the increase consisting of Treasuries. On net, therefore, the form of financing has become less favorable, even though there have been no serious problems so far. The concern is that financing will become more difficult-with consequences to U.S. interest rates and the exchange rate-precisely when other factors make the U.S. slow and look an unattractive place to invest, compounding the slowdown.

A final concern has to do with protectionism. It is all too easy for politicians to blame other countries for imbalances - after all, foreigners do not vote. The solution then appears easy. Impose punitive tariffs! Yet as we have seen, the imbalances are a shared responsibility, and no one country will be able to solve it unilaterally, least of all by imposing tariffs. And a tariff here will bring forth a tariff there, potentially harming the entire world economy. We have seen the movie before in the depression of the 1930s and it is terrifying. It is to forestall such a descent into autarky that the Fund has been arguing that countries should avoid pointing fingers at each other. If instead countries see the imbalances as a shared responsibility, it will help guide the domestic debate in each country away from the protectionism that may otherwise come naturally.

What can be done? Consumption growth in the United States has to slow, and this will require a steady withdrawal of the massive amounts of fiscal and monetary stimulus infused in the post-bubble years. Exchange rate movements will also have an important role in facilitating the transition. This implies that a number of currencies, especially in Emerging Asia, will need to appreciate. And finally, in a large number of countries, including Japan, the Euro area, Emerging Asia, and oil exporters, further structural reforms are needed to increase domestic incentives to invest, and in some cases, consume.

Some people hanker after a grand accord along the lines of the Louvre or Plaza accords. It is hard, however, to think of what countries would, or could, commit to in such an accord, at least at this stage. Better to focus on building a common understanding of the problem, and to convince each country of the importance of doing what is necessary. This is what the IMF has been doing for the last few years.

There has been some progress, though less than we would like. For instance, the United States has agreed that reducing its fiscal deficit is part of the solution and is committed to reducing the deficit by half by 2009. While the goal is welcome, we believe the measures are not ambitious enough, and some revenue raising measures will have to be contemplated, especially in view of Hurricane Katrina's effect on broader U.S. government spending. Similarly, we welcome greater exchange rate flexibility in some countries in Asia, especially the recent initial step in this direction by China-though further progress soon toward more flexible exchange rate management will be crucial.

Let me turn finally to an issue of some controversy. Some have argued the Fund has been remiss in not pushing China to appreciate more, with some economists asking for a huge step appreciation of the order of about 25 percent. First, I reject the premise of the accusation. The Fund has been discussing the need for greater exchange rate flexibility with China for some time - starting as early as 2000-long before others woke up to the growing global imbalances. Nevertheless, more action is needed. With the imbalances increasing, China's reserve build-up reaching enormous proportions, and China's current account surplus starting to grow significantly, it is in both the world and China's interest to allow the renminbi to appreciate more.

However, a huge step appreciation will probably do much more harm than good. For one, a number of the most efficient Chinese enterprises will be driven out of business and others forced into distress. In a developed economy, the necessary restructuring could be speedily effected. In an economy like China's with an underdeveloped financial system, the restructuring would be long drawn-out, painful, and could even damage the banking system significantly. If there is one lesson we have learnt in recent years, it is that emerging markets do not handle large exchange rate movements well. Moreover, it is not even clear that such a large exchange rate appreciation would have much of an effect on the U.S. current account deficit - quite possibly other countries in Emerging Asia would simply take up China's export share.

Instead, we would advocate a less interventionist approach where the authorities let the exchange rate react more flexibly to market forces-the authorities already have a framework for this, and they should use it. A more flexible exchange rate, especially if accompanied by more flexibility in emerging Asia, will allow the underlying forces adjusting international demand more room to play. Equally important, however, for China, is the process of modernizing the financial system so that both banks and corporations face a realistic cost of capital, invest sensibly, and offer a realistic return to savers. Not only can this reduce excessive investment in the Chinese economy, it can also reduce excessive savings. A growing China that consumes more will benefit not only itself but also the world.

Let me conclude. The world economy has been resilient in the face of shocks, in part due to improvements in the quality of policy. This has allowed a variety of imbalances to build up. The IMF is concerned whether the needed transitions to reduce imbalances will take place smoothly, which is why though the central scenario is one of robust growth, we believe the risks are weighted to the downside. Instead of pointing fingers at one another, or raising barriers against on another's goods, however, we should recognize that the need of the hour is sensible domestic policy reform. In addition, of course, we should continue with the process of reducing trade barriers, which means working towards an ambitious Doha round. Let me end my remarks here. Thank you.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6278 | Phone: | 202-623-7100 | |