IMF ANNUAL Meetings Update | OCTOBER 10, 2023

In our second daily recap of the Annual Meetings in Marrakech, today, October 10, 2023, we spotlight the growing divergence between country groups in the world economy’s slow recovery, financial risks from the higher-for-longer interest rate environment, the IMF’s game-changing facility for strengthening countries’ resilience to climate change, how capacity-development programs are empowering African economies in a shock-prone world, and much more.

Global Economy’s Slow Recovery Marked By Growing Divergences

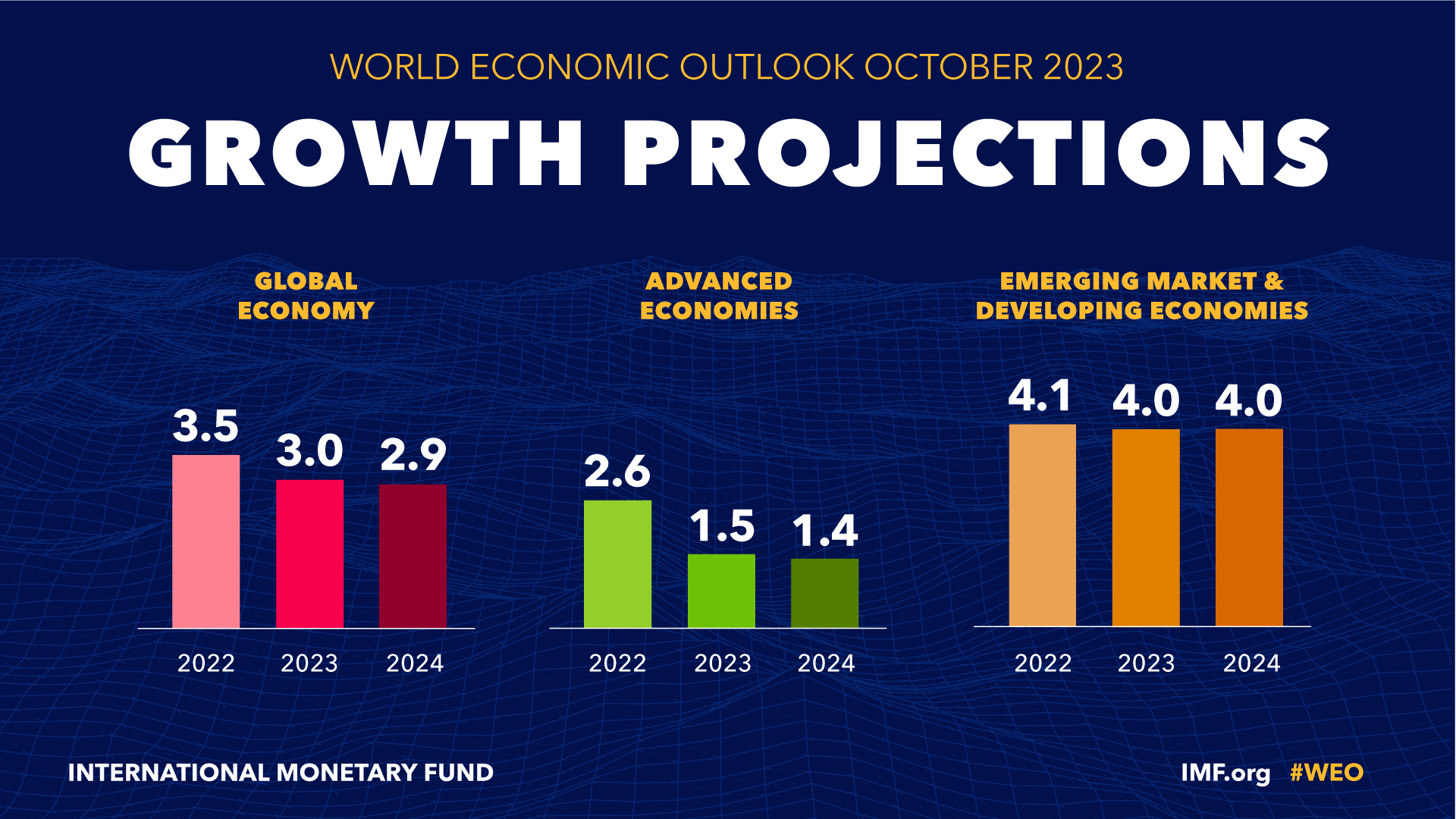

Global economic growth has slowed and recovery is marked by important divergences between advanced economies and emerging markets and developing economies, according to the IMF’s World Economic Outlook report, released on Tuesday.

