Fiscal Reform Can Help Dominican Republic Attract Greater Investment

June 24, 2024

Changes to taxation and other policies can help the already fast-growing economy realize its full potential

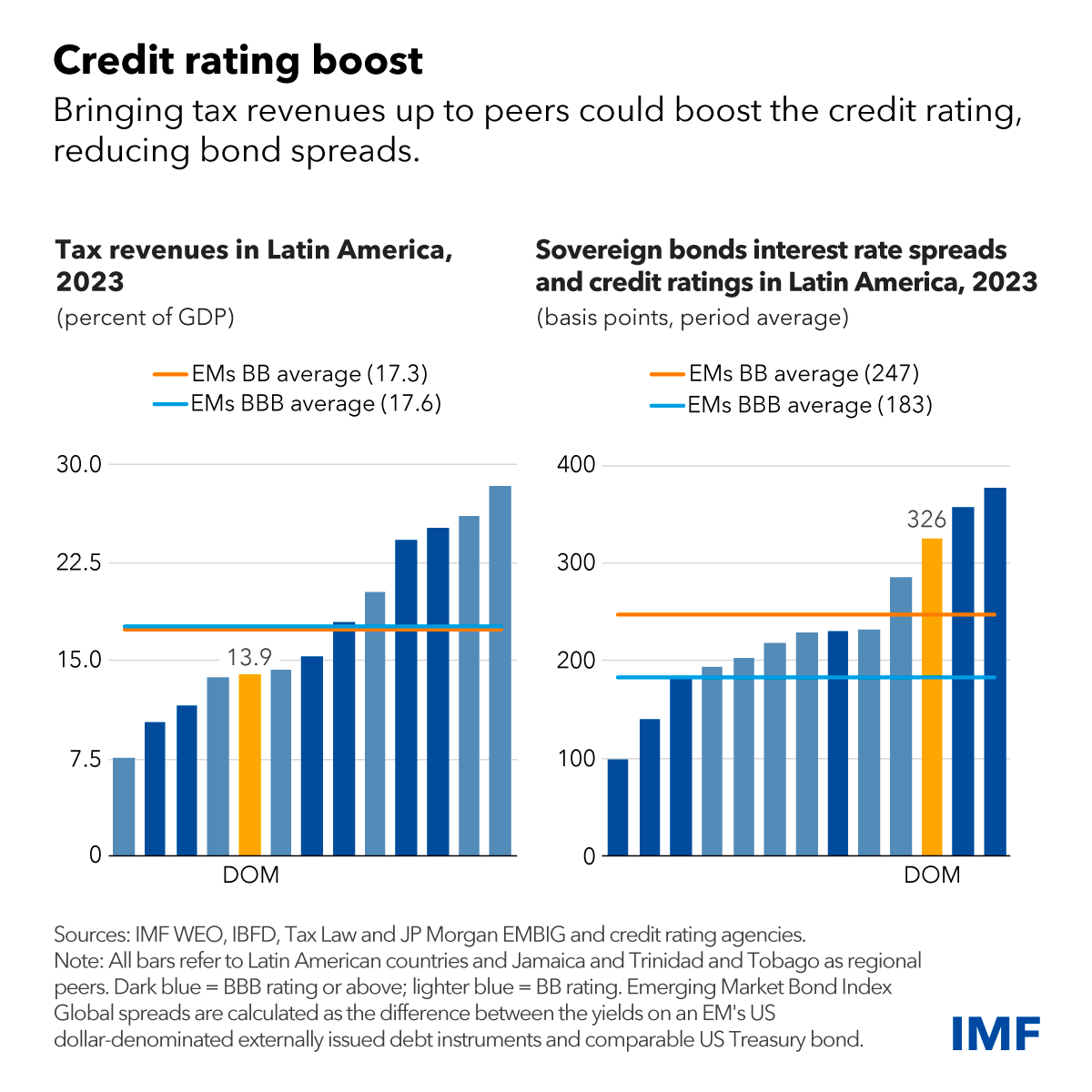

The Dominican Republic leads Latin America in GDP growth, with an average annual rate of around 5 percent per year since the 1970s. The Caribbean nation has made great strides in reducing poverty and improving living standards. Reaching investment grade on its sovereign bonds would further accelerate progress by lowering interest rates, increasing capital flows, and broadening the investor base. This would also reduce private sector financing costs and boost the economy's growth potential.

Interest rates on public debt are high relative to peers, notably those with investment grade. High interest rates mean fewer resources for spending on infrastructure, social services, and making the economy more resilient to climate change, an important risk for the country. Elevated public debt (or interest payments) relative to low tax revenues—known as debt affordability—is a key risk constraining its credit rating and contributing to high interest rates. That’s why reforms, especially to the tax system, will be key. A comprehensive tax reform could help the country boost revenues and earn an investment grade rating.

Revenue raising

Tax revenues are limited by costly exemptions and a high threshold before personal income taxes apply. Streamlining tax incentives and exemptions—which together amount to about 5 percent of GDP, or a third of all tax revenues—is also crucial for simplifying the tax system and reducing evasion.

