Commercial Real Estate Under Pressure

In This Episode

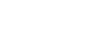

2020 was a record-breaking year for housing markets in many countries- including the US, but for the commercial real estate sector, it was a completely different story. Lockdown and containment measures severely affected economic activity, pushing down commercial property transactions and prices in cities around the world. A new analytical chapter in the Global Financial Stability Report looks at how continued downward pressure on prices could threaten financial stability and hamper the recovery. In this podcast, lead author Andrea Deghi, and team lead Mahvash Qureshi, say vacancy rates of office space in the US almost doubled in 2020 due to people having to work from home, a trend likely to continue well beyond the pandemic.

Read the analytical chapter

Read the blog

Join Us on Every Major Platform

Latest Podcasts

BEHIND THE MIC

Bruce Edwards

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

Rhoda Metcalfe

RHODA METCALFE is an independent journalist and audio producer.