“The global economy is limping along, not sprinting,” Pierre-Olivier Gourinchas, the IMF’s economic counselor and the director of the Research Department, told a press briefing.

Global economic growth will slow from 3.5 percent in 2022 to 3 percent this year and 2.9 percent next year, a 0.1 percentage point downgrade for 2024 from July’s previous projections. Global inflation is forecast to decline steadily, from 8.7 percent in 2022 to 6.9 percent in 2023 and 5.8 percent in 2024.

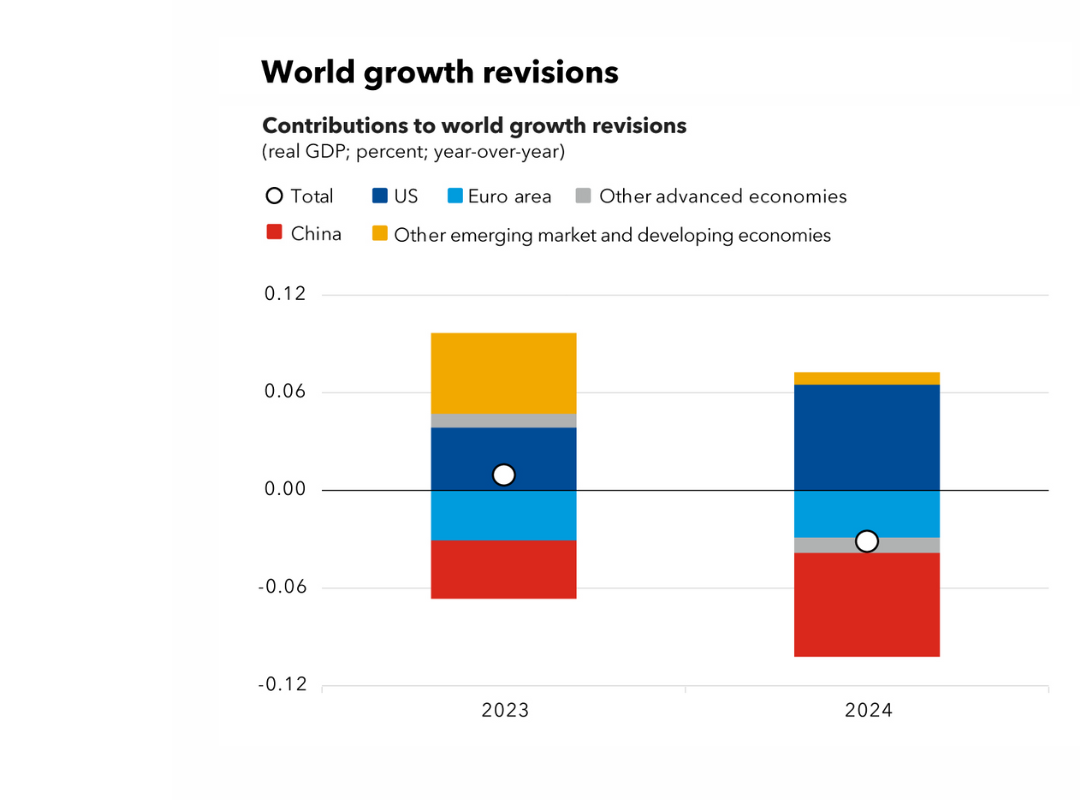

Writing in a blog, Gourinchas said that US growth has been revised up, with resilient consumption and investment, while the euro area has been revised down, as tighter monetary policy and the energy crisis took a toll. There is divergence also among emerging markets and developing economies, with China facing growing headwinds, while Brazil, India and Russia are revised up, he added. Gourinchas told the briefing it’s too soon to assess the impact of the conflict between Israel and Hamas, but IMF research shows that a 10 percent increase in oil prices brings down global output by 0.15 percentage points the following year and increases inflation by 0.4 percentage points.