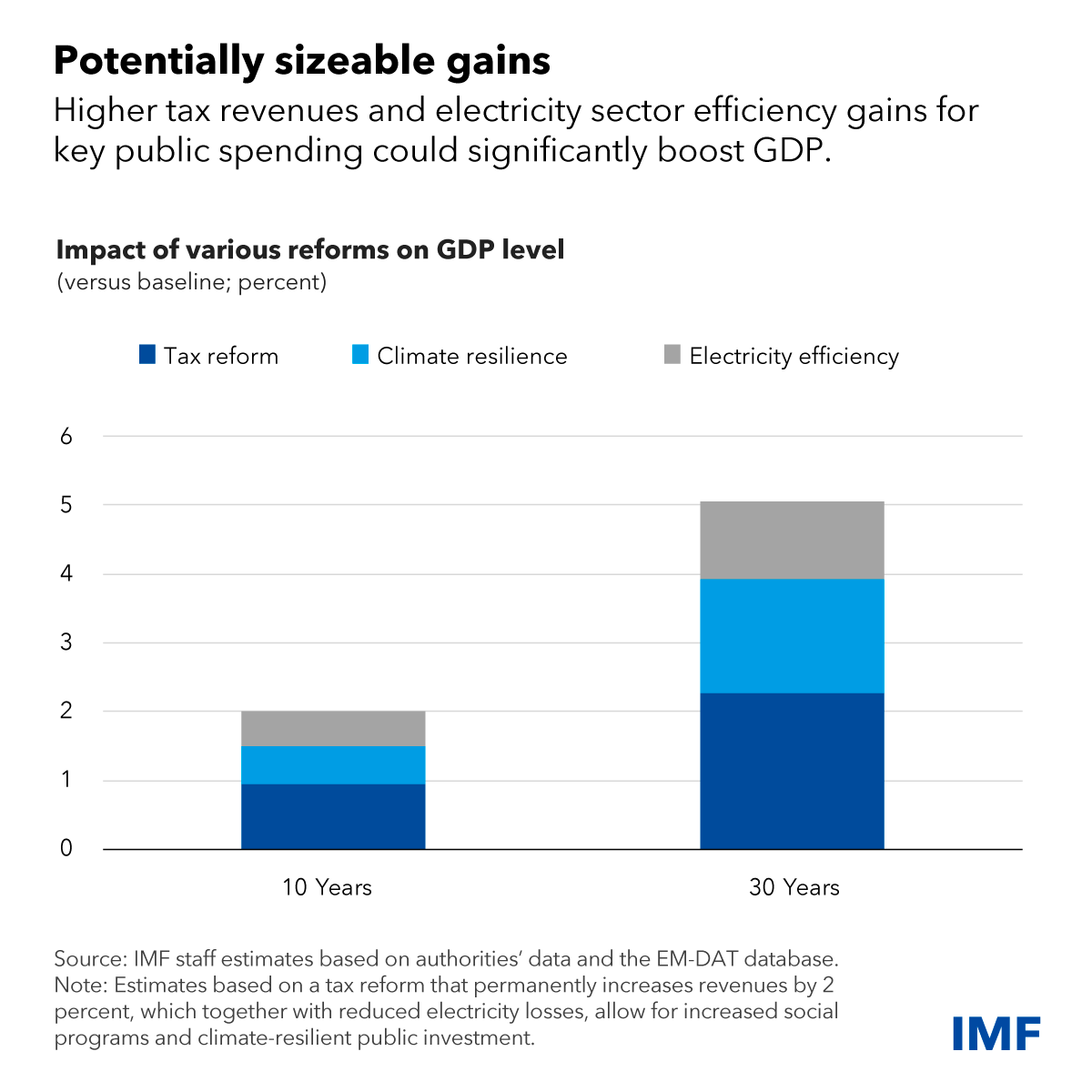

Permanently raising tax revenues by at least 2 percent of GDP would allow for sustainable increases in key public investment and social spending – helping to boost productivity and private consumption while reducing inequality and poverty. Overall, a comprehensive tax reform could raise the level of GDP by around 1 percent after 10 years and by 2 percent after 30 years (see Chart). Additional public resources from the reform would also create space in the budget to scale up public investment in infrastructure that can mitigate losses from climate events, which are sizeable for the country.

The Dominican Republic is vulnerable to climate shocks including hurricanes, storms, and floods which already cause average annual losses of around 0.5 percent of GDP to infrastructure alone. The country is also increasingly vulnerable to rising temperature and sea levels. Climate change is expected to increase these vulnerabilities. Making public infrastructure more resilient to climate events so that their impact is 40 percent less severe could further boost GDP by around 0.5 percent after 10 years and by 1.75 percent after 30 years.

Fiscal rule

Beyond the much-needed increase in tax revenues, comprehensive fiscal reform should include the adoption of a fiscal rule imposing long-term limits on public debt that would increase certainty and help safeguard fiscal sustainability. Recapitalizing the central bank remains a crucial step to ensure its financial autonomy. In this regard, the IMF has provided technical assistance in the design of a Fiscal Responsibility Law, which is pending approval by the lower chamber of Congress, and has supported the authorities’ efforts to draft a new central bank recapitalization law.

Electricity sector

Another critical reform is addressing the long-standing inefficiencies in the electricity sector that result in high losses, which have averaged between 1 and 2 percent of GDP per year in the last decade. We estimate that cutting losses by half—to a level comparable to those in advanced economies—could increase GDP by 0.3 percent after 10 years as efficiency improves, costs are reduced, and blackouts are eliminated. These improvements, along with lower non-technical losses and tariff adjustments to bring electricity prices in line with production costs, would eliminate electricity sector losses and provide further fiscal space for development needs, boosting GDP by a further 0.2 percent after 10 years and 0.75 percent after 30 years.

Considering the Dominican Republic’s potential, the challenges it currently faces and the uncertainty of the global outlook, delaying a comprehensive fiscal reform would not only be costly but also a missed opportunity on its journey towards investment grade. Undertaking these key reforms could further boost the level of GDP by around 2 and 5 percent after 10 and 30 years respectively.

****

Emilio Fernandez-Corugedo is a Deputy Division Chief and Pamela Madrid is a Senior Economist in the IMF’s Western Hemisphere Department. Frank Fuentes is an Advisor to the IMF Executive Director representing the Dominican Republic.