Higher-for-Longer Interest Rate Environment is Squeezing More Borrowers

Risks to the world economy remain skewed to the downside, as elevated inflation means central banks may have to keep interest rates higher in a way that stretches the capacity of borrowers to repay debt, according to the IMF’s latest Global Financial Stability Report. Central banks have unleashed the steepest series of interest-rate increases in decades during their two-year drive to tame inflation—and may not be done yet. One warning sign is the diminished ability of individual and business borrowers to service their debt, also known as credit risk, Tobias Adrian, the IMF’s financial counsellor and director of the Monetary and Capital Markets Department, writes in a blog. Making debt more expensive is an intended consequence of tightening monetary policy to contain inflation, according to Adrian. The risk is that borrowers might already be in precarious positions financially, and the higher interest rates could amplify these fragilities, leading to a surge of defaults.

Quote of the Day

The global economy is limping along, not sprinting.

PIERRE-OLIVIER GOURINCHAS, IMF CHIEF ECONOMIST

IMF’s Climate Facility Is A Game Changer For Vulnerable Countries

The Resilience and Sustainability Trust is a “game-changer” for developing nations seeking to cope with climate change, Ryan R. Straughn, Barbados’s finance minister, told a panel discussion on the IMF’s new instrument to provide affordable long-term financing to vulnerable countries. Straughn said that the RST had come at the right time to allow Caribbean island nations that are vulnerable to tropical storms, hurricanes and other disasters supplement their limited fiscal capacity. Hekuran Murati, Kosovo’s finance minister, told the panel that the RST would help to finance investment in green power and other structural reforms that will enable a faster energy transition. Kenya’s finance minister Njuguna Ndung’u described the devastating impact of climate change on his country. “Kenya has had one of the worst droughts in 40 years. All of a sudden, food scarcity.” Nogui Acosta Jaén, Costa Rica’s finance minister, commended the IMF for recognizing the need for an instrument that helps countries move forward with decarbonization.

CHART of the Day

According to our latest projections, world economic growth will slow from 3.5 percent in 2022 to 3 percent this year and 2.9 percent next year.

Among advanced economies, the US growth outlook has been revised up, with resilient consumption and investment, while euro area activity was revised downward. Many emerging market economies also proved unexpectedly resilient, with the notable exception of China.

Learn more

Capacity Development Is Empowering African Economies

In a shock-prone world, African countries, the IMF and partners are working together to increase capacity for economic empowerment, Gita Gopinath, the IMF’s first deputy managing director, told a panel on Tuesday. In addition to eight regional capacity development centers on the continent and an extensive network of experts, Gopinath said that a new global finance initiative is being launched to strengthen the ability of governments to raise revenue. “Capacity development efforts can help Africa, both north and south of the Sahara, become the engine of the global economy,” Dominique Desruelle, IMF Director of Capacity Development, told the event. Sierra Leone’s finance minister Sheku A. F. Bangura highlighted the growing importance of capacity development related to tax and spending policy. Caroline Abel, governor of the central bank of Seychelles, underscored capacity development’s human capital potential, especially for countries with young populations. “Apart from enhancing our technical capabilities we also see that IMF capacity development is creating leaders,” she said.

Number of the Day

6.9%GLOBAL INFLATION

Global inflation is forecast to decline steadily, to 6.9 percent in 2023 from 8.7 percent in 2022, due to tighter monetary policy aided by lower international commodity prices.

Learn more

Photos

Julia Estefania speaks at an Analytical Corner event on Monetary Policy Transmission: Lags and Heterogeneities.

Moroccan musicians welcome participants to the campus of the 2023 Annual Meetings in Marrakech.

Attendees deep in discussion at the 2023 Annual Meetings.

Upcoming Events

Press Briefing: Fiscal Monitor

Global warming threatens the planet and human livelihoods, with 2023 set to become the warmest year on record. Recognizing the threat, countries have set climate goals—for example, many countries have committed to reducing greenhouse gas emissions to net zero by midcentury—and have taken a range of policy actions.

Event Details

Joint Seminar: Delivery On the Ground: Country Action for A Livable Planet

This event, jointly hosted by the World Bank and the IMF, will explore innovative ways countries can deliver significant impacts that improve people’s quality of life, through policies that accelerate low-carbon and resilient growth to better draw in the private sector and attract more climate finance.

Event Details

IMF Seminar: Financing Resilience, Growth and Shared Prosperity

This seminar will discuss how countries can overcome the funding squeeze and build a more resilient future growth path and, in particular, explore the role the international community can play with well-coordinated policy advice, capacity building, and financial support.

Event Details